Murrey Math Lines 02.05.2018 (USDJPY, USDCAD)

USDJPY, “US Dollar vs. Japanese Yen”

In the H4 chart, USDJPY is trading inside the “overbought zone”. Later, the price is expected to test the +1/8 level, rebound from it, and then resume falling towards the support at the 7/8 one.

As we can see in the H1 chart, the pair is also trading inside the “overbought zone”. If the price breaks the 8/8 level, it may continue falling to reach the support at the 6/8 one. Another scenario implies that the instrument may test the resistance at the +2/8 level first and then resume falling towards the 6/8 one.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, may continue trading towards 108.59.

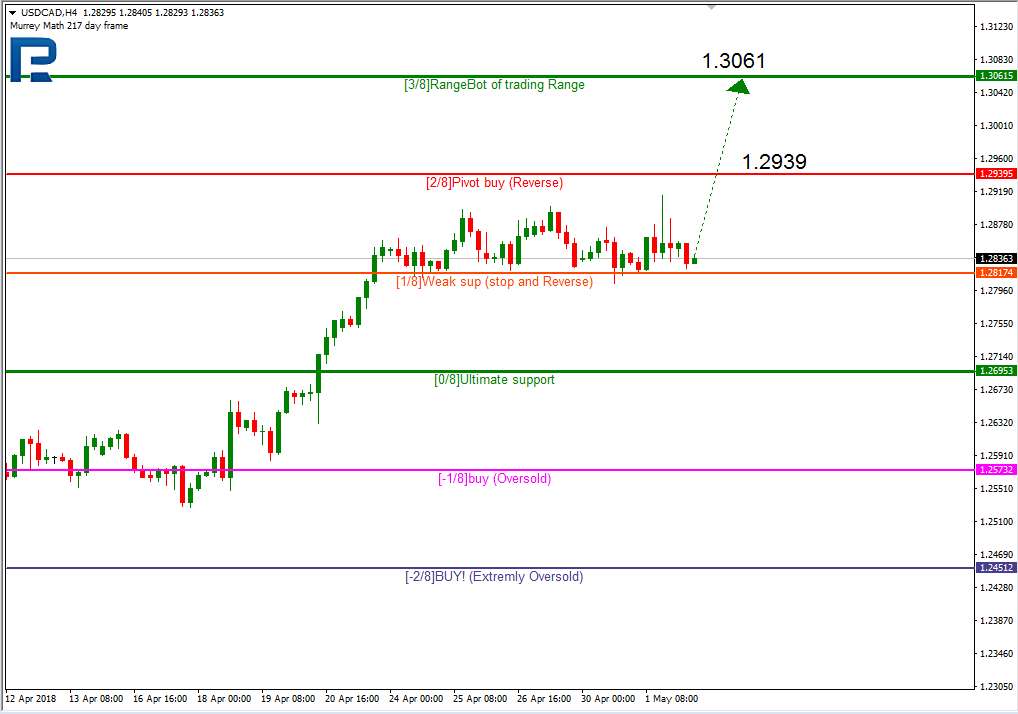

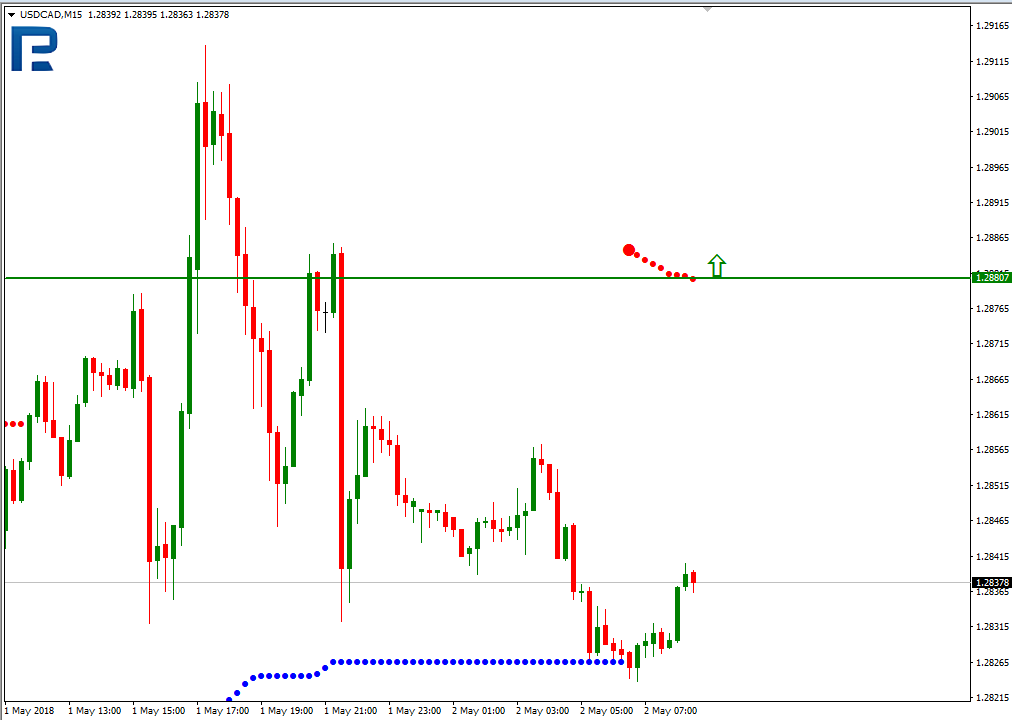

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, USDCAD may break the 2/8 level and then continue trading up0wards to reach the resistance at the 3/8 one.

As we can see in the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue trading upwards.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.