Murray Math Lines 22.05.2017 (EUR/USD, GBP/JPY)

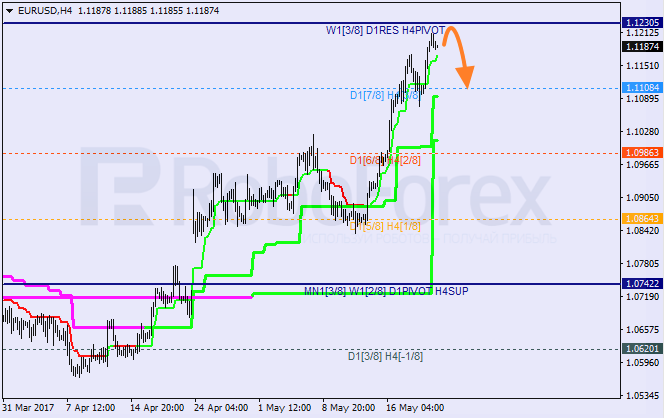

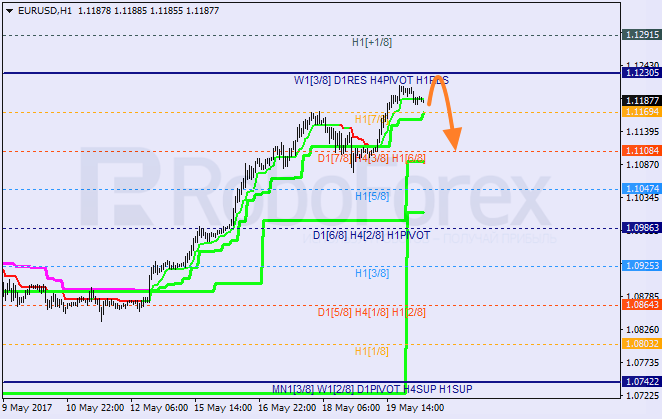

EUR USD "Euro vs. US Dollar"

The EUR/USD has hit a new high and moved close to a Murray level 4/8. If the pair rebounds from this level, this can be seen as a signal for a new descending correction. The nearest target for the bears is the 3/8 level and Super Trend daily line.

On the H1-chart a Murrey level 8/8 can act as a fairly good resistance level. If this level is rebounded from, we can see how the price moves downwards along a correction move towards the 6/8 level. If this line is rebounded from, the growth can resume to break through the last high.

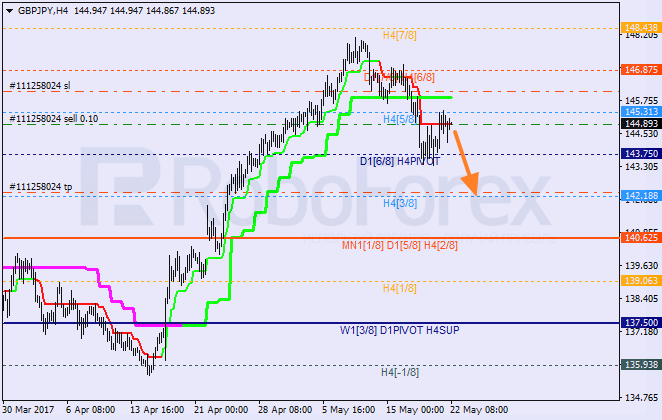

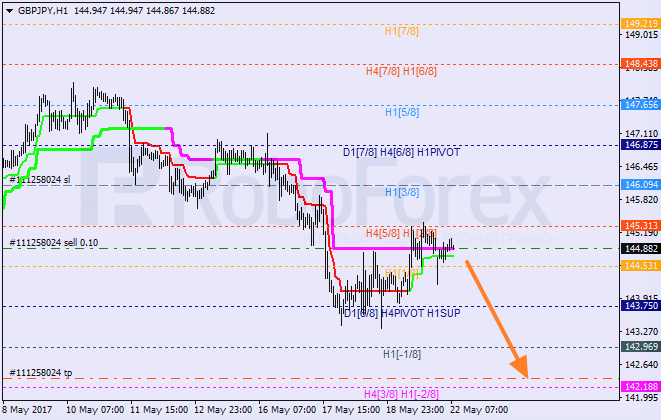

GBP JPY "Great Britain Pound vs. Japanese Yen"

The cross is consolidating under the 5/8 level. Earlier the Super Trend lines formed a "bearish cross". Consequently, in the near-term the market can move downwards to reach the 3/8 level.

On the H1-chart a double rebound from the2/8 level occurred, which suggests a further downside move. Thus, afterwards a new local low and a test of -2/8 level can occur. If the latter is rebounded from, the Murray analysis will have to be redrawn.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.