Murray Math Lines 22.03.2013 (USD/CAD, GBP/CHF, EUR/JPY)

22.03.2013

Analysis for March 22nd, 2013

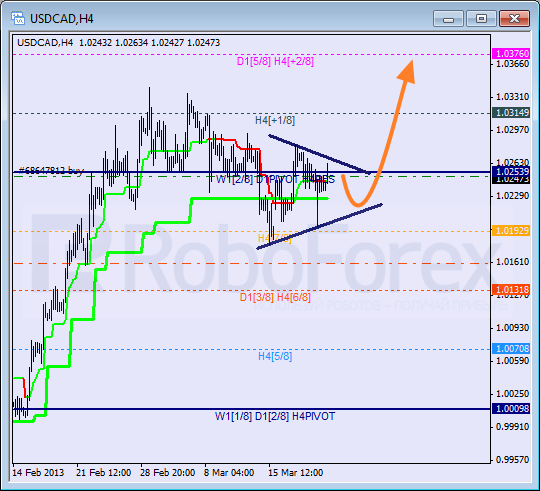

USD/CAD

Canadian Dollar is still consolidating. We can’t exclude a possibility that the price movement may take the form of a classic continuation pattern, “triangle”. Earlier the Super Trends’ lines formed “bullish cross”. Most likely, in the nearest future the pair will break the +2/8 level and the lines at the chart will be redrawn.

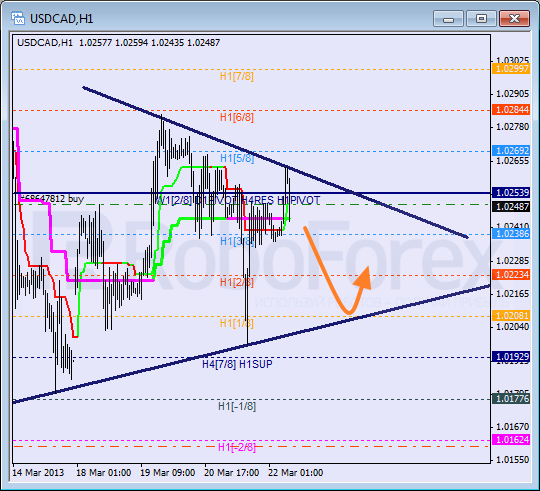

At the H1 chart we can see that the pair is going to test the 1/8 level once again. If the pair rebounds from this level, the price will start a new ascending movement. The first target for the buyers will be the 8/8 level.

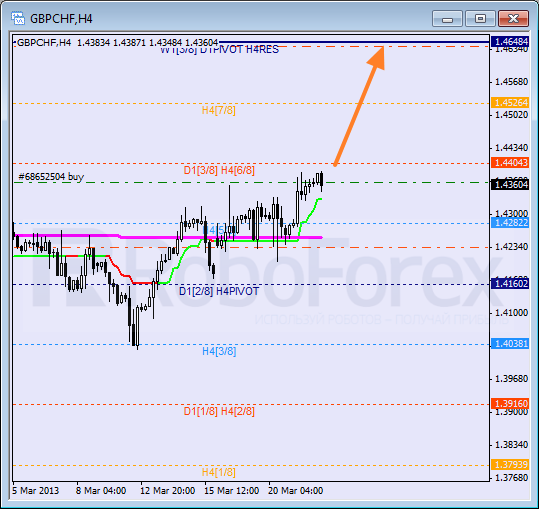

GBP/CHF

The pair is moving above the 5/8 level and may continue growing up; earlier the Super Trends’ lines formed “bullish cross”. The main target for the next several days is at the 8/8 level.

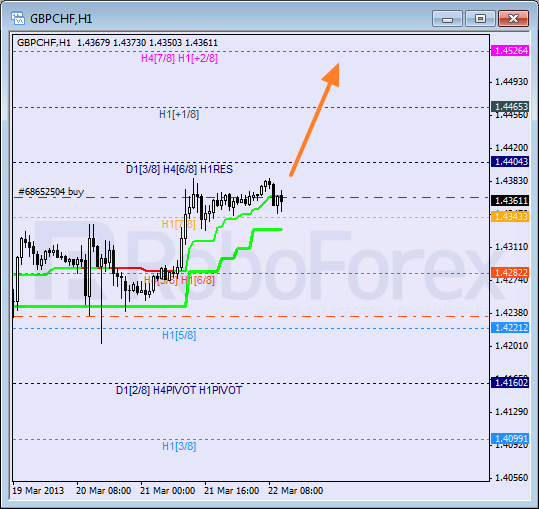

At the H1 chart the price is very close to an “overbought zone”; the bulls are supported by the Super Trends’ lines. We can’t exclude a possibility that the pair may break the 8/8 level during Friday and enter an “overbought zone”.

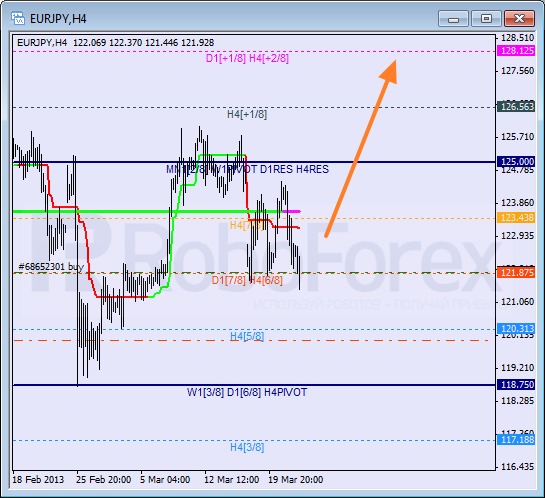

EUR/JPY

The pair is still being corrected. The bulls are trying to rebound from the 6/8 level. If they succeed, the price will start growing up again. The first target is at the +2/8 level.

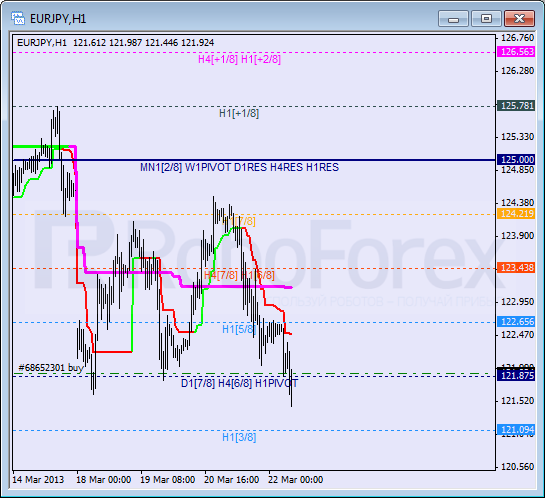

The pair is moving in the middle of the H1 chart. If the price rebounds from the 4/8 level, the market will start a new ascending movement. Today I’ve opened a quite risky buy order. If the market is able to keep the price above the Super Trends’ lines, I’ll add several more buy orders.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.