Wave Analysis 12.01.2017 (EUR/USD, GBP/USD, USD/JPY, AUD/USD)

Forecast for January 12th, 2017

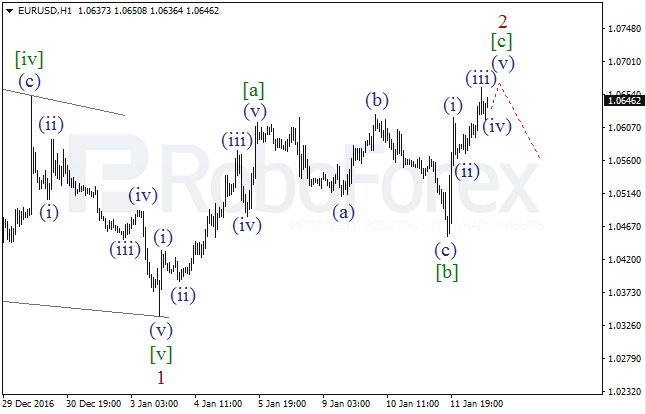

EUR USD, “Euro vs US Dollar”

In case of the EUR/USD pair, the correction continues. Earlier, the price formed the bearish wedge in the wave 1. As a result, after finishing the wave [c] of 2, the market may resume moving downwards.

More detailed structure is shown on the H1 chart. It’s highly likely that the pair may form the fifth wave in the wave [c]. To confirm a new decline, the market has to form another descending impulse.

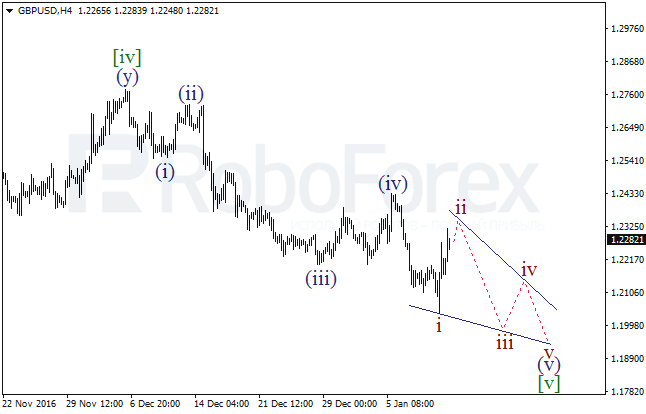

GBP USD, “Great Britain Pound vs US Dollar”

Possibly, the GBP/USD pair is forming the diagonal triangle in the wave (v) of [v]. In the nearest future, the market may continue forming the second wave of this pattern. Later, the market is expected to resume falling in the wave iii of (v).

As we can see at the H1 chart, after finishing the wave (iv), the pair formed the descending impulse, which may be the first wave of the diagonal triangle. In the nearest future, the market may complete the zigzag in the ii and then resume its decline.

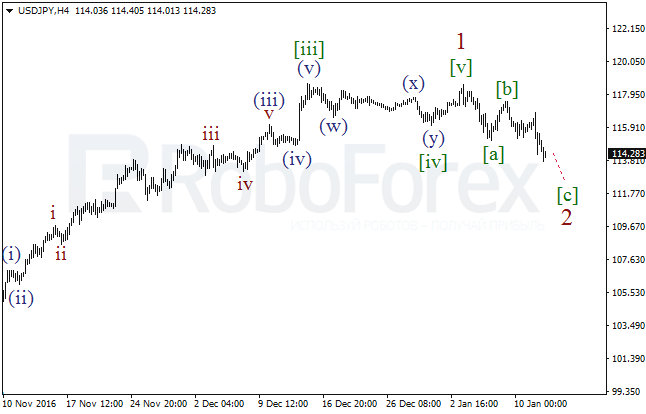

USD JPY, “US Dollar vs Japanese Yen”

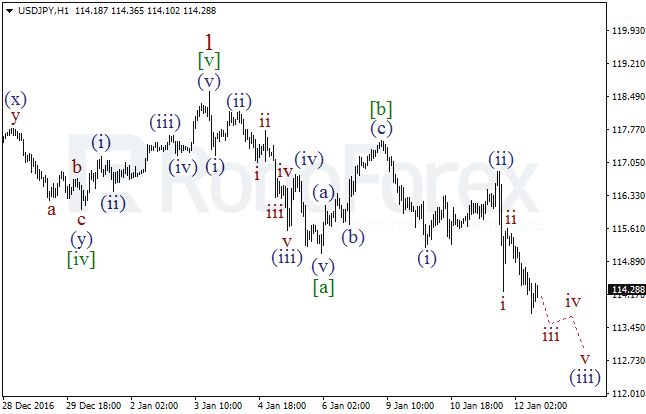

In case of the USD/JPY pair, the correction continues. Earlier, the price completed the impulse in the wave 1. It’s highly likely that in the nearest future the market may move downwards in the wave [c] of 2 and reach new lows.

More detailed structure is shown on the H1 chart. The pair is probably extending the wave (iii) and may yet continue falling in the wave iii inside it. Consequently, on Thursday the market may reach a new local low.

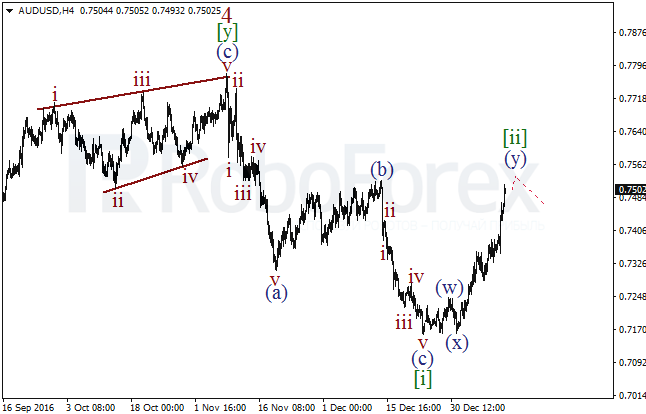

AUD USD, “Australian Dollar vs US Dollar”

The AUD/USD pair is still being corrected, that’s why the main scenario implies that the price is forming the diagonal triangle in the wave 5. Consequently, the previous descending zigzag may the first wave of the above-mentioned pattern. However, in the nearest future the market may continue moving upwards in the wave [ii].

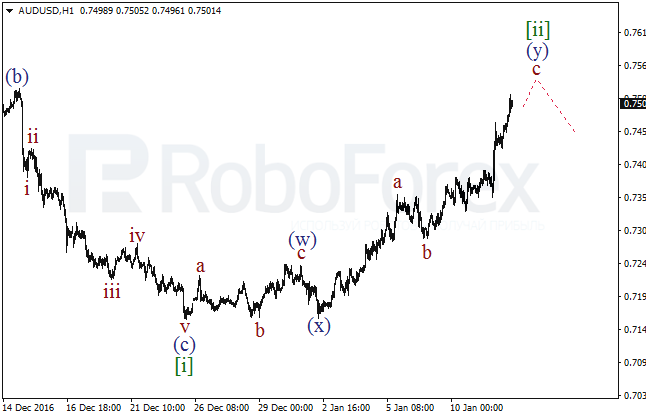

As we can see at the H1 chart, the wave [ii] may take the form of the double zigzag. As a result, on Thursday the market may continue growing while forming the ascending impulse in the wave c of (y).

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.