Technical Analysis & Forecast 13.02.2024

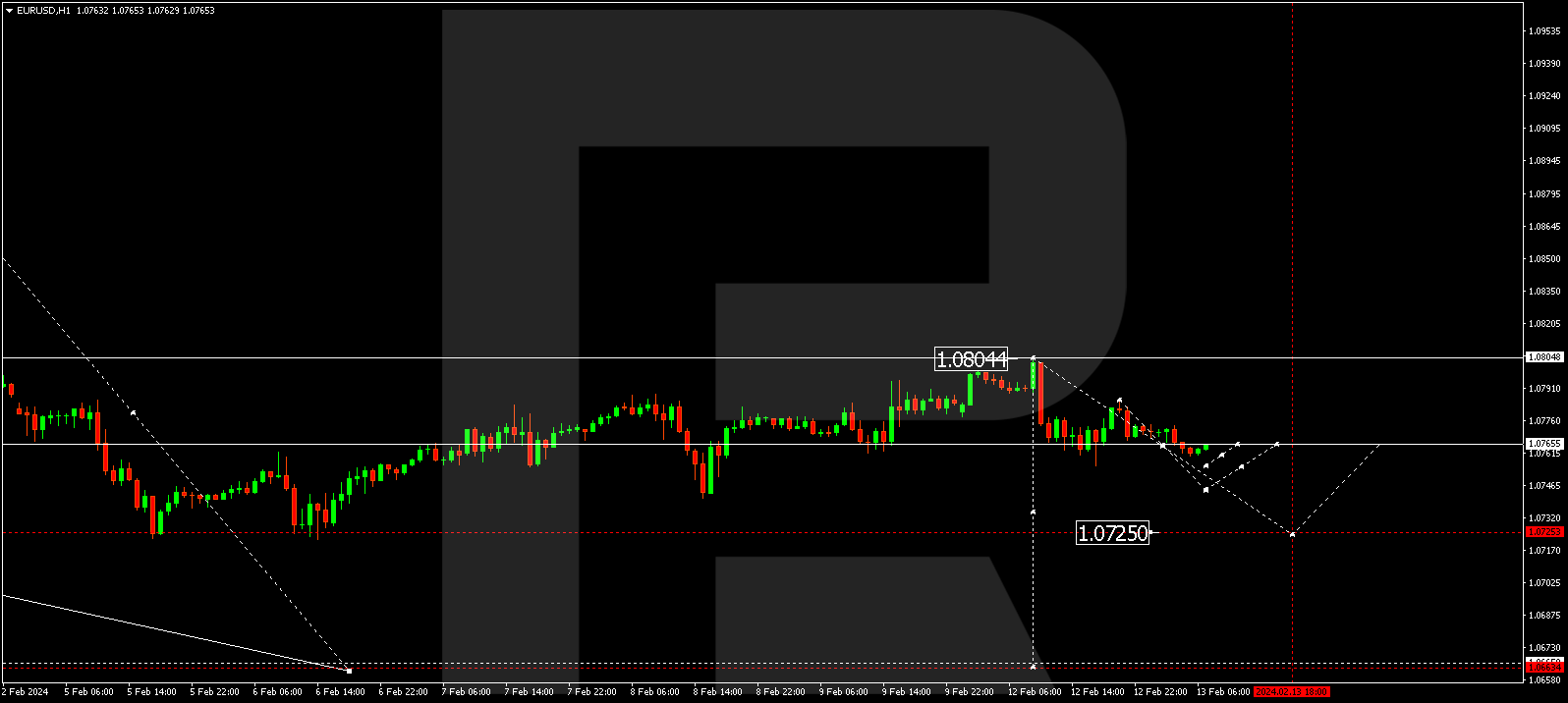

EURUSD, “Euro vs US Dollar”

The EURUSD pair has formed a decline wave to 1.0755. Currently, the market is forming a narrow consolidation range around 1.0765. An escape from the range downwards to 1.0744 is expected today. And if this level also breaks downwards, the potential for a wave to 1.0725 might open, from where the trend could continue to 1.0666. This is the first target.

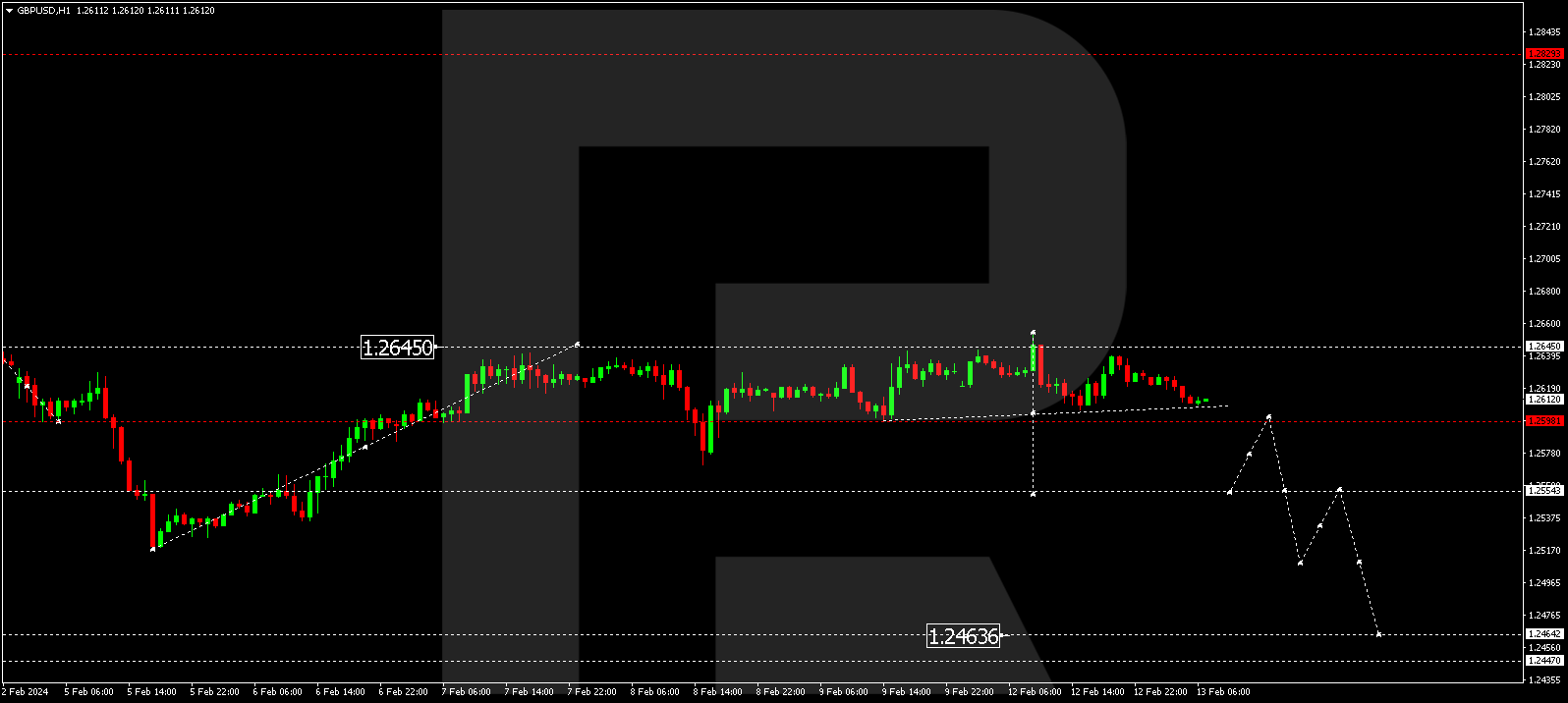

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair continues developing a consolidation range around 1.2598. With an escape from the range downwards, a structure of a decline wave to 1.2555 is expected to form. And with a breakout of this level as well, the potential for a decline wave to 1.2464 might open. This is a local target.

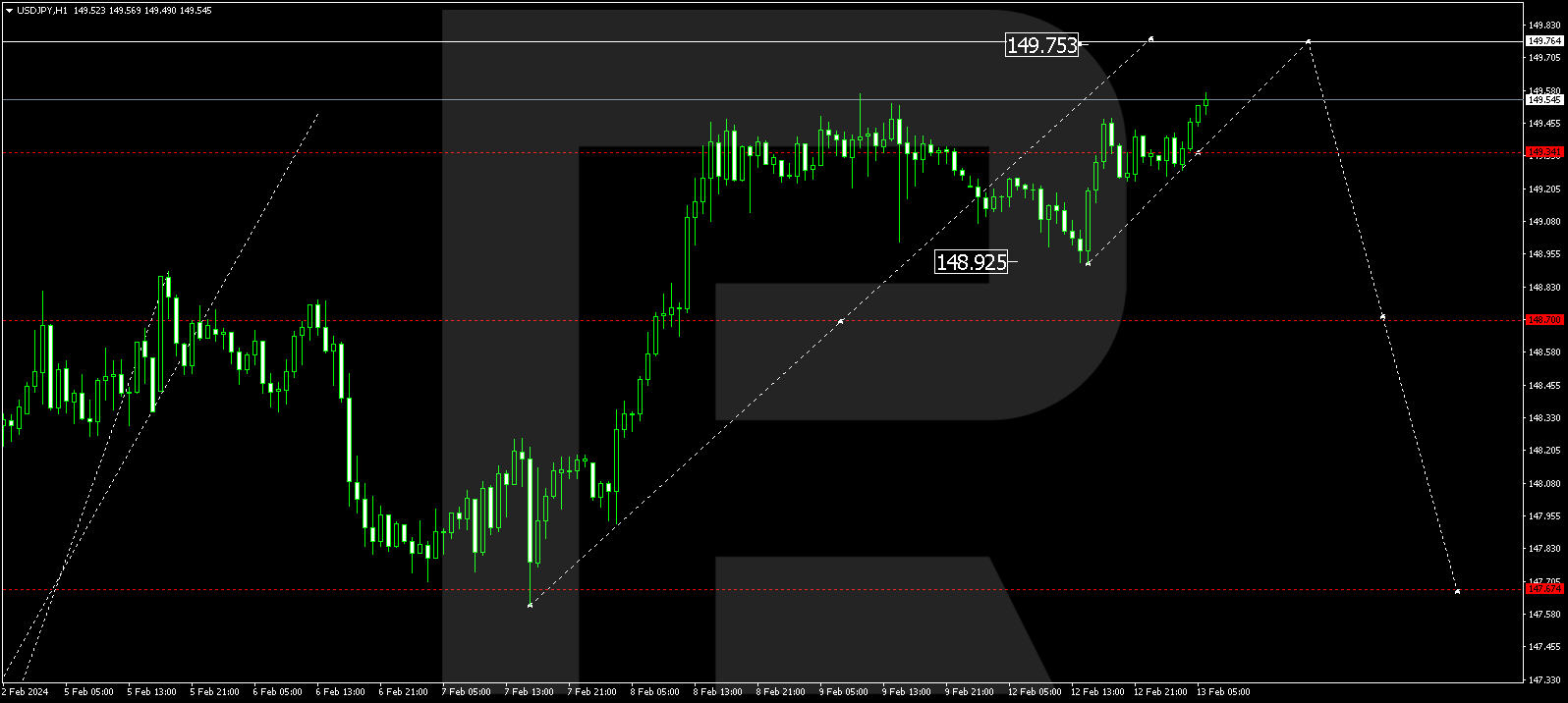

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair is forming a consolidation range around 149.34. An escape from the range upwards to 149.76 is not excluded today. Next, a decline wave to 148.70 might begin, from where the trend could continue to 147.67.

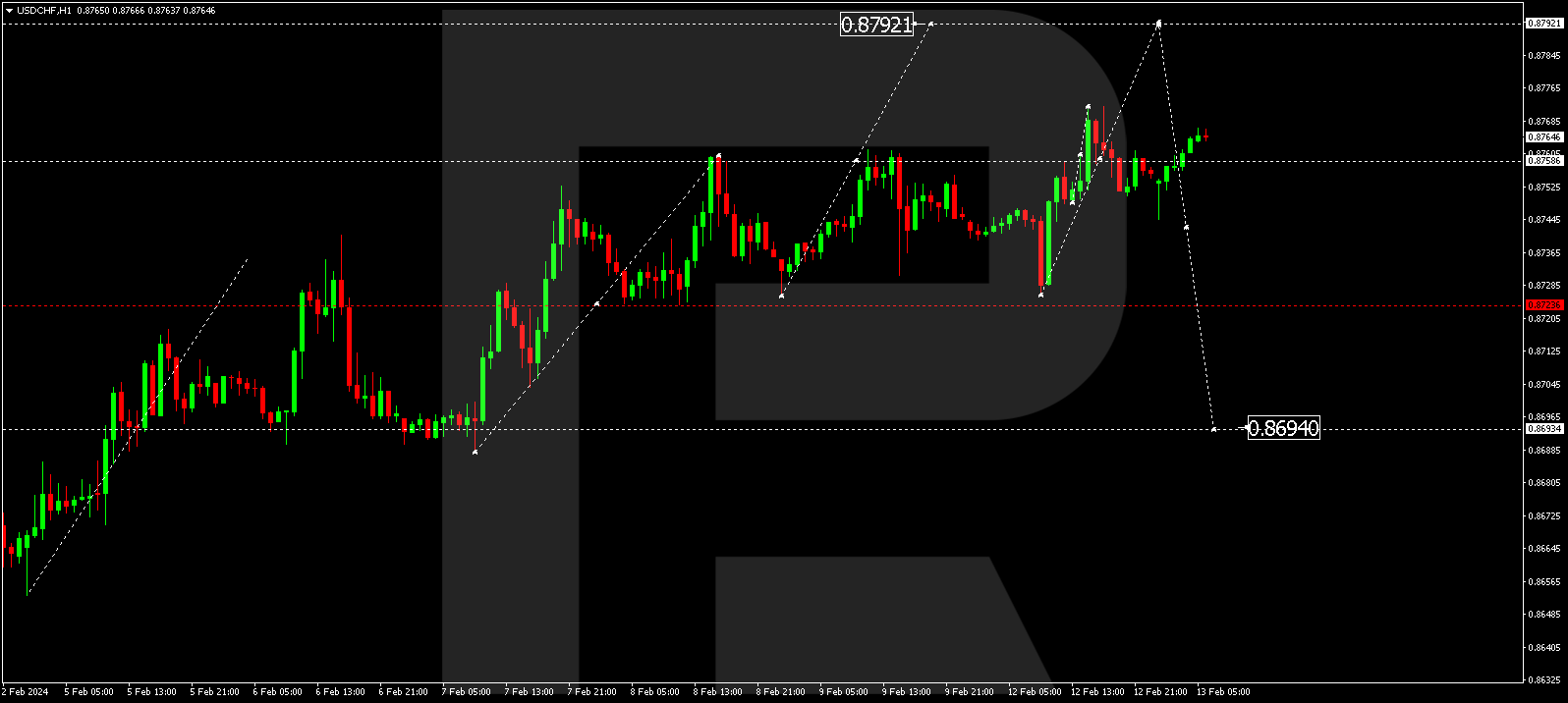

USDCHF, “US Dollar vs Swiss Franc”

The USDCHF pair continues forming a consolidation range around 0.8755. An escape from the range upwards to 0.8792 could follow today. Once this level is reached, a correction wave to 0.8694 is expected to form.

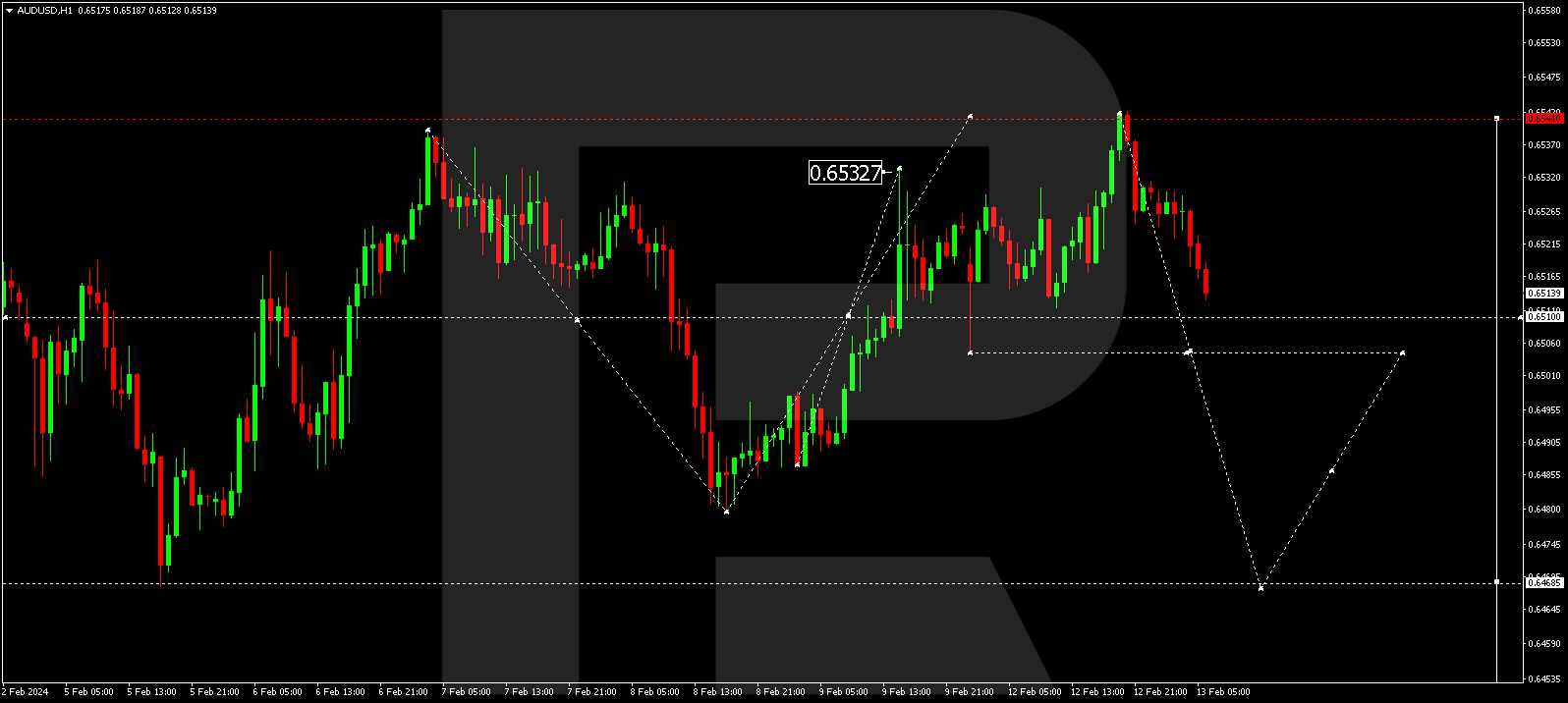

AUDUSD, “Australian Dollar vs US Dollar”

The AUDUSD pair continues forming a consolidation range around 0.6520. An escape downwards to 0.6500 is expected today. Next, a correction to 0.6520 might form, followed by a decline to 0.6450, from where the wave could extend to 0.6400. This is the first target in a decline structure by the downtrend.

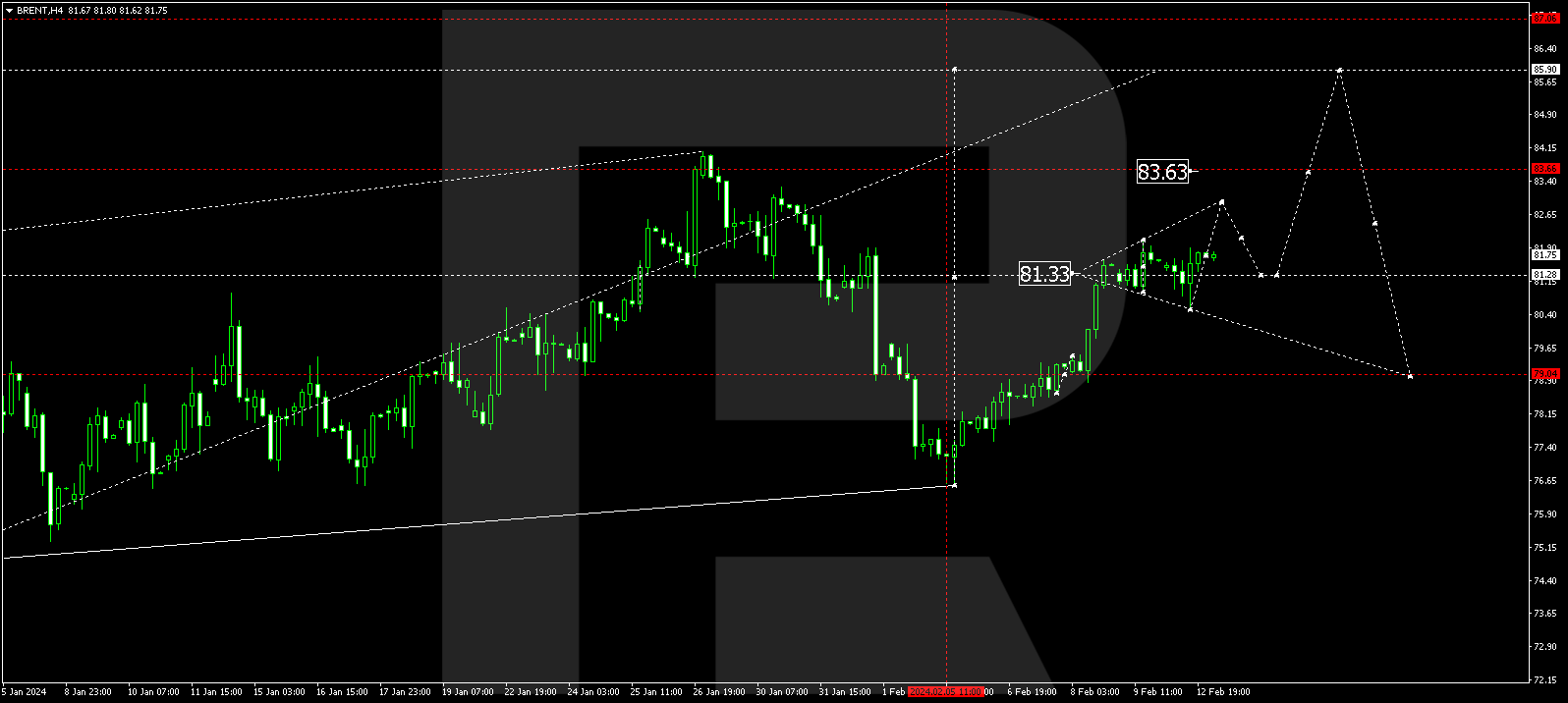

BRENT

Brent continues forming a consolidation range under 82.33. With an escape from the range downwards, a correction link to 79.10 is not excluded. With an upward escape, the potential for a growth wave to 83.63 might open. This is a local target. Once this level is reached, a correction to 81.30 could form, followed by a rise to 85.90. This is the first target.

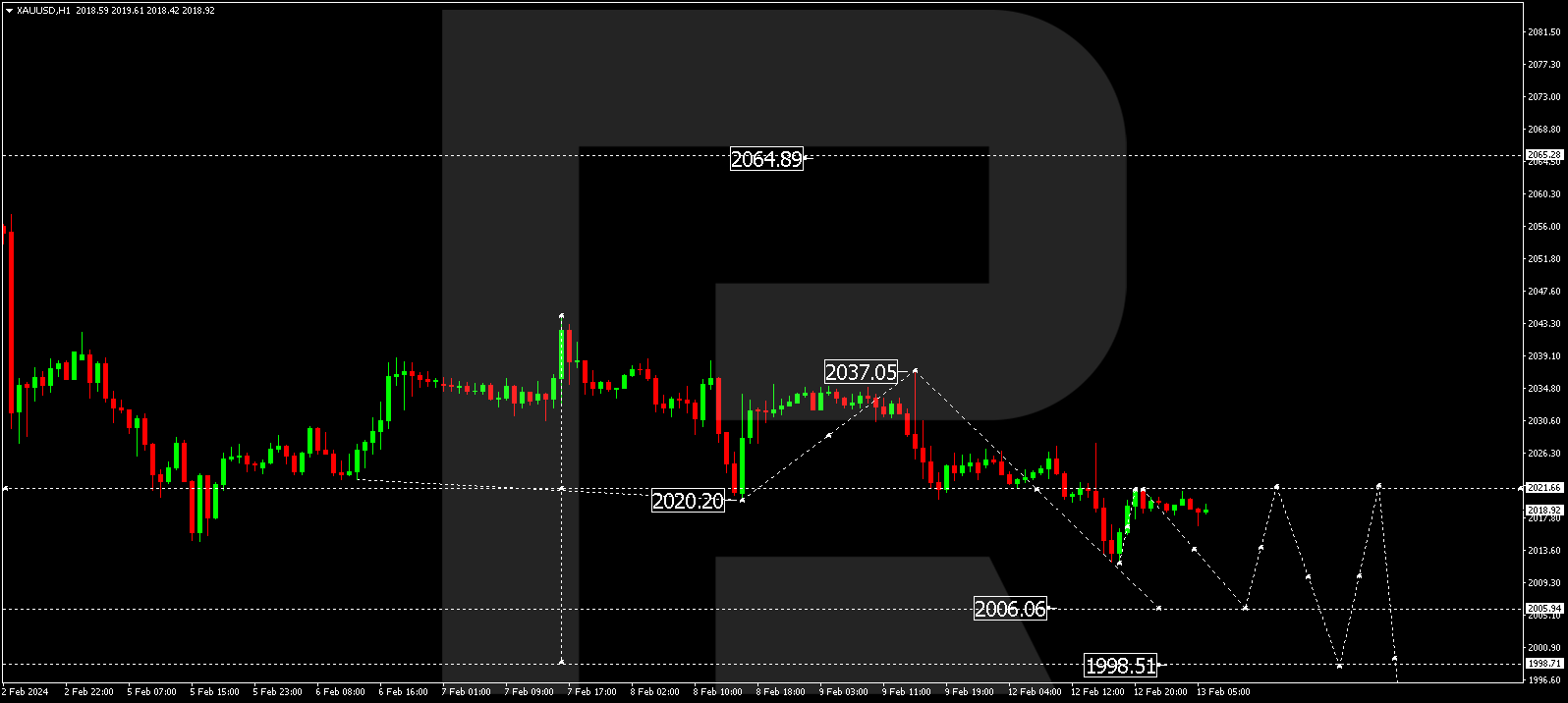

XAUUSD, “Gold vs US Dollar”

Gold has completed a decline wave to 2011.90. By now, the market has completed a technical return to 2021.66 (a test from below). The wave could extend to 2006.06. This is a local target. Once this level is reached, a correction link is not excluded. And after the correction a decline wave to 1998.50 is expected.

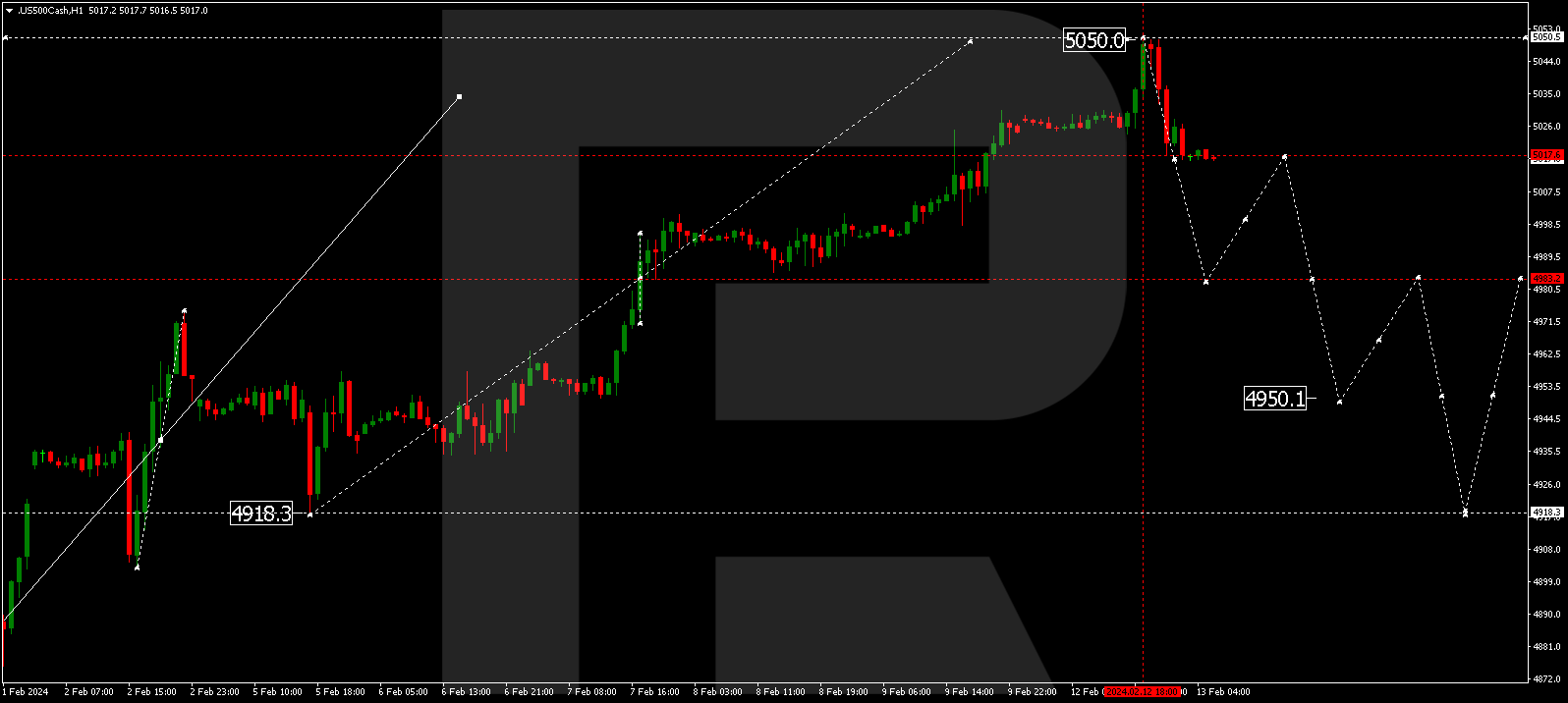

S&P 500

The stock index has completed a growth wave to 5050.0. A decline impulse to 5017.0 has formed today. Currently, a consolidation range is forming around this level. The impulse is expected to continue to 4993.0. This is the first target. Next, a correction link to 5017.0 is expected (a test from below). After that a decline wave to 4950.0 could start, from where the trend might continue to 4918.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.