Ichimoku Cloud Analysis 05.03.2024 (XAUUSD, USDCAD, USDCHF)

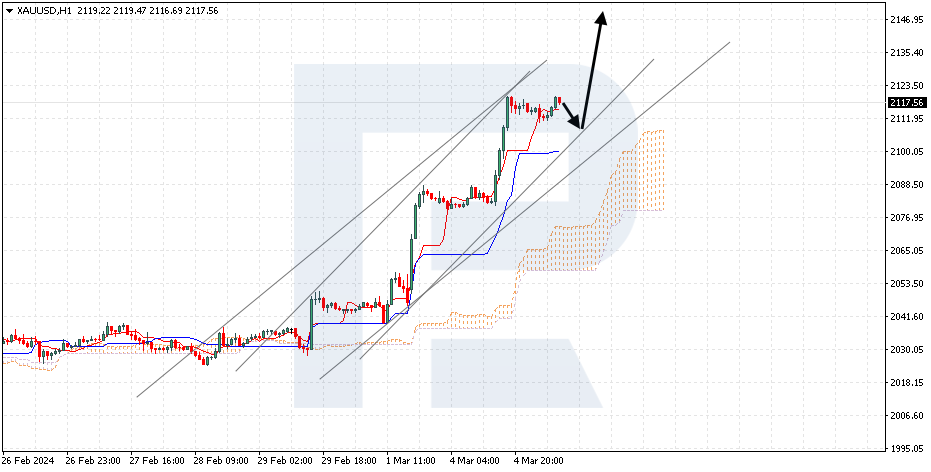

XAUUSD, “Gold vs US Dollar”

Gold is rising within the bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Kijun-Sen line at 2100 is expected, followed by a rise to 2145. An additional signal confirming the rise will be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price finding a foothold below 2045, which will signal a further decline to 2005.

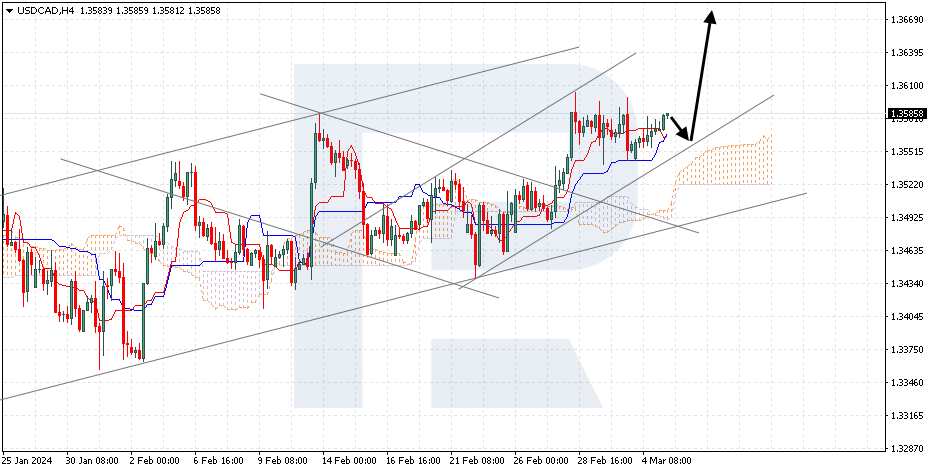

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD is rebounding from the support level. The pair is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 1.3565 is expected, followed by a rise to 1.3665. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price gaining a foothold below 1.3505, which will indicate a further decline to 1.3410.

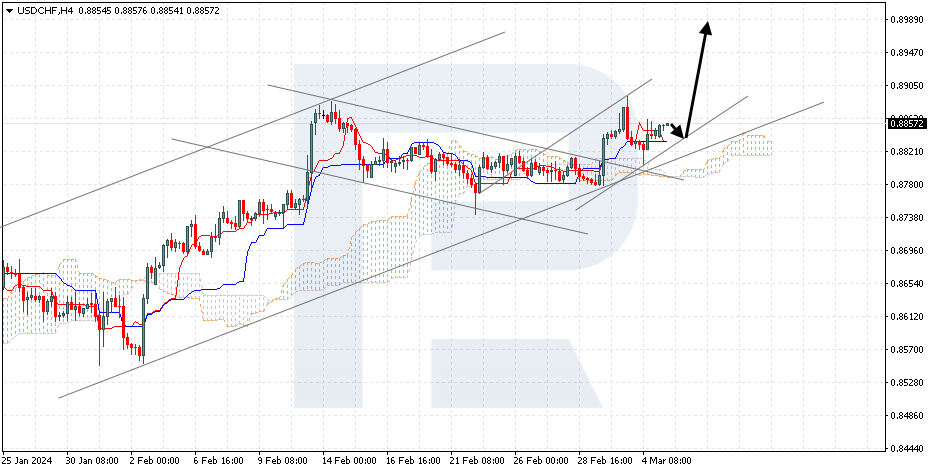

USDCHF, “US Dollar vs Swiss Franc”

USDCHF steadied above the signal lines of the indicator. The pair is going above the Ichimoku Cloud, suggesting an uptrend. A test of the Tenkan-Sen line at 0.8845 is expected, followed by a rise to 0.8985. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud, with the price securing below 0.8765, indicating a further decline to 0.8675.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.