Ichimoku Cloud Analysis 02.04.2024 (EURUSD, BRENT, NZDUSD)

EURUSD, “Euro vs US Dollar”

EURUSD has gained a foothold below the signal lines of the indicator. The pair is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the Kijun-Sen line at 1.0735 is expected, followed by a decline to 1.0670. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the Cloud’s upper boundary, with the price securing above 1.0815, indicating further growth to 1.0905.

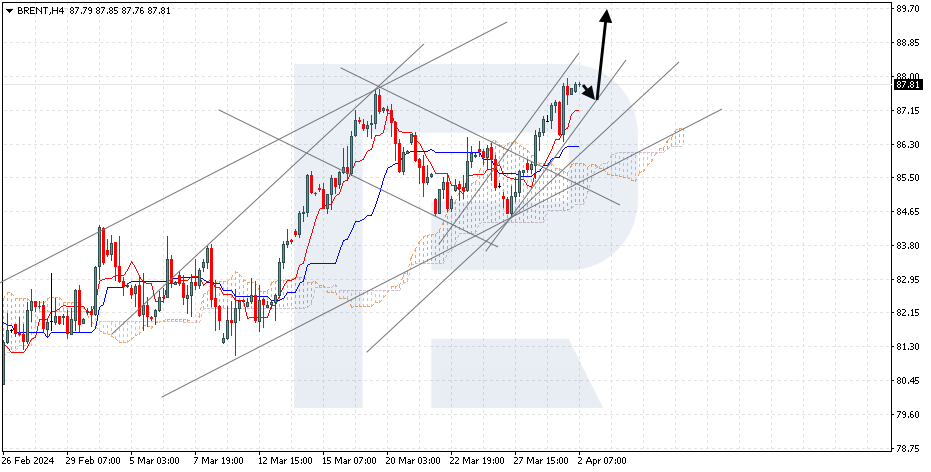

BRENT

Brent is on the rise within a bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 87.05 is expected, followed by a rise to 89.70. An additional signal confirming the rise could be a rebound from the lower boundary of the bullish channel. The scenario could be cancelled by a breakout of the lower boundary of the Cloud, with the price gaining a foothold below 84.60, which will signal a further decline to 81.55.

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD has established itself below the support level. The pair is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Cloud’s lower boundary at 0.5975 is expected, followed by a decline to 0.5860. An additional signal confirming the decline might be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud, with the price finding a foothold above 0.6045, indicating a further rise to 0.6135.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.