The euro bears can’t believe their ears. Fundamental analysis for 02.06.2014

02.06.2014

The June meeting of the ECB is getting closer, and on Thursday Mario Draghi will announce its results at a press conference. According to the Financial Times, he will have plenty to say, namely the possibility of reducing interest rates. It is expected that the key interest rate will be reduced from 0.25% to 0.10% and the deposit rate, for the first time in the modern history of the world's central banks, can be brought to a negative value.

Much will depend on the data on inflation in the euro area, the publication of which is scheduled for Tuesday. Despite the fact that the statistics are expected to be at last month’s 0.7% (of course, on an annualized basis), there is a substantial likelihood that the final figures will be even worse. In this scenario, once again there is talk about migration to a "Japanese deflation" in the euro zone and Draghi would therefore simply be forced to act.

Moreover, the ECB could go further and renew the LTRO program, which provides commercial banks with cheap long-term loans from the regulator on an unrestricted basis. It has already conducted two rounds of the program, which resulted in European banks attracting about 1 trillion Euros of loans. Although then the goals were different, the ECB struggled with high rates on the bond market.

If Mario Draghi really decides on these two complementary steps, namely the reduction of deposit rates to negative levels with a simultaneous launch of LTRO, then it really becomes an unprecedented incentive measure. As the U.S. Federal Reserve and the Bank of England are gradually heading for a way out of their QE, then such a move could lead the ECB to a real collapse of the Eurodollar.

Earlier Draghi acknowledged the threat of a destructive spiral of "low inflation and reduction in lending." If the case takes such a turn, then any recovery of the euro zone will not be possible, and the current inflation target of 2% would be simply unattainable. Logically, it is easier to prevent the occurrence of such a "spiral", rather than to break it up when the vicious circle has already started.

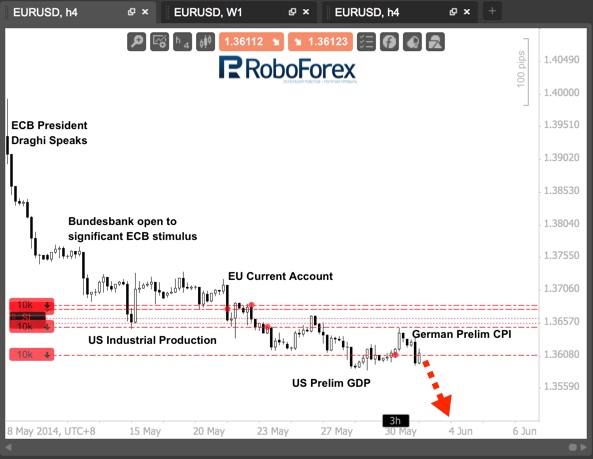

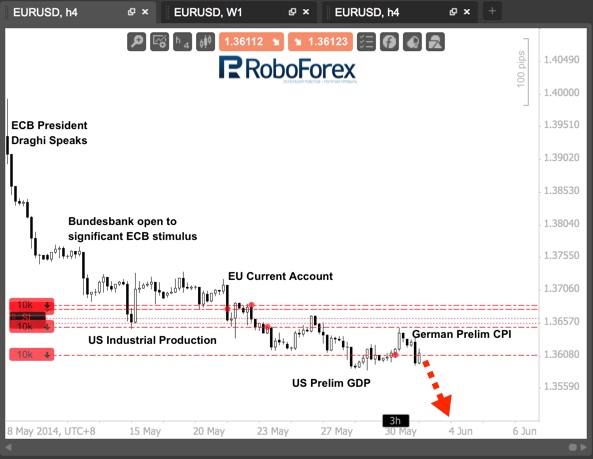

I continue to hold transactions to sell, which makes sense against the background of the future ECB policy easing. The lower inflation in Germany adds fuel to the fire, where the rate is in the negative zone for two consecutive months: -0.2% in April and 0.1% in May. Since the German Statistics for the last month came out worse than expected, and added to a pan-European assessment, tomorrow we will see inflation in the euro zone at 0.5% - 0.6%, if not lower, which completely unties the hands of the ECB in terms of deployment of new stimulus measures.

RoboForex Analytical Department

Much will depend on the data on inflation in the euro area, the publication of which is scheduled for Tuesday. Despite the fact that the statistics are expected to be at last month’s 0.7% (of course, on an annualized basis), there is a substantial likelihood that the final figures will be even worse. In this scenario, once again there is talk about migration to a "Japanese deflation" in the euro zone and Draghi would therefore simply be forced to act.

Moreover, the ECB could go further and renew the LTRO program, which provides commercial banks with cheap long-term loans from the regulator on an unrestricted basis. It has already conducted two rounds of the program, which resulted in European banks attracting about 1 trillion Euros of loans. Although then the goals were different, the ECB struggled with high rates on the bond market.

If Mario Draghi really decides on these two complementary steps, namely the reduction of deposit rates to negative levels with a simultaneous launch of LTRO, then it really becomes an unprecedented incentive measure. As the U.S. Federal Reserve and the Bank of England are gradually heading for a way out of their QE, then such a move could lead the ECB to a real collapse of the Eurodollar.

Earlier Draghi acknowledged the threat of a destructive spiral of "low inflation and reduction in lending." If the case takes such a turn, then any recovery of the euro zone will not be possible, and the current inflation target of 2% would be simply unattainable. Logically, it is easier to prevent the occurrence of such a "spiral", rather than to break it up when the vicious circle has already started.

I continue to hold transactions to sell, which makes sense against the background of the future ECB policy easing. The lower inflation in Germany adds fuel to the fire, where the rate is in the negative zone for two consecutive months: -0.2% in April and 0.1% in May. Since the German Statistics for the last month came out worse than expected, and added to a pan-European assessment, tomorrow we will see inflation in the euro zone at 0.5% - 0.6%, if not lower, which completely unties the hands of the ECB in terms of deployment of new stimulus measures.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.