ECB was a bit late. Fundamental analysis for 03.06.2014

03.06.2014

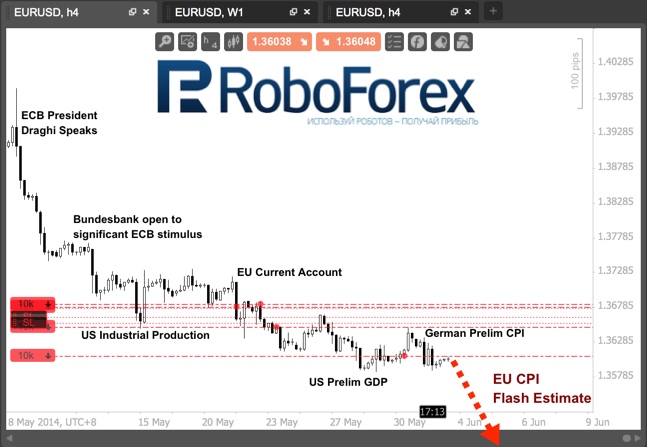

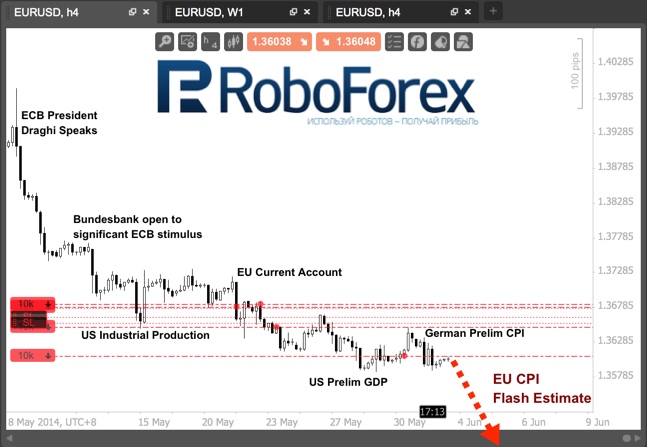

The start of the week was marked by a decrease in the euro/dollar, the cause for which was weak data on German inflation (-0.1% in May), and the poor statistics on European industrial production. Today's report on inflation in the euro area will be decisive for the euro/dollar, which is expected at 13:00 GMT, if the data comes out worse than expected, the “euro bears” will get a real carte blanche.

Meanwhile, the ECB has been “sitting on its hands” for so long, while its fellow central banks actively pumped liquidity into their subordinate economies that the effectiveness of incentives that may be announced on Thursday still raises questions. For example, the regulator decides to lower the deposit rate and starts a new round of the LTRO program, offering banks unlimited loans at low rates.

However, until now no clear mechanism is in place to nudge banks to direct these funds for lending to small and medium-sized businesses, and the ECB considers these directions a priority. If everything comes down to the deposit rate, and if it is lowered too much, then the bankers may prefer to pay some money to the ECB for "parking" their funds in its accounts, than to expand their loan portfolios.

Consequently, if the banks do not start to actively give out loans, the inflation will not receive an incentive to start growth. A reduction in the key rate is unlikely to help the cause - previously the ECB has already reduced the rate from 0.5% to the current 0.25% when inflation fell for the first time to the level of 0.7%. Another rate cut, for example, to 0.10%, can prevent a further fall in inflation, but it’s unlikely to contribute to its growth.

The likely return of the LTRO is due to the reluctance of the ECB to personally deal with buying assets. At a time this program was even called "quantitative easing through the back door." However, there is a substantial likelihood that later on, the regulator despite the apparent reluctance to do this, will still have to take matters into their own hands and start a direct purchase of assets.

Transactions to sell are still being held, as there remains the potential for further reduction in the currency pair. Apart from European news, on Friday we will receive a report on the U.S. labour market. After last month’s record data when 288k jobs were immediately created, it is expected to slow down to statistics of 215 - 220k, which is still a high value. Accordingly, the dollar may receive additional support.

RoboForex Analytical Department

Meanwhile, the ECB has been “sitting on its hands” for so long, while its fellow central banks actively pumped liquidity into their subordinate economies that the effectiveness of incentives that may be announced on Thursday still raises questions. For example, the regulator decides to lower the deposit rate and starts a new round of the LTRO program, offering banks unlimited loans at low rates.

However, until now no clear mechanism is in place to nudge banks to direct these funds for lending to small and medium-sized businesses, and the ECB considers these directions a priority. If everything comes down to the deposit rate, and if it is lowered too much, then the bankers may prefer to pay some money to the ECB for "parking" their funds in its accounts, than to expand their loan portfolios.

Consequently, if the banks do not start to actively give out loans, the inflation will not receive an incentive to start growth. A reduction in the key rate is unlikely to help the cause - previously the ECB has already reduced the rate from 0.5% to the current 0.25% when inflation fell for the first time to the level of 0.7%. Another rate cut, for example, to 0.10%, can prevent a further fall in inflation, but it’s unlikely to contribute to its growth.

The likely return of the LTRO is due to the reluctance of the ECB to personally deal with buying assets. At a time this program was even called "quantitative easing through the back door." However, there is a substantial likelihood that later on, the regulator despite the apparent reluctance to do this, will still have to take matters into their own hands and start a direct purchase of assets.

Transactions to sell are still being held, as there remains the potential for further reduction in the currency pair. Apart from European news, on Friday we will receive a report on the U.S. labour market. After last month’s record data when 288k jobs were immediately created, it is expected to slow down to statistics of 215 - 220k, which is still a high value. Accordingly, the dollar may receive additional support.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.