The Fed is in a trend. Fundamental analysis for 18.09.2014

18.09.2014

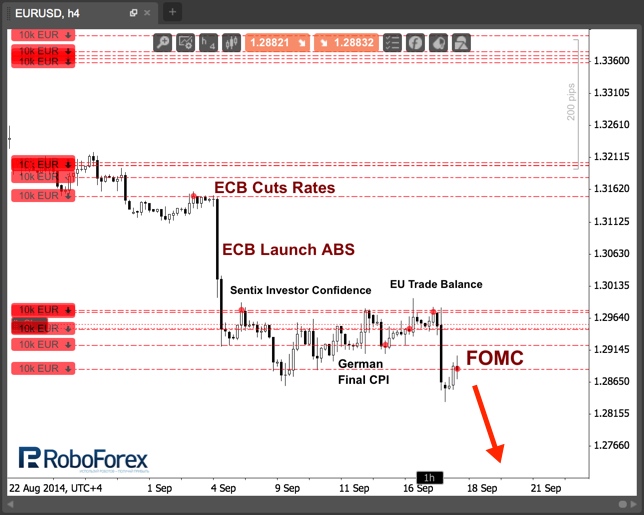

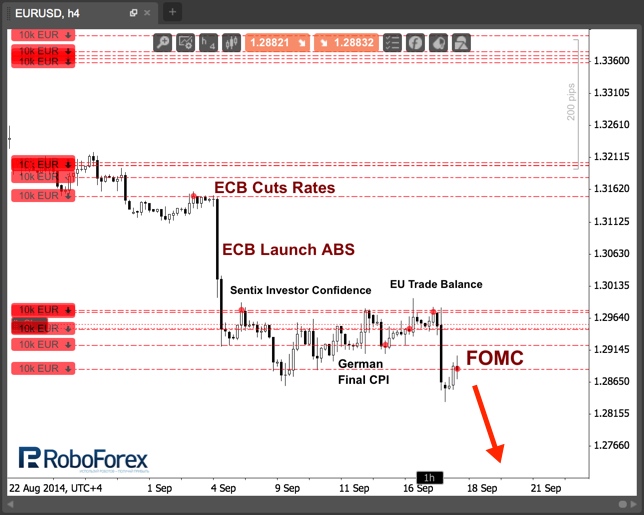

The outcome of yesterday's FOMC meeting, as expected, helped the euro bears to update the minimum. The Fed once again reduced volume of QE3 by another $10 billion, and confirmed the possibility of the full completion of the program in the next month, if of coarse the economy does not present any unpleasant surprises. Moreover, the Fed lowered its own forecasts for GDP growth and unemployment for the year.

The most anticipated were the comments from Janet Yellen on the prospects of increasing the rates. In general, there is some roll back to earlier positions. Yellen reiterates that the prospects of an earlier or later start of the cycle of growth of rates will depend on the economic situation. Saying that, if statistics are better than our expectations, the rate may be increased earlier.

Do recall that the Fed, among other things, publishes its forecasts on the interest rates. Therefore, by the end of next year, the regulator expects to see its rate at 1.25% - 1.5%, which would require raising rates for five FOMC meetings. That is why, now it is expected that the first increase will occur during the upcoming summer and the whole affair revolves around whether the Fed will begin to raise rates before this date.

During 2016, the Fed expects the rates to be in the range of 2.75 - 3%, and it is about six more sessions, where an increase will have to be announced at the results. Nevertheless, the final normalization of monetary policy on interest rates is expected in 2017, when the Fed expects the rate at 3.75% with unemployment at 4.9% - 5.3% and inflation of 1.9% - 2.0%. However, the phrase "extended period" of low interest rates still remained in the final statement of the FOMC.

At the next press conference, Yellen was asked to specify how long it this period might be, especially given the expectations on interest rates. The response was vague, that it is not necessary to tie everything to the calendar, and the regulator will act according to circumstances. Meanwhile, the target to return rates in their normal plane has already been taken, and it is only a matter of time before the Fed takes the first step in this direction.

It is possible that on Thursday the Eurodollar will receive a continuation in its reduction as at 13.45 GMT Janet Yellen is scheduled to speak at the conference in Washington. It is possible that she may again go through the possibility of an early rate hike, but it is a great food for the euro bears. One of the central themes still remains the referendum in Scotland, which, if it is successful, may lower the euro on fears of increasing activity of the decoupling of Catalonia from Spain.

RoboForex Analytical Department

The most anticipated were the comments from Janet Yellen on the prospects of increasing the rates. In general, there is some roll back to earlier positions. Yellen reiterates that the prospects of an earlier or later start of the cycle of growth of rates will depend on the economic situation. Saying that, if statistics are better than our expectations, the rate may be increased earlier.

Do recall that the Fed, among other things, publishes its forecasts on the interest rates. Therefore, by the end of next year, the regulator expects to see its rate at 1.25% - 1.5%, which would require raising rates for five FOMC meetings. That is why, now it is expected that the first increase will occur during the upcoming summer and the whole affair revolves around whether the Fed will begin to raise rates before this date.

During 2016, the Fed expects the rates to be in the range of 2.75 - 3%, and it is about six more sessions, where an increase will have to be announced at the results. Nevertheless, the final normalization of monetary policy on interest rates is expected in 2017, when the Fed expects the rate at 3.75% with unemployment at 4.9% - 5.3% and inflation of 1.9% - 2.0%. However, the phrase "extended period" of low interest rates still remained in the final statement of the FOMC.

At the next press conference, Yellen was asked to specify how long it this period might be, especially given the expectations on interest rates. The response was vague, that it is not necessary to tie everything to the calendar, and the regulator will act according to circumstances. Meanwhile, the target to return rates in their normal plane has already been taken, and it is only a matter of time before the Fed takes the first step in this direction.

It is possible that on Thursday the Eurodollar will receive a continuation in its reduction as at 13.45 GMT Janet Yellen is scheduled to speak at the conference in Washington. It is possible that she may again go through the possibility of an early rate hike, but it is a great food for the euro bears. One of the central themes still remains the referendum in Scotland, which, if it is successful, may lower the euro on fears of increasing activity of the decoupling of Catalonia from Spain.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.