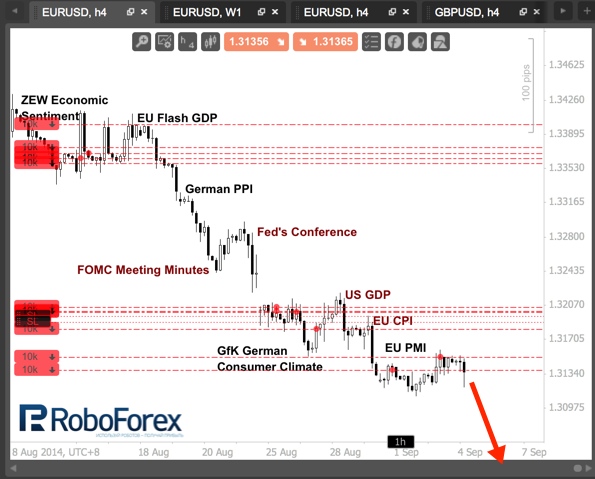

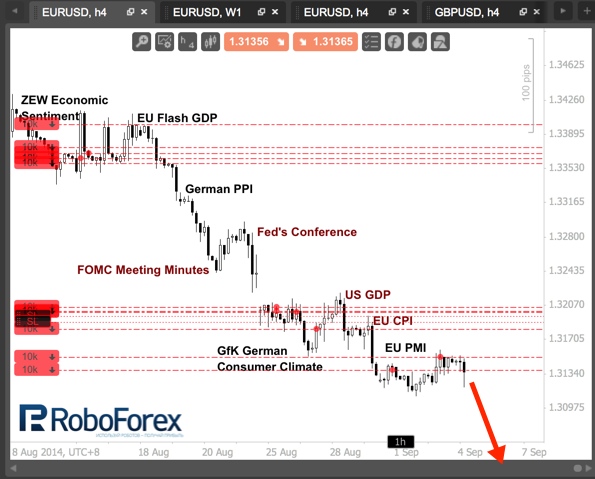

Fateful decision of the ECB. Fundamental analysis for 04.09.2014

04.09.2014

One can argue which is more important for the further fate of the Eurodollar this week - the results of the ECB meeting or Friday's report on American employment, but both of these events could have a strong impact on the market. Regarding the States, if unemployment will continue to fall and new jobs will show strong momentum again - it will be another argument in favour of an earlier rate hike by the Fed.

Speaking of the results of the ECB meeting, it is unlikely that we will see another rate cut - it simply is not able to resist the extremely low inflation, which has slipped to around 0.3% by the end of August. The deposit rate is also likely to be at the level of -0.1%, and all eyes will be on Mario Draghi’s press conference, during which he will reveal hi position in relation to the current statistics.

It is possible that Draghi will tell us more about the possible European version of quantitative easing. It is expected that not to interfere with Berlin, the ECB may choose to purchase not the debt obligations of national governments, but start buying portfolios of loans from banks. Accordingly, inflation will get a boost to growth, and banks - the ability to increase lending.

Equally important will be Draghi’s comments about the relatively low inflation. When at the Kansas Fed symposium, he pointed to the possibility of correction of inflation expectations in the euro area, it was the first sign of the upcoming easing policy by the ECB. It is possible that Draghi will outline the size of the program its possible start date by identifying the parameters of inflation, which will serve as a trigger to start the QE.

Surely, there will be remarks about the responsibility of national governments, but the key will be the promise of the possibility of launching QE. Against the background of the fact that the ECB officials previously talked directly about the low probability of massive purchases of assets, the direct words of Mario Draghi on quantitative easing in any form will be a very strong driver for a reduction in the Eurodollar that will be reinforced with the decent American statistics on the labour market.

It is ironic that Draghi’s press conference and the publication of data on the number of jobs are at the same time. Consequently, the markets will have to "digest" both of these events. The index of applications for unemployment benefits is expected to be released at the level of last week (298k), which in general fits into a positive trend. As a result, if there will be no surprises, the Eurodollar has all the chances of continuing to decline.

RoboForex Analytical Department

Speaking of the results of the ECB meeting, it is unlikely that we will see another rate cut - it simply is not able to resist the extremely low inflation, which has slipped to around 0.3% by the end of August. The deposit rate is also likely to be at the level of -0.1%, and all eyes will be on Mario Draghi’s press conference, during which he will reveal hi position in relation to the current statistics.

It is possible that Draghi will tell us more about the possible European version of quantitative easing. It is expected that not to interfere with Berlin, the ECB may choose to purchase not the debt obligations of national governments, but start buying portfolios of loans from banks. Accordingly, inflation will get a boost to growth, and banks - the ability to increase lending.

Equally important will be Draghi’s comments about the relatively low inflation. When at the Kansas Fed symposium, he pointed to the possibility of correction of inflation expectations in the euro area, it was the first sign of the upcoming easing policy by the ECB. It is possible that Draghi will outline the size of the program its possible start date by identifying the parameters of inflation, which will serve as a trigger to start the QE.

Surely, there will be remarks about the responsibility of national governments, but the key will be the promise of the possibility of launching QE. Against the background of the fact that the ECB officials previously talked directly about the low probability of massive purchases of assets, the direct words of Mario Draghi on quantitative easing in any form will be a very strong driver for a reduction in the Eurodollar that will be reinforced with the decent American statistics on the labour market.

It is ironic that Draghi’s press conference and the publication of data on the number of jobs are at the same time. Consequently, the markets will have to "digest" both of these events. The index of applications for unemployment benefits is expected to be released at the level of last week (298k), which in general fits into a positive trend. As a result, if there will be no surprises, the Eurodollar has all the chances of continuing to decline.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.