A recession returns to the euro zone

06.08.2014

Fundamental analysis for 06.08.2014

The negativity from the euro zone continues to flow in a steady stream. Very few people expected a fall in German industrial orders by 3.2% (as a revised figure - the deepest drop since January 2012). Moreover, compared with the previous month, when the reduction was by 1.6%, the rate of decline has increased. Last time such a consistent acceleration of the negative dynamics was observed in late 2012.It turns out that in general, the weak pulse of the euro zone economic recovery has finally died down - without strong German statistics, pan-European data has every chance to return to a new recession. One of the first signs can be regarded as preliminary data on the Italian GDP, which for the second quarter comes with a minus sign, which means that Rome is quite back to a formal recession.

Moreover, this fact was a complete surprise for the whole euro area, because the expectation was a modest growth in the economy by 0.1%, which would retain the illusive hopes for further recovery. Howeve

By the way, now it is unclear what Rome will do with its economic growth forecast of 0.8% in the current year. Apparently

A "Sanctions War" is also unlikely to contribute to the growth of business activity. Yester

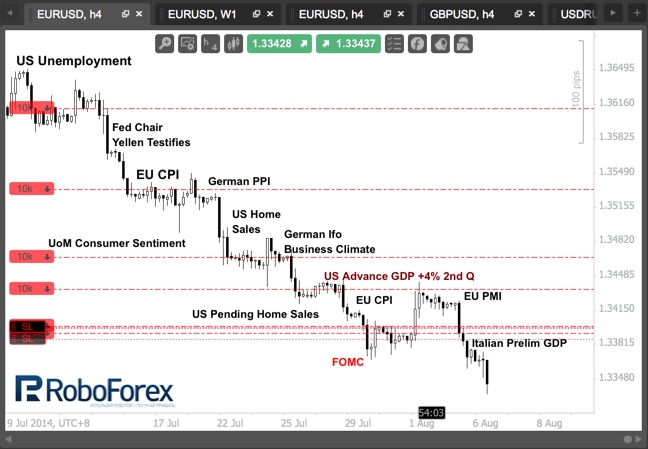

The strategy of retaining the sale transactions justifies itself. I moved all the stop-loss positions to the last maximums, which already provide profitability of all trades. The most interesting thing is awaiting us on Thursday, namely, as Mario Draghi will continue to justify the uselessness of starting the European QE on the background of the fall in inflation to 0.4% and the return of a recession in Italy. We should stock up on popcorn.

RoboForex research department Stanislav Koval

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.