Pressure on the ECB is still growing. Fundamental analysis for 01.09.2014

01.09.2014

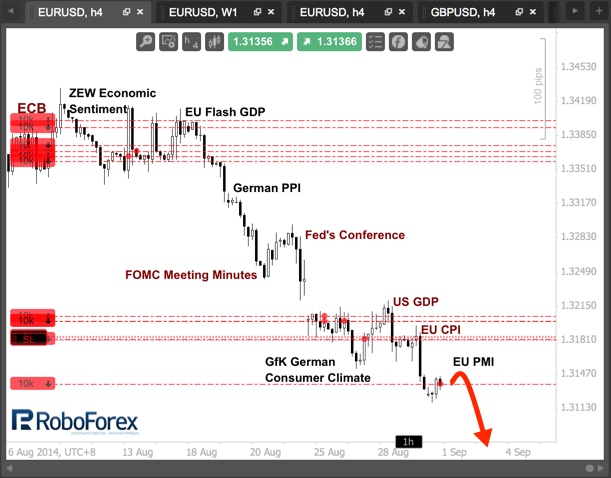

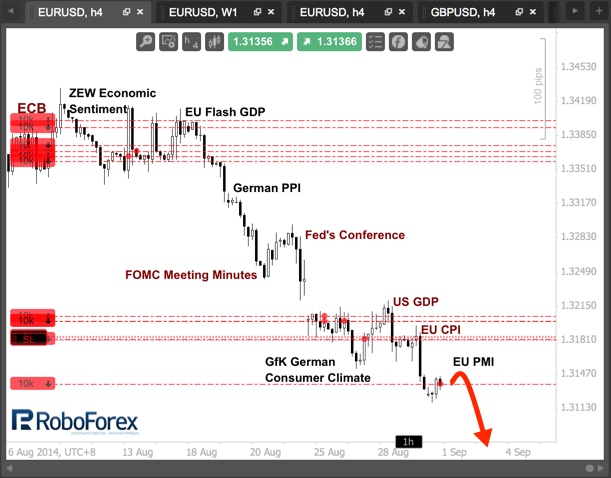

It is a day off in the United States, and thus no strong movements can be expected from the Eurodollar. However, current statistics continue to fuel the downward trend of the currency pair. Last Friday strong data came out on the United States, where, despite the decline in consumer spending, the expectations index was better than the predicted values, and the Chicago PMI came back to the annual maximum.

In the euro zone everything is much more complicated - PMI indices are down in all countries of the monetary union, and the Italian industrial component fell below 50, indicating a reduction in the manufacturing sector. Consequently, there is a risk of a prolonged recession into which the Italian economy entered in the second quarter. Do not forget about the "negative inflation" at the level of 0.2% in the third-largest euro zone economy, which extremely complicates the way out of the recession.

On this not so positive background the ECB is going to the next meeting, the results of which will be announced on the coming Thursday. The potential for reducing rates is almost exhausted and the only intelligible response from the regulator may be a full launch of the program of purchases of securities. However, there is a substantial likelihood that Mario Draghi will once again prefer to drag things along, promising to take action if the situation deteriorates.

Thus it is unclear to what extent the inflation needs to fall, in order for the ECB to start running the QE mechanisms. Do recall that in the June meeting, when the ECB lowered its deposit rate to a negative level of -0.1% and announced the launch of the Bank's lending program, inflation stood at around 0.5%. Now the figure has dropped to 0.3%, and it is unlikely that anyone will be able to give a guarantee that in September inflation will not fall even lower.

The inflation is still further away from plans to the ECB on its return to the target level of 2%. However, in his speech in Kansas, Draghi complained about fundamental problems still in place - the lack of adequate labour mobility, skills mismatching labour market realities and the need for modernization of education. Draghi reiterated that the ECB alone can not solve the outstanding problems in the euro zone, and we have to act together.

Keeping the strategy on transactions on sale is justified. It is very likely that close to the ECB meeting the market will continue to decline, playing on the rumours of a possibility of some action on the part of the regulator. However, if the ECB does not do anything intelligible, the possible effect of "stretched rubber bands" when the market has fallen too far, a sharp rebound could begin. That is why I plan to further move the stops with the prices.

RoboForex Analytical Department

In the euro zone everything is much more complicated - PMI indices are down in all countries of the monetary union, and the Italian industrial component fell below 50, indicating a reduction in the manufacturing sector. Consequently, there is a risk of a prolonged recession into which the Italian economy entered in the second quarter. Do not forget about the "negative inflation" at the level of 0.2% in the third-largest euro zone economy, which extremely complicates the way out of the recession.

On this not so positive background the ECB is going to the next meeting, the results of which will be announced on the coming Thursday. The potential for reducing rates is almost exhausted and the only intelligible response from the regulator may be a full launch of the program of purchases of securities. However, there is a substantial likelihood that Mario Draghi will once again prefer to drag things along, promising to take action if the situation deteriorates.

Thus it is unclear to what extent the inflation needs to fall, in order for the ECB to start running the QE mechanisms. Do recall that in the June meeting, when the ECB lowered its deposit rate to a negative level of -0.1% and announced the launch of the Bank's lending program, inflation stood at around 0.5%. Now the figure has dropped to 0.3%, and it is unlikely that anyone will be able to give a guarantee that in September inflation will not fall even lower.

The inflation is still further away from plans to the ECB on its return to the target level of 2%. However, in his speech in Kansas, Draghi complained about fundamental problems still in place - the lack of adequate labour mobility, skills mismatching labour market realities and the need for modernization of education. Draghi reiterated that the ECB alone can not solve the outstanding problems in the euro zone, and we have to act together.

Keeping the strategy on transactions on sale is justified. It is very likely that close to the ECB meeting the market will continue to decline, playing on the rumours of a possibility of some action on the part of the regulator. However, if the ECB does not do anything intelligible, the possible effect of "stretched rubber bands" when the market has fallen too far, a sharp rebound could begin. That is why I plan to further move the stops with the prices.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.