The euro zone loses the foundation of stability

31.10.2014

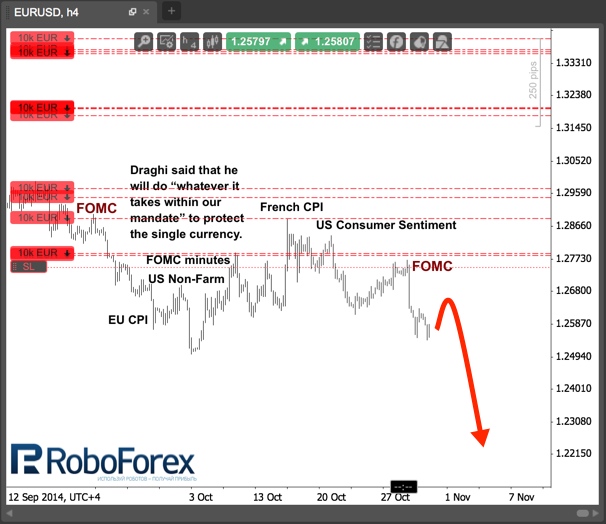

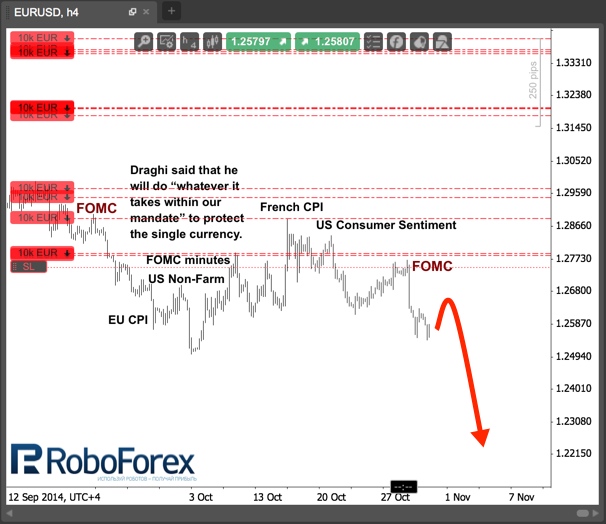

This week was not the most successful for Eurodollar - most of the statistics were published in a negative light, reflecting the further development of the recession in the euro zone, and now talk of restoration is certainly not necessary. Most revealing was the rollback of inflation in Germany to a level of -0.3%, and after two months of the indicator coming out at zero this may cause concern. Moreover, the German retail sank immediately by 3.2%, which is the strongest decline since 2008.

Moreover, the Italian unemployment has returned to growth, and in France there was another reduction in consumer spending. Overall, this data suggests radical changes in the structure of the European crisis. If the locomotive of the recession was previously in peripheral countries, now more and more problems begin to clearly appear in the largest economies of the euro zone - Germany gradually loses the statute of the guarantor of the stability of the Monetary Union.

European inflation is also not showing an upward trend, despite the best efforts of the ECB in this direction. The figure reflected a slight increase from 0.3% to 0.4%, but core inflation was at a loss, returning to the historic low of 0.7%. In light of the "negative inflation" in Germany, the further promotion of the "flywheel" of asset purchases by the ECB becomes simply inevitable.

Along with all this, the US Federal Reserve announces the end of QE3, while promising to keep rates for a "significant time" at a low level. In this case, everybody understands that the issue of this "significance" is relative. The regulator’s own forecasts regarding the dynamics of rates suggest growth starting from the middle of next year, and possibly earlier if the stats will continue to go in a positive way.

The data from the States is really pleasing to the eye - the dynamics of GDP are exceeding all forecasts and consumer confidence is coming to pre-crisis highs. As a pillar of the American economy is the consumer sector, this positivity indicates the possibility of further recovery of GDP, which could be the basis for decision of the regulator to raise rates before the expected market timing.

The Eurodollar sales strategy is still justified. I moved the stops for transactions into the area of a local maximum. Later, after the local correction, I expect the currency pair to advance further down, especially if the evening statistics in the States will be released in a positive light. The data on consumer sentiment and spending will be crucial. If statistics are released at the expected level or a little better, it will be possible for the resumption of the downward movement.

RoboForex Analytical Department

Moreover, the Italian unemployment has returned to growth, and in France there was another reduction in consumer spending. Overall, this data suggests radical changes in the structure of the European crisis. If the locomotive of the recession was previously in peripheral countries, now more and more problems begin to clearly appear in the largest economies of the euro zone - Germany gradually loses the statute of the guarantor of the stability of the Monetary Union.

European inflation is also not showing an upward trend, despite the best efforts of the ECB in this direction. The figure reflected a slight increase from 0.3% to 0.4%, but core inflation was at a loss, returning to the historic low of 0.7%. In light of the "negative inflation" in Germany, the further promotion of the "flywheel" of asset purchases by the ECB becomes simply inevitable.

Along with all this, the US Federal Reserve announces the end of QE3, while promising to keep rates for a "significant time" at a low level. In this case, everybody understands that the issue of this "significance" is relative. The regulator’s own forecasts regarding the dynamics of rates suggest growth starting from the middle of next year, and possibly earlier if the stats will continue to go in a positive way.

The data from the States is really pleasing to the eye - the dynamics of GDP are exceeding all forecasts and consumer confidence is coming to pre-crisis highs. As a pillar of the American economy is the consumer sector, this positivity indicates the possibility of further recovery of GDP, which could be the basis for decision of the regulator to raise rates before the expected market timing.

The Eurodollar sales strategy is still justified. I moved the stops for transactions into the area of a local maximum. Later, after the local correction, I expect the currency pair to advance further down, especially if the evening statistics in the States will be released in a positive light. The data on consumer sentiment and spending will be crucial. If statistics are released at the expected level or a little better, it will be possible for the resumption of the downward movement.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.