An unprofitable place. Fundamental analysis for 10.11.2014

10.11.2014

Last Friday started off with strong enough statistics on the US labour market, which actually confirmed the correctness of actions of the Federal Reserve, which bowed out at the last QE3 meeting. According to published data, in October, 214k jobs were created, which is certainly less than the forecast, but it was still enough for the further recovery of the labour market. Moreover, last month’s increase was revised from 248k to 256k.

Unemployment also continued to decline, falling to the level of 5.8%, and this is below the forecast of the Fed at the end of this year. If not for the virtual absence (if you take into account inflation) income growth, it would be safe to expect a rate hike in the spring of 2015. The situation was used by the Republicans in the last election to "recapture" the majority in the Senate from the Democrats, skilfully playing on the public’s discontent.

Despite the fact that the recovery is not very sharp and fast, job growth is happening for 49 consecutive months - the longest period since the end of the Second World War. Even the poor data for August, when originally only 142k new jobs were announced, they have been revised to increase by 203k. In addition, the current positive statistics came against the backdrop of the euro zone’s unenviable position and a slowdown in China.

However, the question arises whether the labour market can show previous rates of growth in the absence of support from the Fed. It is possible that it is because of this uncertainty the Fed makes no clarity on the terms of the first rate increase. Meanwhile, probably few can guarantee that the completed round of quantitative easing was the last, especially given the pessimistic IMF forecasts for global growth.

In general, the economic situation in the US is still strikingly different from the situation in the euro zone, where the ECB’s attempts to start the mechanism of asset purchases is unlikely to lead to any significant improvements in the short term. Inflation is still among the most critical levels, and more and more countries in the euro zone are being plunged into deflation. In this situation, any special prospects for the single currency are not yet visible.

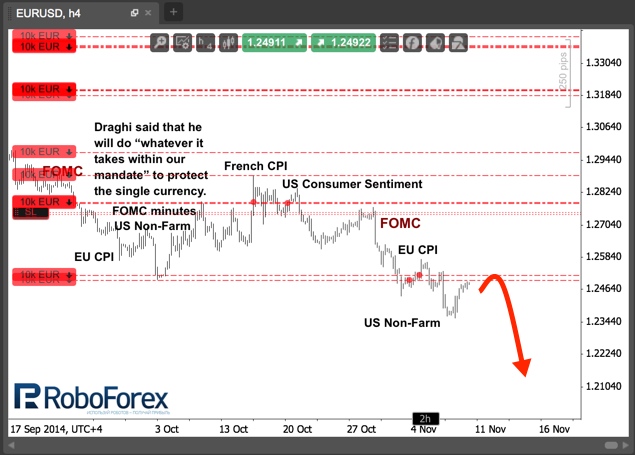

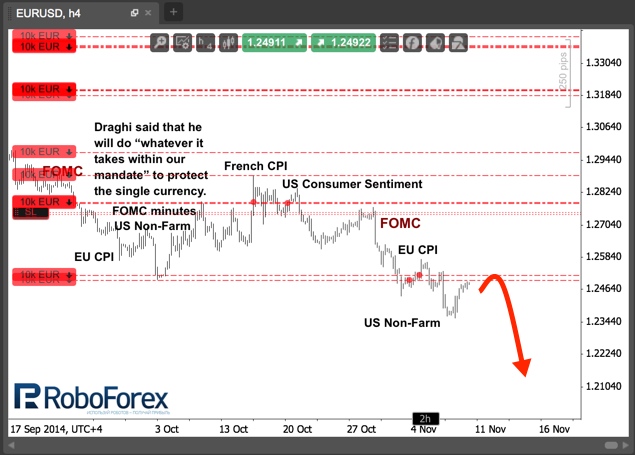

I still hold the transactions for sale and moving the foots after the declining market. Since Tuesday is a day off in the United States, as well as in France, the development of the correction is likely – in its sideways version. Later in the week a number of European statistics will come out, but the most interesting will be Friday's data on inflation and GDP dynamics in the euro area. If data will be worse than the forecast, it can be a driver of the new downward movement of the market.

RoboForex Analytical Department

Unemployment also continued to decline, falling to the level of 5.8%, and this is below the forecast of the Fed at the end of this year. If not for the virtual absence (if you take into account inflation) income growth, it would be safe to expect a rate hike in the spring of 2015. The situation was used by the Republicans in the last election to "recapture" the majority in the Senate from the Democrats, skilfully playing on the public’s discontent.

Despite the fact that the recovery is not very sharp and fast, job growth is happening for 49 consecutive months - the longest period since the end of the Second World War. Even the poor data for August, when originally only 142k new jobs were announced, they have been revised to increase by 203k. In addition, the current positive statistics came against the backdrop of the euro zone’s unenviable position and a slowdown in China.

However, the question arises whether the labour market can show previous rates of growth in the absence of support from the Fed. It is possible that it is because of this uncertainty the Fed makes no clarity on the terms of the first rate increase. Meanwhile, probably few can guarantee that the completed round of quantitative easing was the last, especially given the pessimistic IMF forecasts for global growth.

In general, the economic situation in the US is still strikingly different from the situation in the euro zone, where the ECB’s attempts to start the mechanism of asset purchases is unlikely to lead to any significant improvements in the short term. Inflation is still among the most critical levels, and more and more countries in the euro zone are being plunged into deflation. In this situation, any special prospects for the single currency are not yet visible.

I still hold the transactions for sale and moving the foots after the declining market. Since Tuesday is a day off in the United States, as well as in France, the development of the correction is likely – in its sideways version. Later in the week a number of European statistics will come out, but the most interesting will be Friday's data on inflation and GDP dynamics in the euro area. If data will be worse than the forecast, it can be a driver of the new downward movement of the market.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.