Fibonacci Retracements Analysis 27.03.2018 (EURUSD, USDJPY)

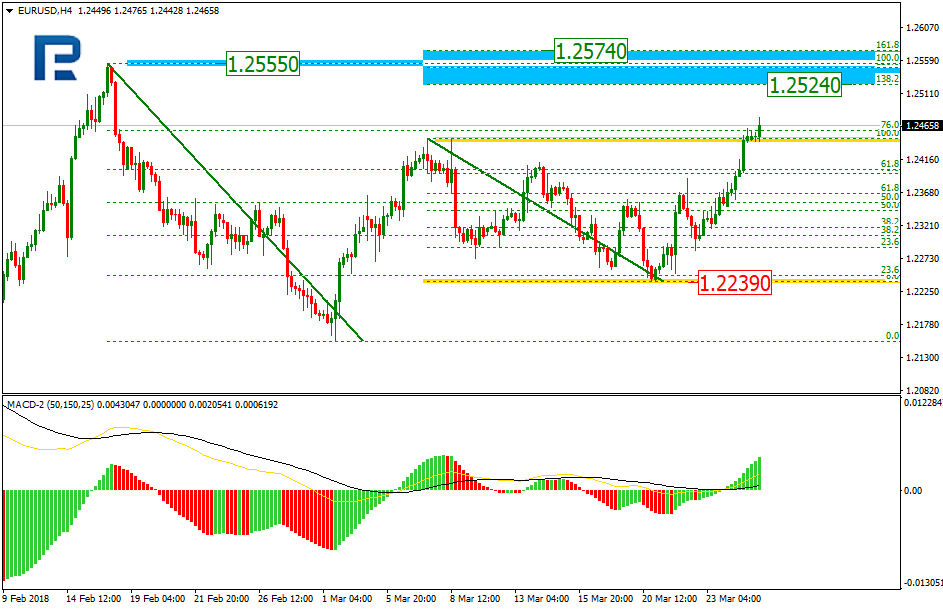

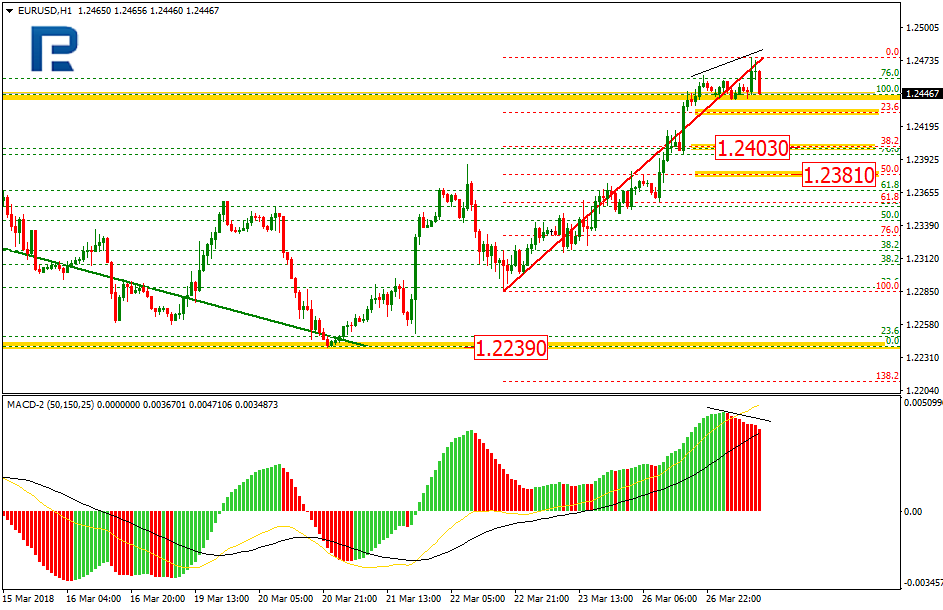

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, EURUSD has broken the local high and right now is trading towards the long-term high at 1.2555, which is inside the post-correctional extension area between the retracements of 138.2% and 161.8% at 1.2524 and 1.2574 respectively. The support level is at 1.2239.

In the H1 chart, the divergence is being formed, which may indicates a possible short-term pullback soon. The target of this pullback may be the retracements of 38.2% and 50.0% at 1.2403 and 1.2381 respectively.

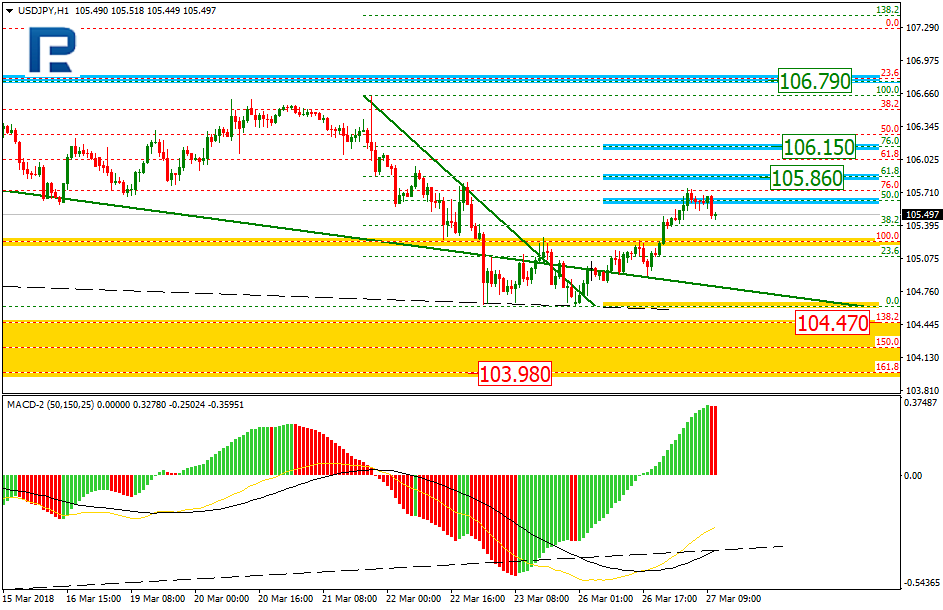

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, after breaking the low, USDJPY is still falling towards the post-correctional extension area between the retracements of 138.2% and 161.8% at 104.47 and 103.98 respectively. Taking into account the convergence that is being formed, one may expect a new correction soon. The possible targets are the retracements of 23.6%, 38.2%, and 50.0% at 106.79, 108.10, and 109.18 respectively.

In the H1 chart, the pair is moving upwards and has already reached the retracement of 50.0%. The next targets are the retracements of 61.8% and 76.05 at 105.86 and 106.15 respectively.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.