Fibonacci Retracements Analysis 22.07.2019 (GOLD, USDCHF)

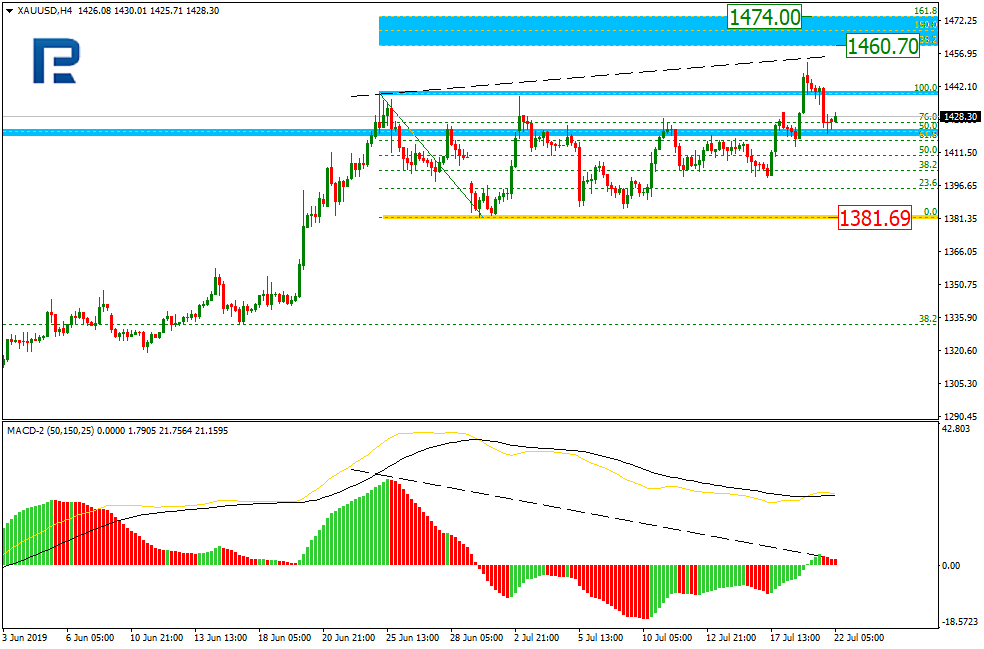

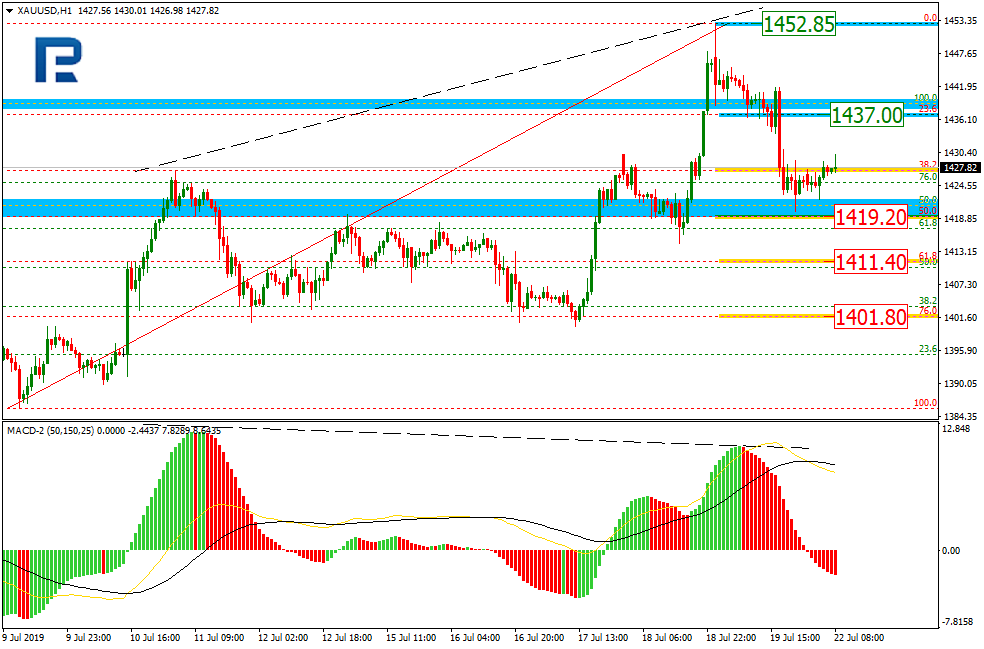

GOLD

On H4 we can see that after a breakthrough of the upper border of the consolidation channel and th renewal of the maximum the quotations have dropped. Such a decline may be regarded as an attempt to test the overcome resistance area from above, turning it into a support area. The key support, in its turn, is situated at the fractal level of 1381.69. Further perspectives for gold lay in the post-correction amplification range of 138.2-161.8% (1460.70-1474.00) Fibo. Later a movement and hitting of the long-term target level of 61.8% (1510.00) look possible.

On H1 we can see a descending correcting dynamics after a divergence. By now the quotations have neared 50.0% (1419.20) Fibo. Further decline may be aimed a 61.8% (1411.40) and 76.0% (1401.80). The local resistance is at 23.6% (1437.00).

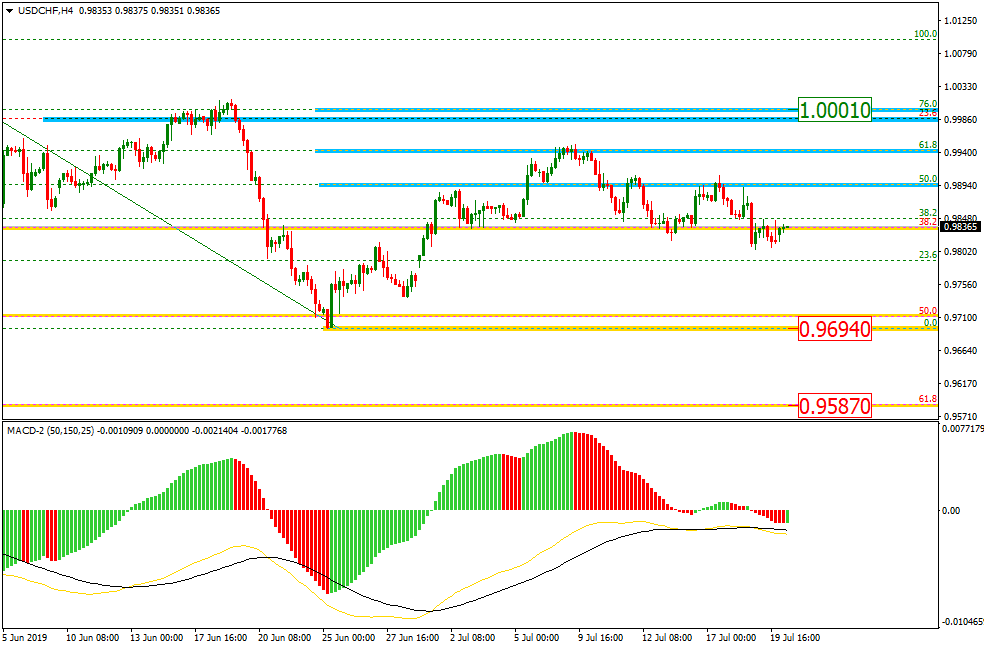

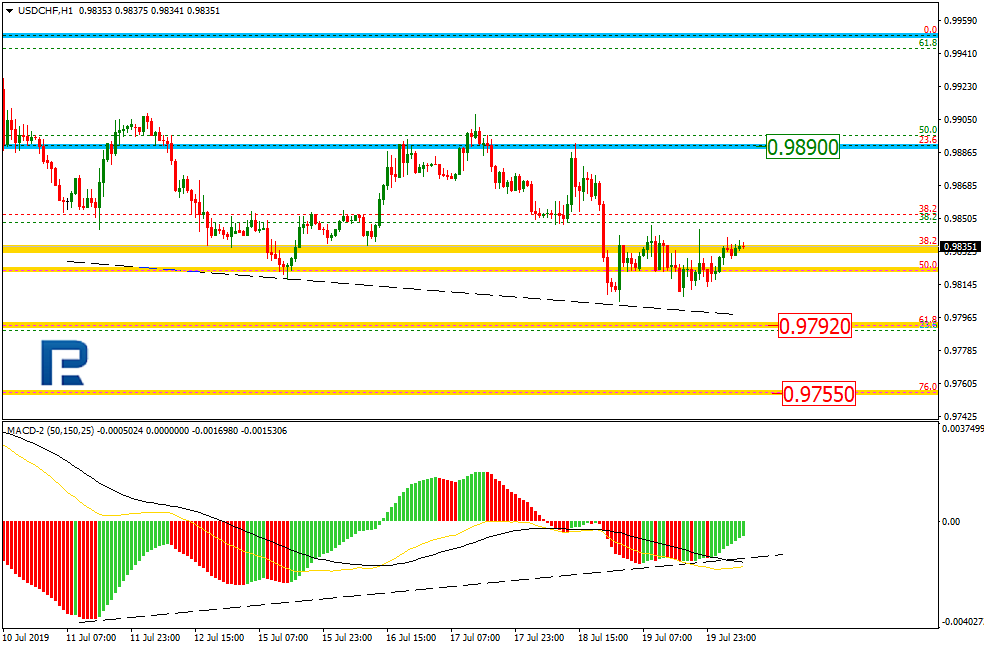

USDCHF

On H4 the pair demonstrates a decline after a correcting growth to 61.8% Fibo. Such reserve may warn about the development of growth to 76.0% (1.0001), the area of psychological resistance. The local goal of the decline is the minimum at 0.9694, upon breaking which the quotations may head for the mid-term goal at 61.8% (0.9587).

On H1 the decline of the quotations is nearing 61.8% (0.9792) Fibo. When forming a convergence, a pullback to the resistance at 23.6% (0.9890) should not develop. After the pullback yet another decline to 76.0% (0.9755) may follow.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.