Fibonacci Retracements Analysis 08.07.2019 (GOLD, USDCHF)

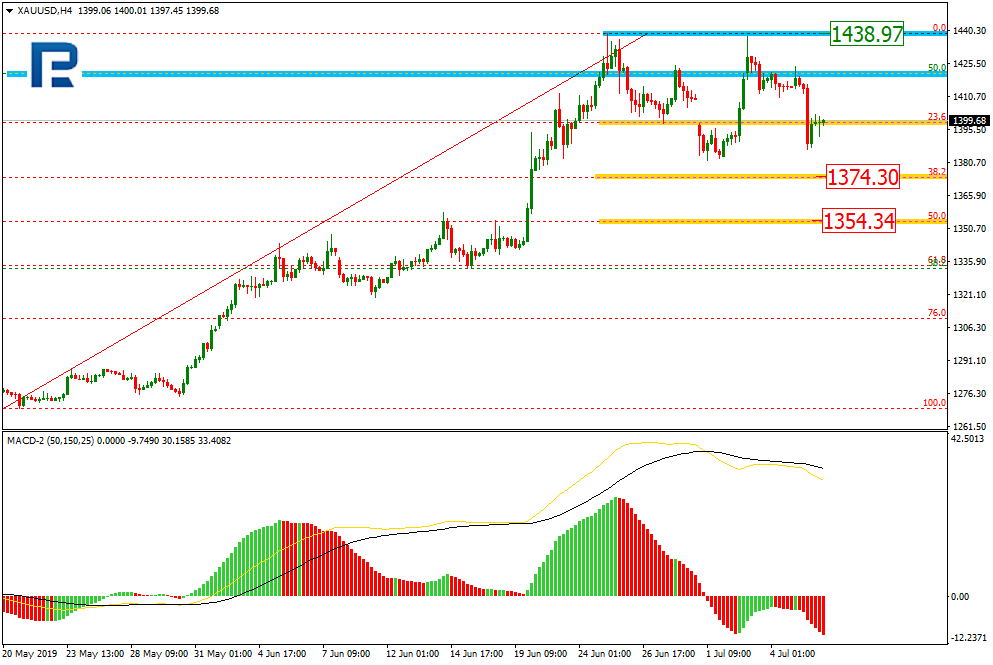

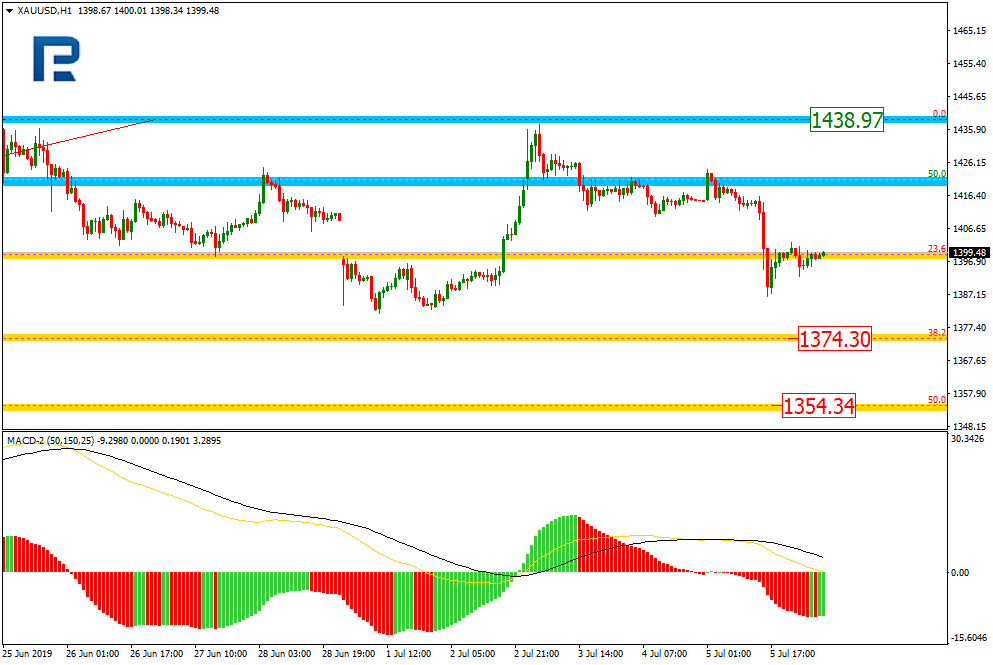

XAUUSD, “Gold vs US Dollar”

In the H4 chart, XAUUSD tried to form a new rising impulse to update the high, but faced the strong resistance from bears, which made the pair return to the local low. As a result, the price may yet continue the correction towards 38.2% and 50.0% fibo at 1374.30 and 1354.34 respectively. The resistance is the high at 1438.97. If the pair breaks it, the instrument may continue growing towards long-term 618% fibo at 1510.00.

As we can see in the H1 chart, the pair is trading between the high and the target Fibonacci retracement, 38.2% at 1374.30.

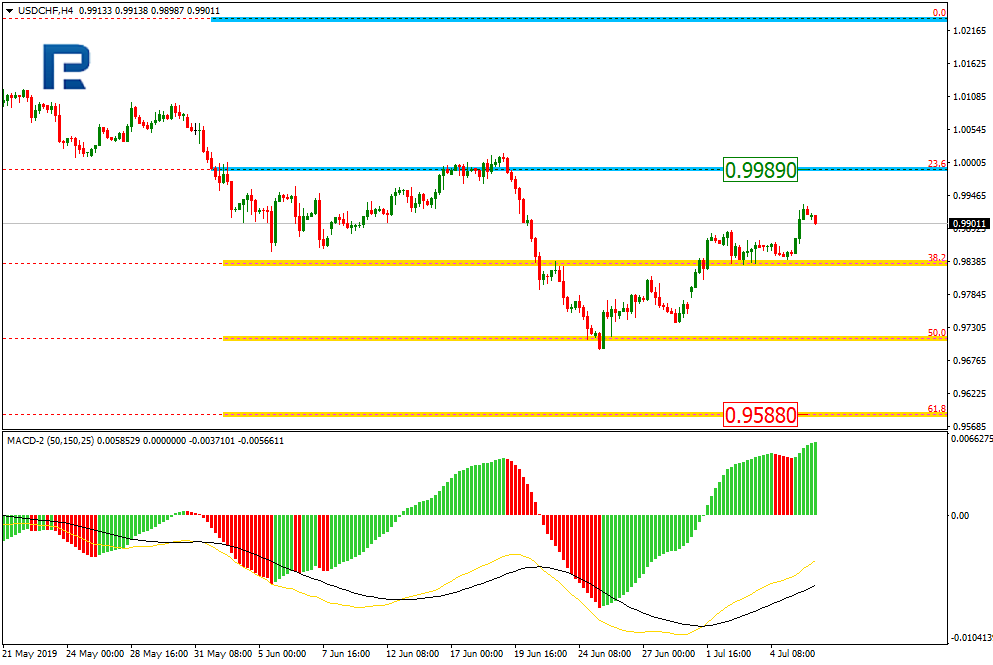

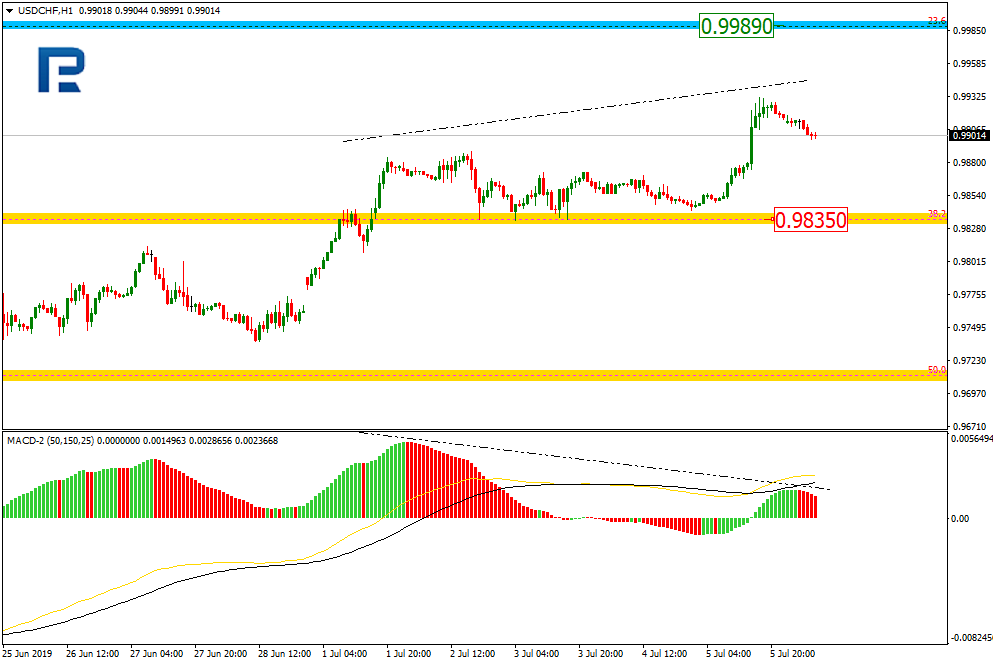

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after reaching 50.0% fibo, USDCHF is forming a new correctional uptrend, which is heading towards the resistance at 23.6% fibo at 0.9989. After completing the pullback, the price may fall towards 61.8% fibo at 0.9588.

In the H1 chart, the uptrend continues. At the same time, there is a divergence on MACD, which may indicate a possible reverse soon. If the pair breaks the local support at 38.2% fibo at 0.9835, the instrument may start a new wave to the downside.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.