Murrey Math Lines 11.01.2017 (EUR/USD, USD/CAD)

Analysis for January 11th, 2017

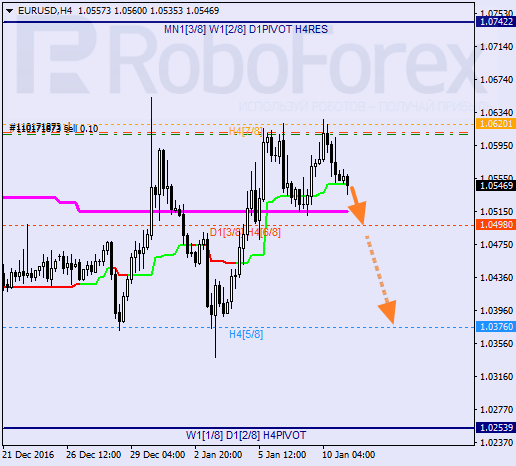

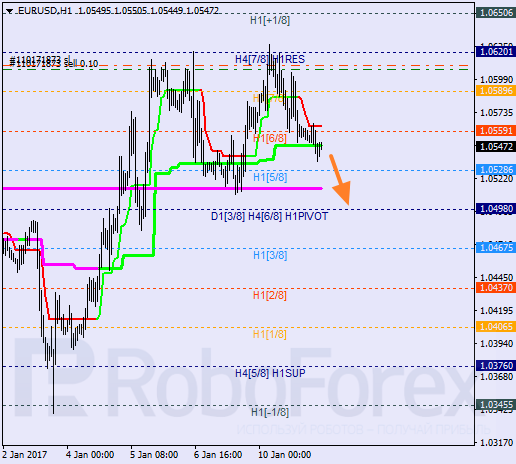

EUR USD, “Euro vs US Dollar”

The EUR/USD pair rebounded from the 7/8 level for the third time, which means that the downtrend may resume. To confirm a new decline, the market has to break the 6/8 level along with Super Trends and fix below them. If it happens, the closest target for bears will be the 5/8 level.

As we can see at the H1 chart, the 8/8 level provided resistance. If Super Trends form “bearish cross” in the nearest future, the pair may break the 4/8 level and continue falling towards its downside targets. However, if the market rebounds from the 4/8 level, it may test the local highs once again.

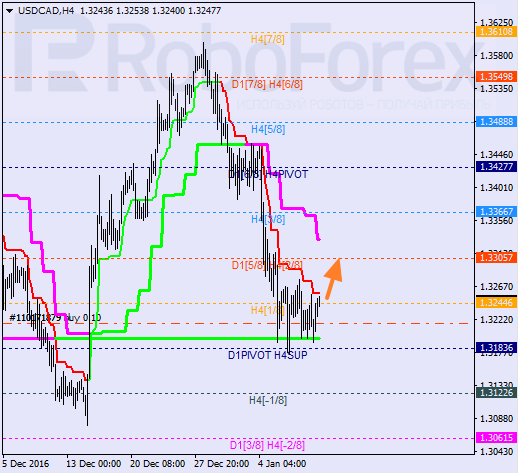

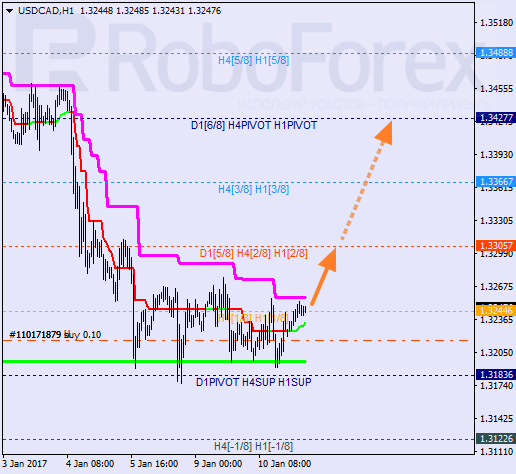

USD CAD, “US Dollar vs Canadian Dollar”

The USD/CAD pair rebounded from the 0/8 level and the weekly Super Trend several times. Consequently, in the nearest future the market may start an ascending correction, at least. The closest target is the 2/8 level. If later the price breaks this level, the pair will continue moving upwards.

The lines at the H4 and H1 charts are completely the same. If Super Trends form “bullish cross” in the nearest future and the price fixes above the 2/8 level, later the market may test the 4/8 one.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.