Fibonacci Retracement Analysis 27.07.2017 (GOLD, USD/CHF)

GOLD

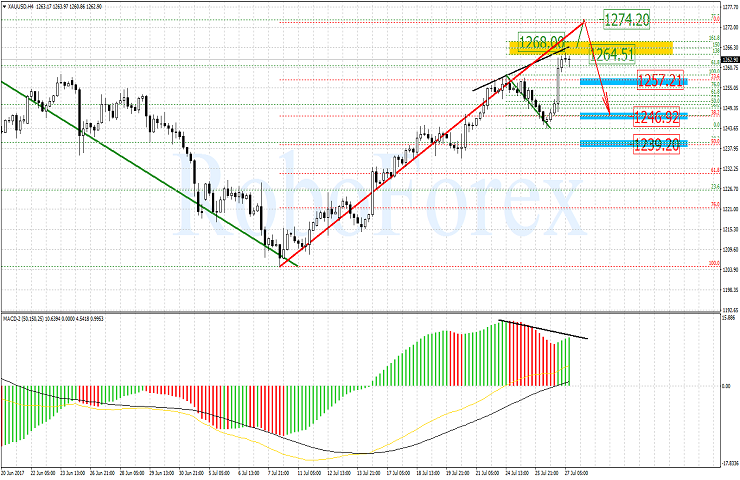

On the H4-chart of GOLD we can see that the uptrend is being developed and a pre-reversal divergence is being built. After a short-term throwback the ascending impulse hit 138.2% level. 1268.00 and 1274.00 levels can be the next targets for this rising move. If those levels are achieved and the current divergence is completed, a correction move towards 23.6% Fibo (1257.21) can be expected. Then GOLD can move lower to reach 38.2% (1246.92).

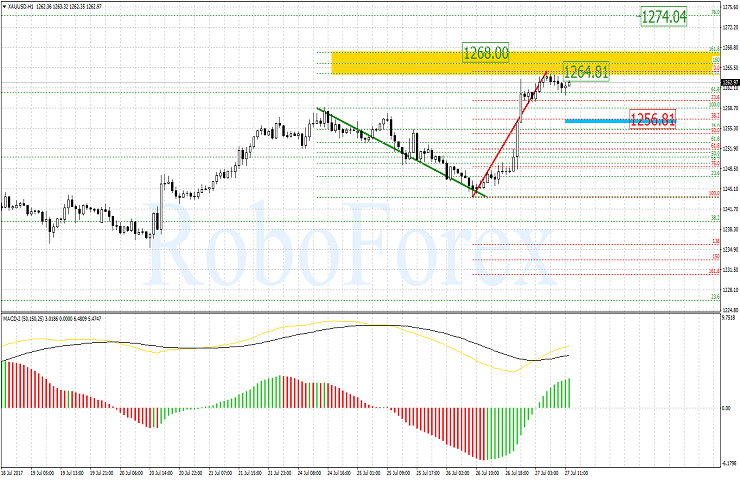

The H1-chart of GOLD confirms a possible further rise towards 1268.00 and 1274.00 levels. But in the short term a throwback towards 1256.81 (Fibo 38.2%) can also be taken into account.

USD/CHF

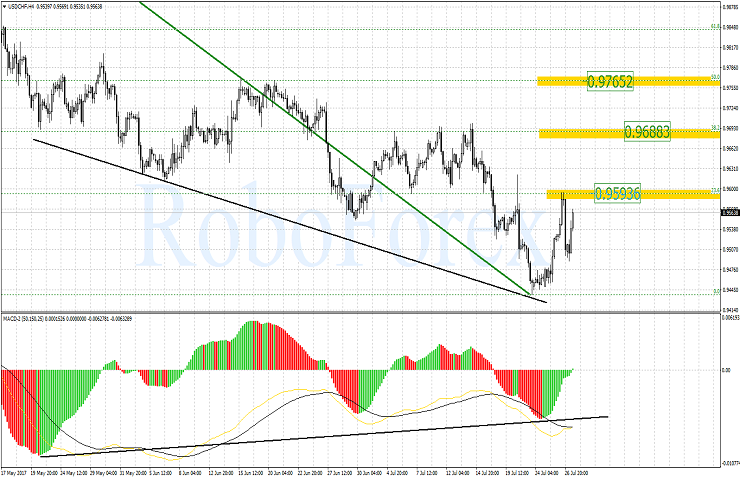

Looking at the H4-chart of USD/CHF pair, we see the start of an ascending correction after a prolonged downtrend. At the moment the pair has corrected by Fibo 23.6%. The next target is 0.9688 level (38.2%).

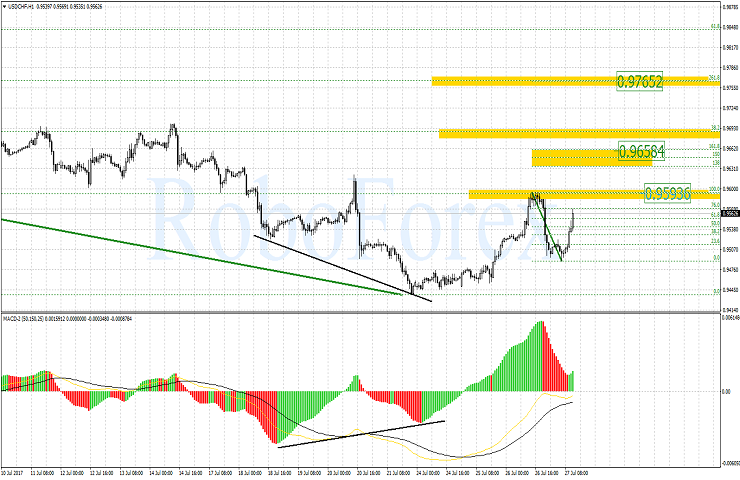

H1-chart of USD/CHF: after the correction move occured, there is a new ascending impulse being developed. If the local high 0.9593 is broken, price can move higher to reach 0.9658 level which corresponds to 161.8% Fibo elongation.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.