Wave Analysis 19.02.2013 (EUR/USD, GBP/USD, USD/CHF, USD/JPY)

19.02.2013

Analysis for February 19th, 2013

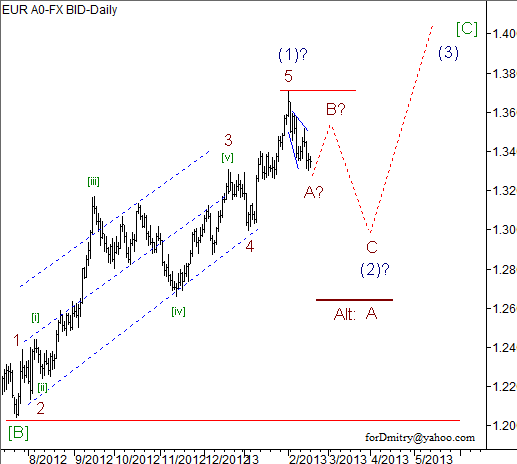

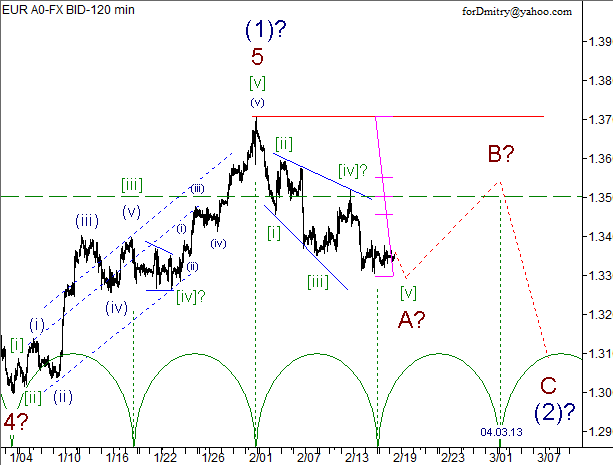

EUR/USD

We may assume that Euro is forming a descending correction (2) of [C], which may take the form of zigzag.

We may assume that the price is forming wedgeA of (2) inside a descending correction (2) of [C].

We can’t exclude a possibility that the pair is completing a descending wedgeA of (2). Later the price is expected to start forming an ascending correction B of (2), which may continue for a couple of weeks.

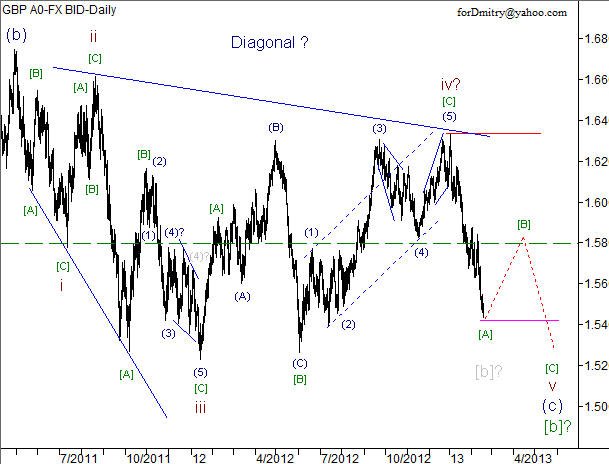

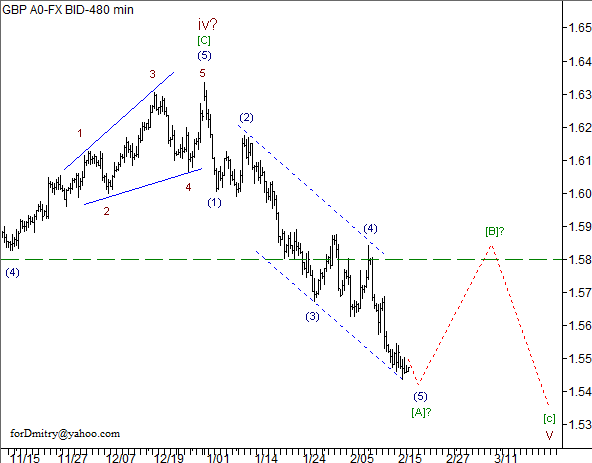

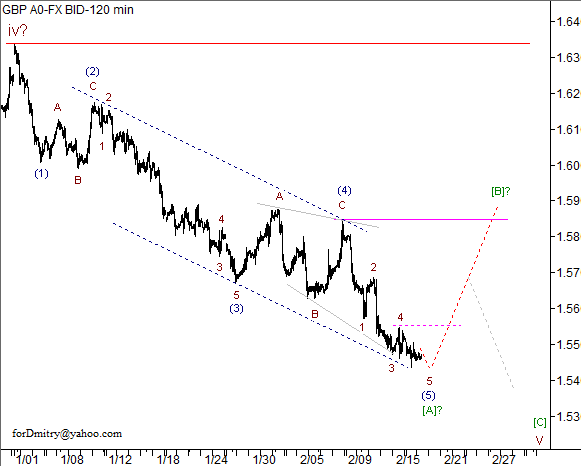

GBP/USD

We may assume that Pound is finishing a large descending correction [b] of B.

We may assume that currently the pair is forming a descending zigzag[A]-[B]-[C] of v of (c) of [b] of B.

We may assume that the pair is completing a descending impulse [A] of v, which may be followed by a local ascending correction [B] of v.

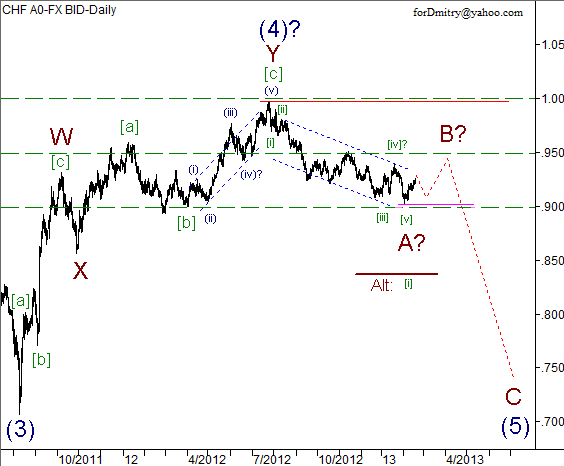

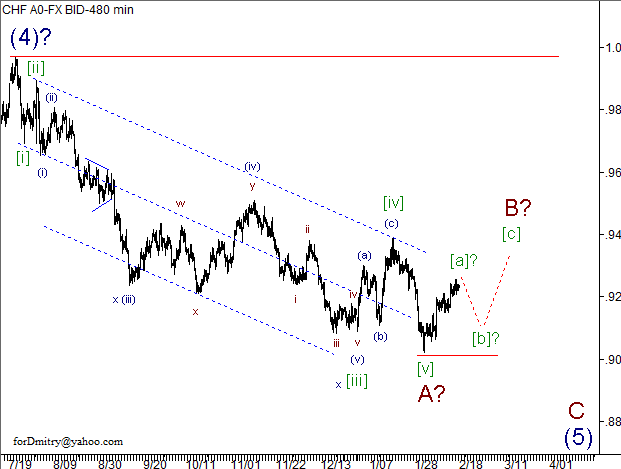

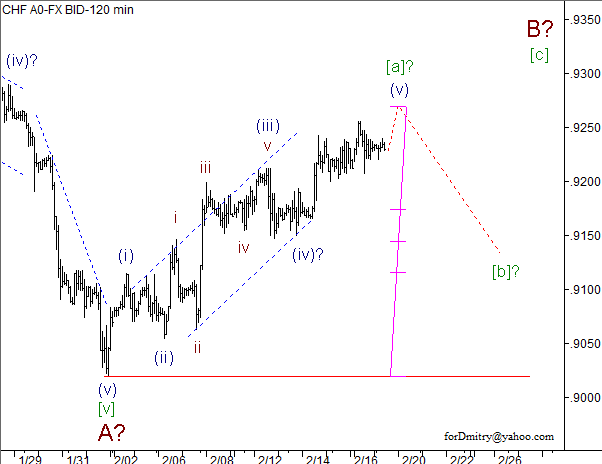

USD/CHF

We can’t exclude a possibility that Franc completed a descending impulse A of (5) and started forming an ascending correction B of (5).

We may assume that the price is forming an ascending correction B of (5), which may take the form of double zigzag.

We can’t exclude a possibility that the pair is finishing the first wave [a] of B of an ascending correction B, which may be followed by a local descending correction [b] of B.

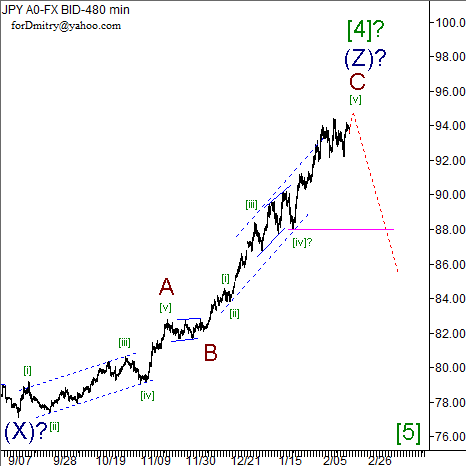

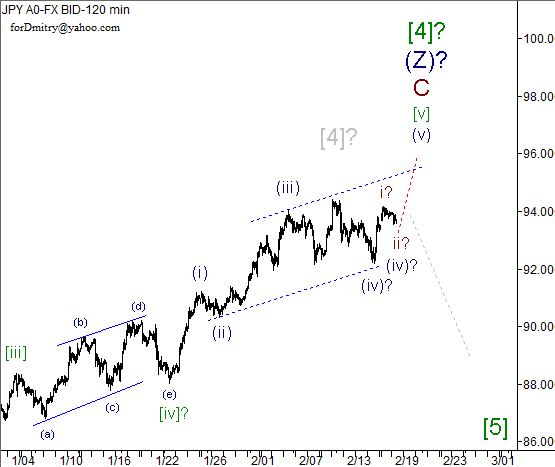

USD/JPY

We may assume that the price is finishing a final ascending structure inside a possible zigzag(Z) of [4]. If the assumption is correct, after that the pair is expected to make a reverse and start moving downwards inside wave [5] of V.

We may assume that the pair is completing an ascending zigzag(Z) of [4] and a large correction [4].

We may assume that the pair is completing an ascending impulse C of(Z) of [4]. If the assumption is correct, then later the price may start falling down and form wave [5].

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.