Ending diagonal triangle. XAU/USD wave analysis

01.10.2014

Analysis for October 1st, 2014

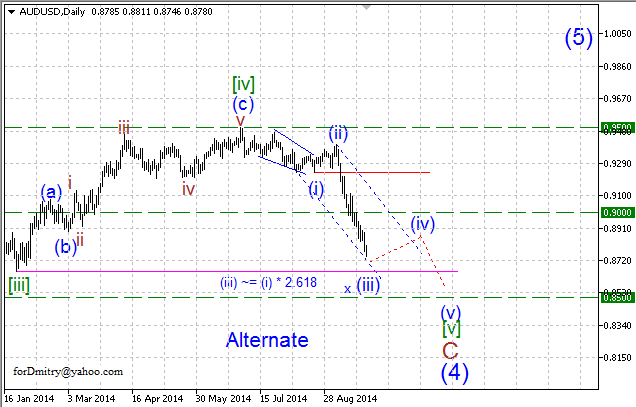

In our previous review, “Long horizontal correction. Wave analysis of XAU/USD for 25.09.2014”, we discussed a possible scenario how the price may complete the final descending impulse (v).

Our expectations on lower levels haven’t changed much. However, these slight changes of the wave structure has forced us to update some details of the chart and trading plans.

The structure and the form of the pattern, which is being formed on lower levels right now, imply that the price might be forming ending diagonal triangle, which may probably turn out to be the final wave of a descending impulse iii of (v).

Probably, the pair is completing an extended descending impulse iii of (v) of the final impulse (v). At the moment, the market is forming ending diagonal triangle(5) of [5] of iii of (v), which later may be followed by an ascending correction iv of (v).

Our expectations on the daily chart haven’t changed. According to the main scenario, the market is finishing the final descending impulse (v) of [c] of A, which may complete a large descending zigzagA.

However, at the same time one should remember that any possible scenario is subjective and the market may move in a completely different direction.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.