Monthly Wave Analysis for October, 2014 (EUR/USD, GBP/USD, USD/CHF, USD/JPY)

29.09.2014

Forecast for October, 2014

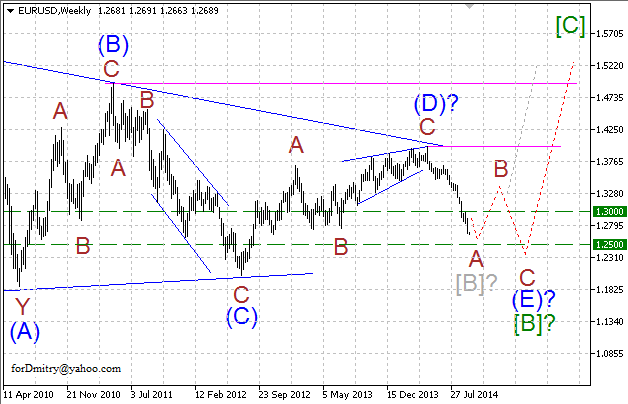

EUR USD, “Euro vs US Dollar”

Probably, Euro is still forming a large ascending zigzag[A]-[B]-[C] of V of (a) and is about to finish its descending correction [B] of V in the form of horizontal running triangle – right now the pair is completing the final descending wave (E) of [B].

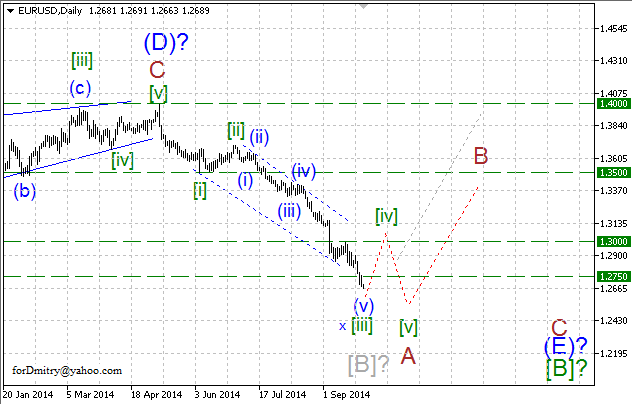

One of the possible scenarios implies that Euro completed an ascending zigzag(D) of [B] of horizontal triangle[B]. Probably, right now the price is forming the final descending zigzag(E) of [B].

Probably, the price is forming the final descending zigzag(E) of [B]. By now, the pair has almost completed impulse [iii] of A of (E), which may be followed by an ascending correction [iv] of A of (E). The depth, relative size, and structure of this correction may help us to predict how the pair will move in the future.

At the same time, an alternative scenario implies that a descending structure, which the price has been forming since the middle of 2008, may be an unfinished wedge a of (b). To confirm this scenario, it would be enough for the price to cross the confirming level at 1.1876. In this case, we can forget about a new historic maximum for a long time.

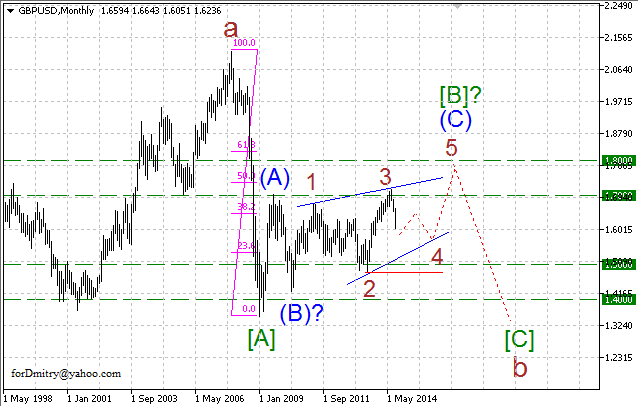

GBP USD, “Great Britain Pound vs US Dollar”

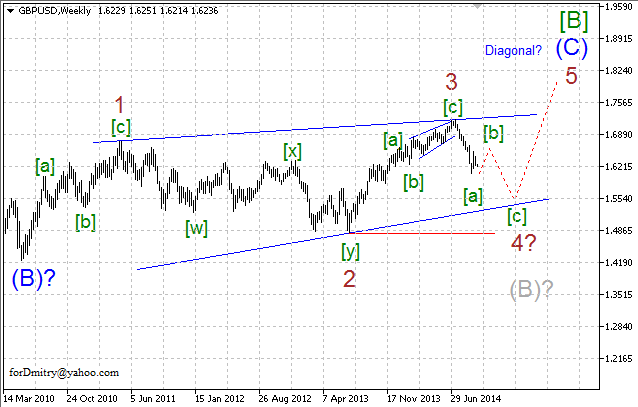

Probably, descending “leg” [A] of b of a large descending zigzag«b» was completed, and at the moment the pair is forming an ascending correction [B] of b, which may also take the form of zigzag. One of the possible scenarios implies that the price has already completed a descending correction (B) of [B] and right now is forming the second “leg” (C) of [B] of zigzag[B] in the form of ending triangle.

Probably, the final wave (C) of [B] of an ascending zigzag[B] is taking the form of ending triangle. If this assumption is correct, then the pair finished an ascending zigzag3 of (C) and started a descending correction 4 of (C), which may take the form of zigzag or more complicated pattern.

Probably, the pair is forming a descending zigzag4 of (C). Right now, the price is forming its ascending correction [b] of 4, after which the market may continue falling.

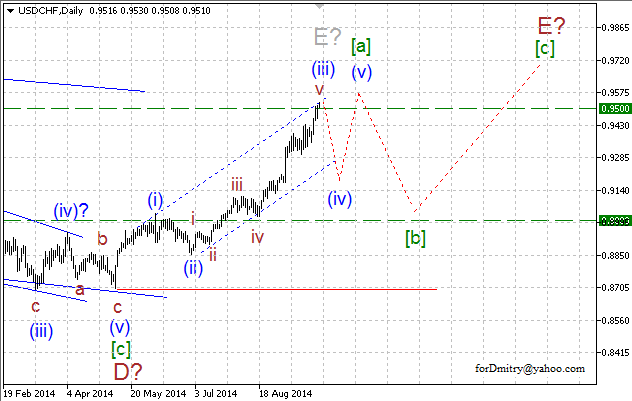

USD CHF, “US Dollar vs Swiss Franc”

Probably, Swiss Franc is finishing global descending trend in the form of triangle(a). Right now, the pair is completing its zigzag[A]-[B]-[C] of V of (a) with ending diagonal triangle [C] of V of (a) as its second “leg”. It may be confirmed by the fact that internal wave structure of this diagonal triangle looks completely formed.

Probably, right now the price is completing an ascending correction (4) of [C] in the form of skewed triangle, which may be followed by the final descending movement inside zigzag(5) of [C]. The pair is forming the final ascending wave E of (4).

The pair is forming the final ascending wave E of (4), which may take the form of zigzag; by now the market has almost completed an ascending impulse (iii) of [a] of E, which may be followed by a descending correction (iv) of [a] of E. The depth, relative size, and structure of this correction may help us to predict how the pair will move in the future.

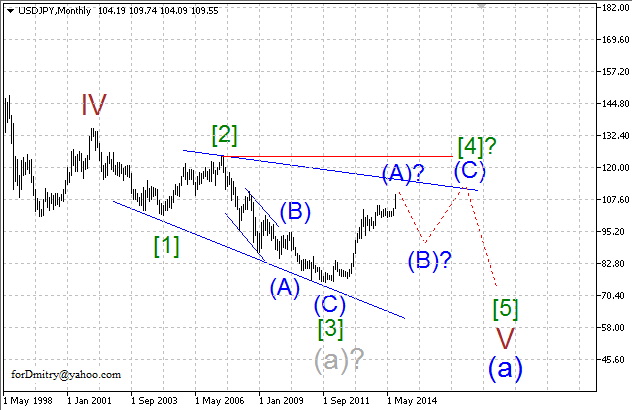

USD JPY, “US Dollar vs Japanese Yen”

One of the possible scenarios implies that the pair is forming the final diagonal triangleV of (a) of a global descending impulse (a). Right now, the price is forming its ascending correction [4] of V of (a), may be in the form of zigzag. Yen is finishing an ascending impulse (A) of [4], which may be followed by a descending correction (B) of [4].

Probably, an ascending correction [4] may take the form of zigzag; right now, the price is completing its first “leg” (A) of [4] in the form of impulse. If this assumption is correct, then after finishing an ascending impulse (A) of [4], the pair may start a large descending correction (B) of [4].

Possibly, right now the price is forming the final ascending impulse 5 of (A). Yen is completing its impulse [iii] of 5, which may be followed by an ascending correction [iv] of 5.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.