Murray Math Lines 22.08.2014 (EUR/USD, SILVER)

22.08.2014

Analysis for August 22nd, 2014

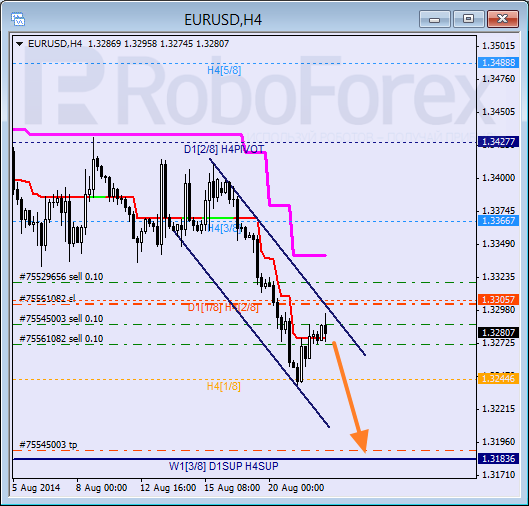

EUR USD, “Euro vs US Dollar”

Despite the fact that Euro rebounded from the 1/8 level and started a new correction, the main trend remains bearish. Considering that the market is moving between Super Trends, the risks are rising, that’s why I decided to decrease the total volume of my position and recorded the profit for my very first sell orders. If later bears are able to regain the initiative and keep the price below the H1 Super Trend, I’ll increase my short position.

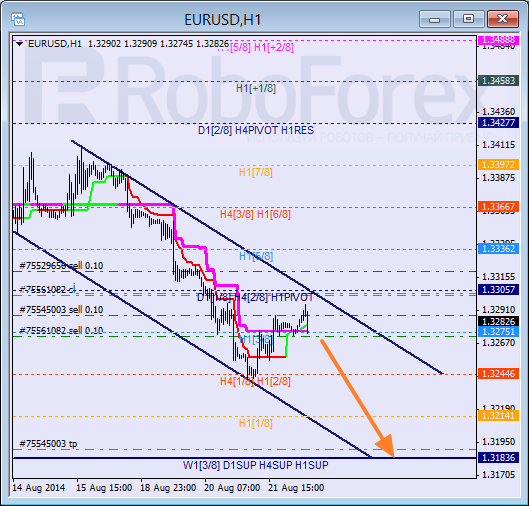

As we can see at the H1 chart, the current correction started after rebounding from the 2/8 level, which means that the market may start a new descending movement, although reverses hardly ever occur here. If later bears are able to keep the price below the 3/8 level, the pair may start falling towards the 0/8 one.

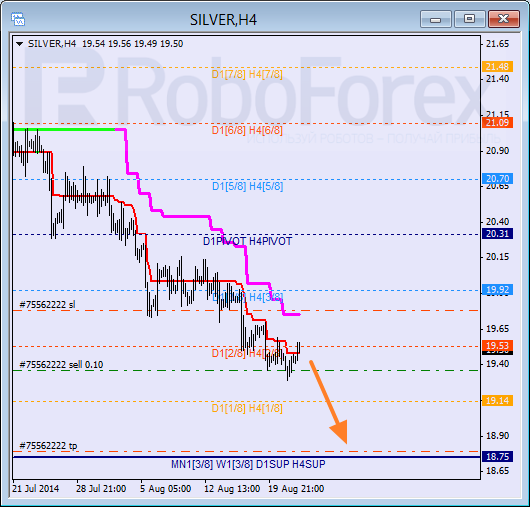

XAG USD, “Silver vs US Dollar”

Silver is still supported by H4 Super Trend. If bears are able to rebound from it again this time, the price may reach the 0/8 level and then start a new and deeper correction.

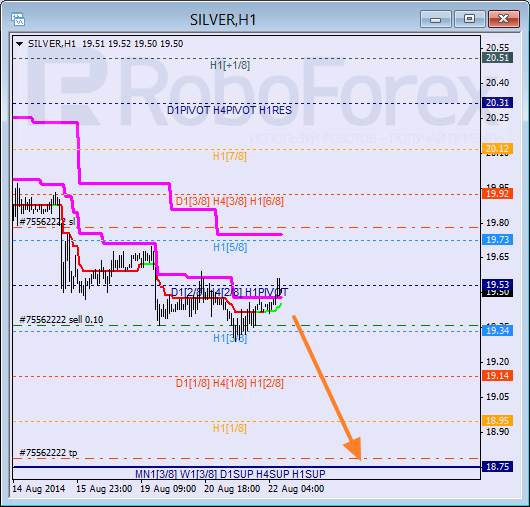

As we can see at the H1 chart, the market got very close to the 4/8 level and now the future scenario depends on how it will move near this level. Taking into account that Super Trends are still influenced by “bearish cross”, the current downtrend is expected to continue. But if the market breaks the 5/8 level, it will be a disastrous for sellers – in this case the price is very unlikely to reach the 0/8 one.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.