Murray Math Lines 21.07.2014 (AUD/USD, EUR/GBP, SILVER)

21.07.2014

Analysis for July 21st, 2014

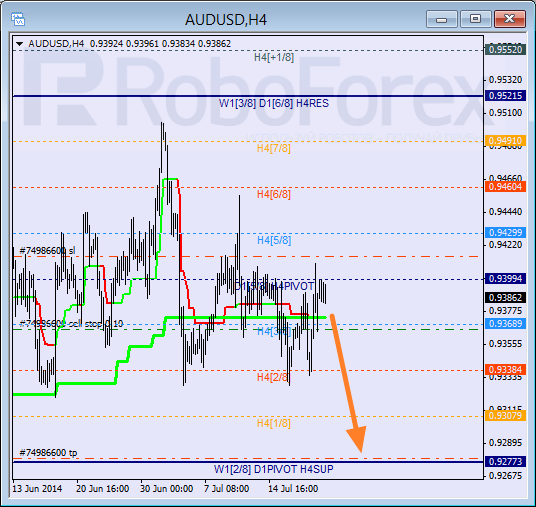

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still consolidating. Last week, pair rebounded from the 4/8 level several times, which means that it may continue falling down. If later price breaks the 3/8 level downwards, market will continue moving downwards to reach the 0/8 one.

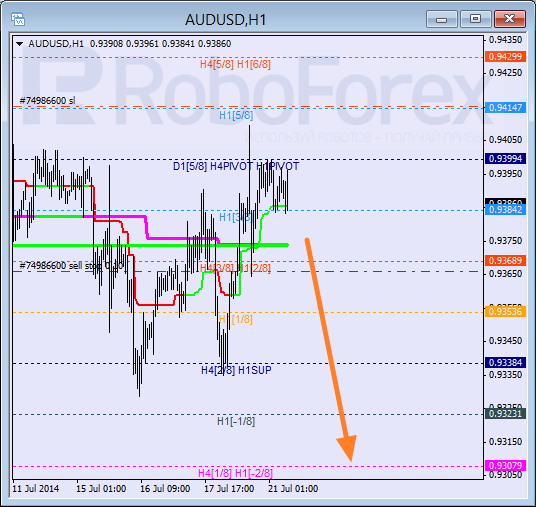

Pair is moving in the middle of H1 chart; Super Trends are influenced by “bullish cross”. However, in the nearest future they may reverse in bearish direction. I’m staying out of the market so far and have only one pending order.

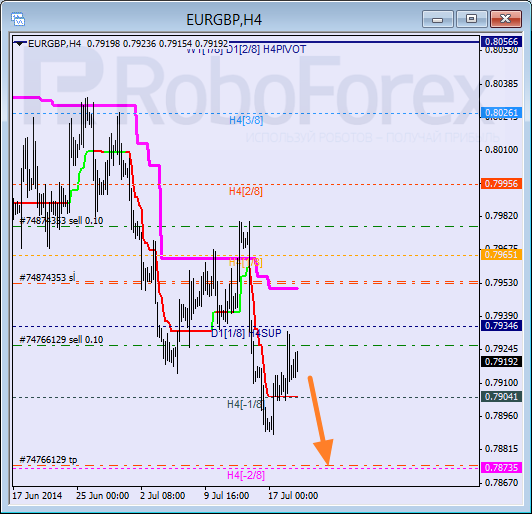

EUR GBP, “Euro vs Great Britain Pound”

Pair is still moving inside “oversold zone”. Last Friday, price tested the 0/8 level and rebounded from it. Target is at the -2/8 level. If market breaks it, lines at the chart will be redrawn.

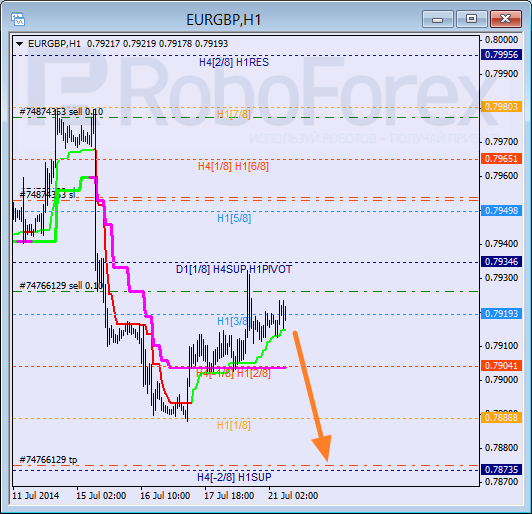

At H1 chart, price is trying to stay below the 3/8 level. Possibly, Super Trends may form “bearish cross” during the day. Main target here is the 0/8 level, which may later become starting point of new correction.

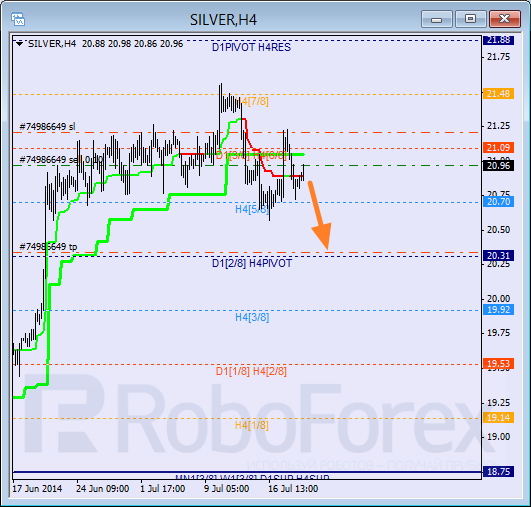

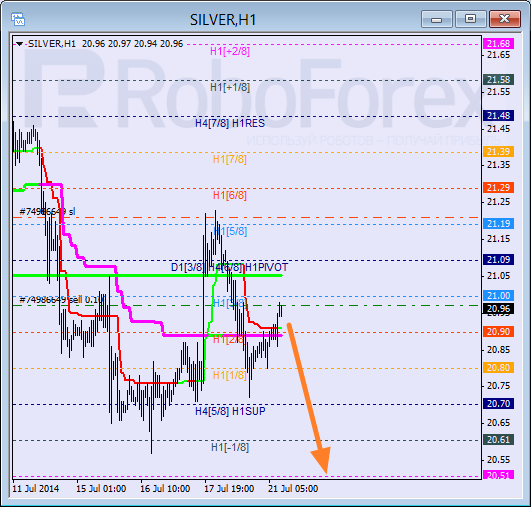

XAG USD, “Silver vs US Dollar”

At H4 chart, current correction is supported by Super Trends. If price rebounds from them, Silver will continue falling down towards the 4/8 level. If this level is broken later, next target will be at the 3/8 one.

As we can see at H1 chart, price wasn’t able to stay inside “oversold zone”. Possibly, Silver may rebound from the 3/8 level during the day. If later market breaks Super Trends downwards, Silver will break the ‑2/8 level and lines at the chart will be redrawn.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.