Murray Math Lines 17.04.2012 (AUD/USD, GBP/JPY, NZD/USD)

17.04.2012

Analysis for April 17th, 2012

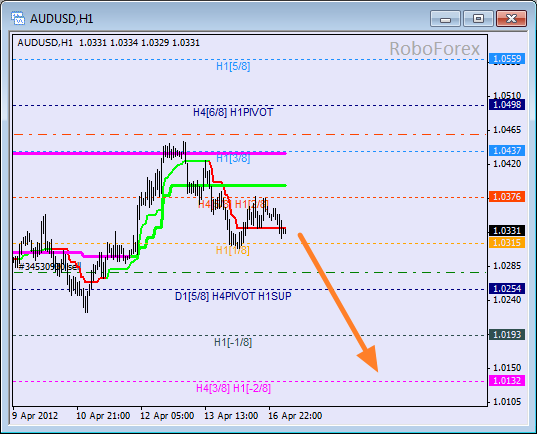

AUD/USD

The descending trend is supported by the weekly and daily Super Trends’ lines, the price rebounded from them yesterday. We can’t exclude a possibility that the market may start moving downwards again in the nearest future. The target for the bears is the 0/8 level.

At the H1 chart the Super Trends’ lines formed “bearish cross”, and at the moment the local correction is taking place. The price may start falling down again during the day. After that we can expect the pair to break the -2/8 level and the lines at the chart will be redrawn.

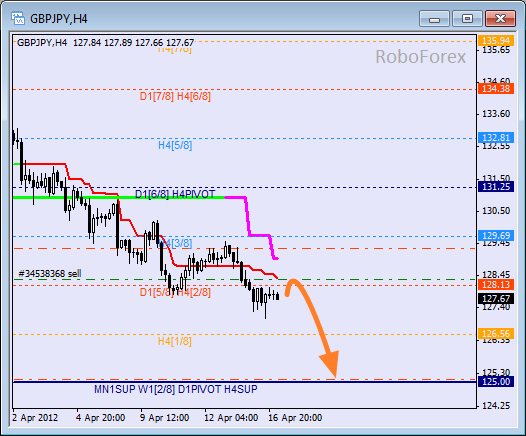

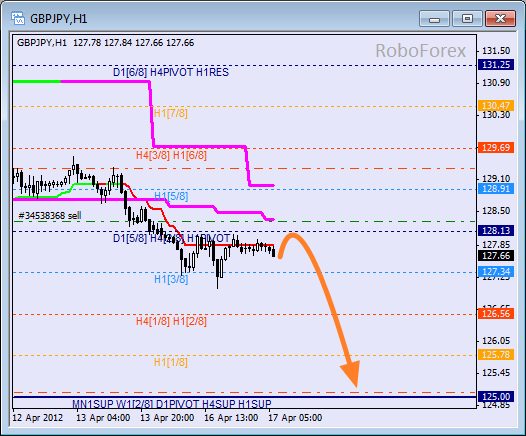

GBP/JPY

After breaking the 2/8 level, the price started the correction. Most likely the price will try to test the H4 Super Trend’s line, and if it rebounds from the line, the market will start falling down again. The target for the bears in this case will be at the 0/8 level.

At the H1 chart the correction is taking place below the 4/8 level. The bears’ first attempt to break the 3/8 level failed. There is a possibility that the local correction may be finished on Tuesday and the pair will continue falling down towards the 0/8 level.

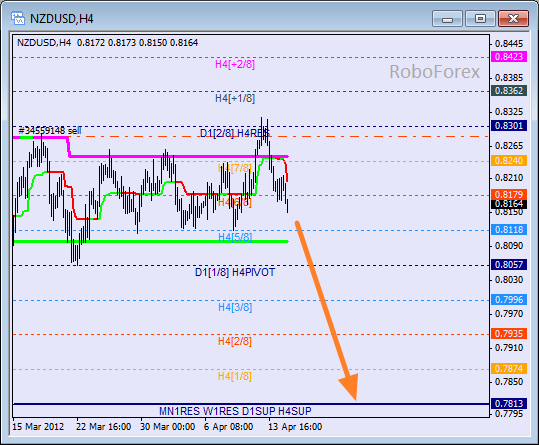

NZD/USD

After rebounding from the 8/8 level and the daily Super Trend’s line once again, New Zealand Dollar started moving downwards. The main obstacle on its way down towards the 0/8 level is the weekly Super Trend’s line. If the price breaks it, the market will continue falling down.

At the H1 chart the market rebounded from the 8/8 level and started moving downwards. After rebounding from the Super Trend’s line, the pair broke the 4/8 level and is now moving below it. If the bears break the 3/8 level, the price will continue falling down towards the 0/8 one.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.