Murray Math Lines 02.04.2012 (USD/CHF, GBP/JPY, GBP/CHF)

02.04.2012

Analysis for April 2nd, 2012

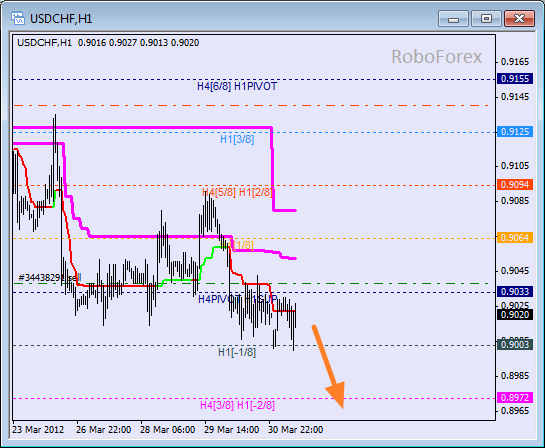

USD/CHF

Franc broke the 4/8 level and is now moving below it. The bears are supported by the H4 Super Trend’s line. Most likely, the price will continue moving downwards in the nearest future. The target for the next several days is the 0/8 level.

At the H1 chart the market is inside an “overbought zone”, the bears are moving the price below the 0/8 level. There is a possibility that the price may start moving downwards again during Monday. In the future the pair may break the -2/8 level and the lines at the chart will be redrawn.

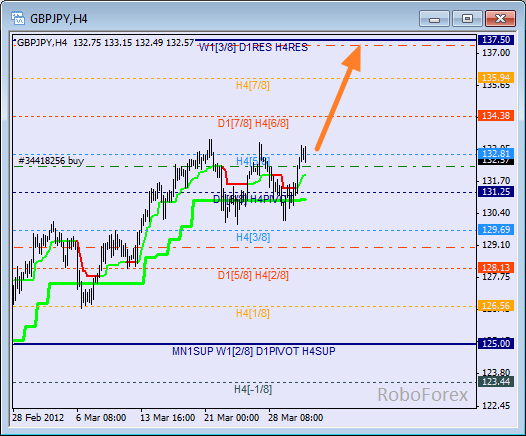

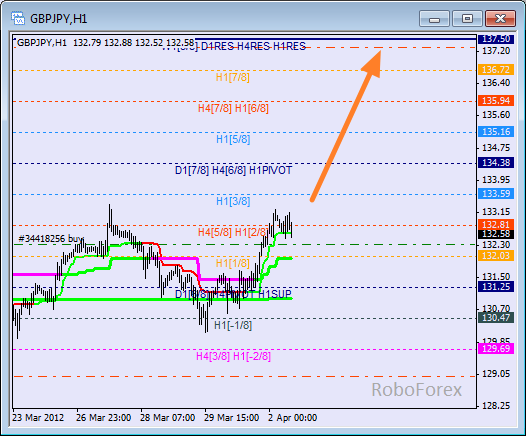

GBP/JPY

The bulls are trying to break the 5/8 level for the third straight time. If they succeed and the market stays above this level, the price will continue moving upwards. The target in this case will be the 8/8 level.

At the H1 chart the local correction is taking place near the 2/8 level. The bulls are supported by the H1 Super Trend’s line. We can’t exclude a possibility that the price may break all the levels, one by one, and reach the target, which is at the 8/8 one.

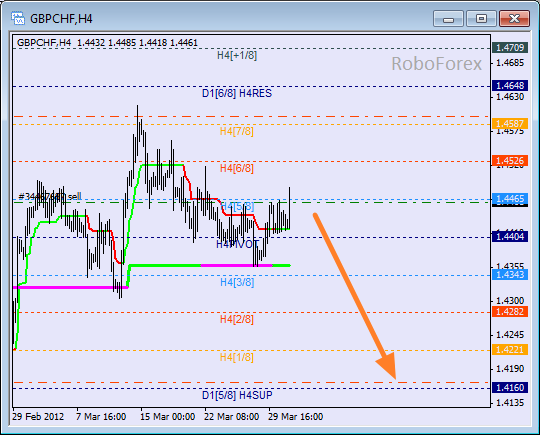

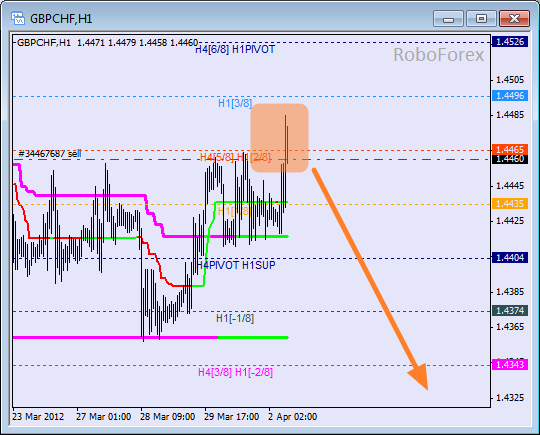

GBP/CHF

The price rebounded from the 7/8 level, thus starting a new descending trend, a local one at least. The bulls were stopped by the daily Super Trend’s line, and the correction started here. However, the price may continue falling down after that, and the target in this case will be the 0/8 level.

At the H1 chart the price left an “overbought zone”, but couldn’t break the 2/8 level, thus indicating that the market may continue moving downwards. In the near term, we can expect the pair to rebound from the current levels, and if it happens, the current down-trend will continue.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.