Murray Math Lines 22.02.2013 (USD/CAD, GBP/CHF, AUD/JPY)

22.02.2013

Analysis for February 22nd, 2013

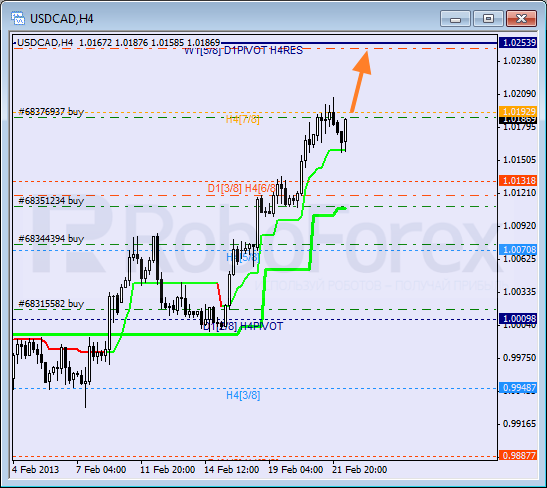

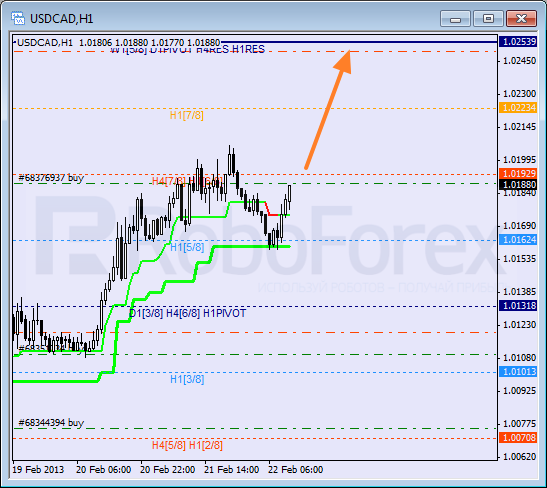

USD/CAD

Canadian Dollar is still being corrected, but the bulls are trying to start a new ascending movement. They are supported by the H4 Super Trend’s line. The main target is still at the 8/8 level.

At the H1 chart the pair rebounded from the 5/8 level. We can’t exclude a possibility that the price may break a local maximum during Friday. Later, the 8/8 level may become a starting point of a short-term correction.

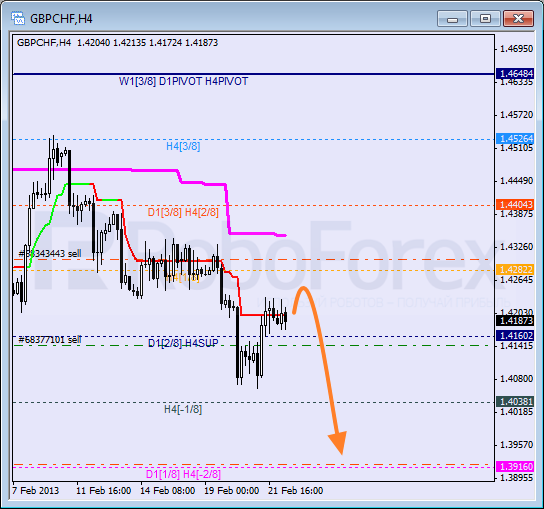

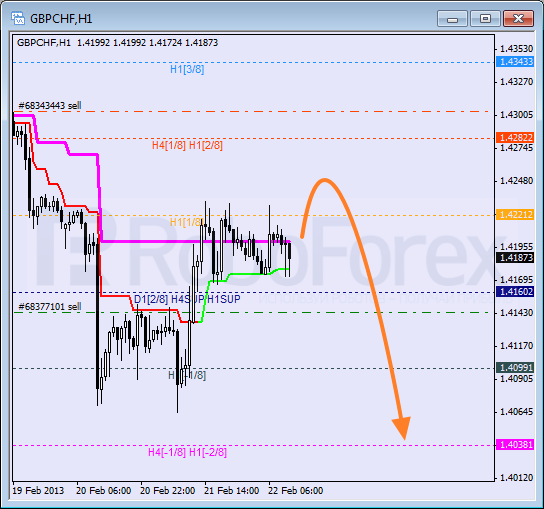

GBP/CHF

The GBP/CHF currency pair is being corrected; however, the market is unlikely to keep the price below the 0/8 level for a long time. If later the price enters an “oversold zone” again, the pair will start a new descending movement.

At the H1 chart the market is also being corrected so far. Later, the price is expected to start a new descending movement. After the pair breaks the -2/8 level, the lines at the chart will be redrawn

AUD/JPY

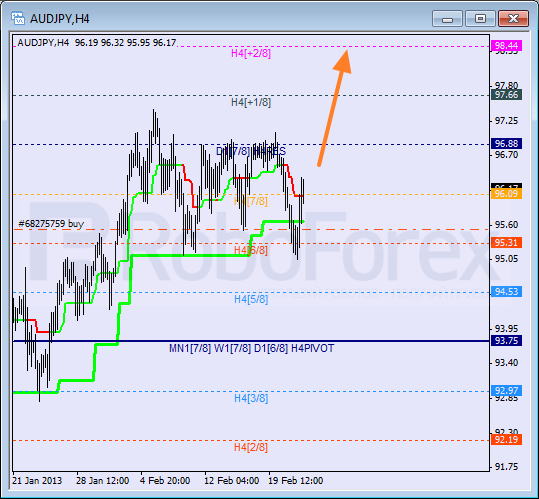

The pair rebounded from the 6/8 level, just as I expected. Currently the price is moving above the moving average lines. Most likely, the bulls will enter an “overbought zone” within the next several hours and break a local maximum.

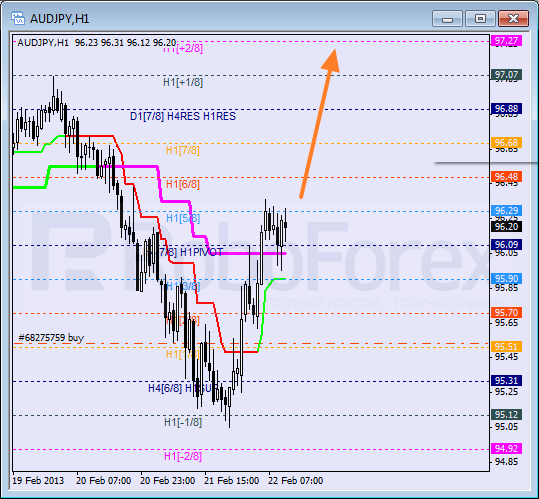

The pair is moving in the middle of the H1 chart. It looks like the Super Trends’ lines are going to from “bullish cross” quite soon. We can’t exclude a possibility that the buyers may reach the 8/8 level during Friday.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.