Inside the final zigzag. GBP/JPY wave analysis

28.08.2014

Analysis for August 28th, 2014

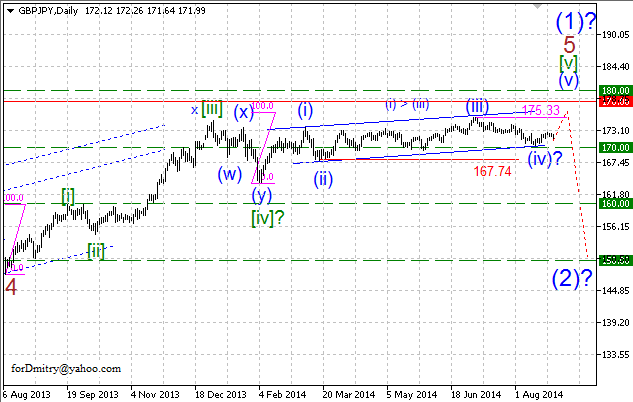

In our previous review, “The final zigzag. Wave analysis of GBP/LPY for 18.08.2014”, we discussed one of the possible scenario how the price may complete the uptrend inside a possible impulse 5 of (1).

Probably, the market is forming the final ascending zigzag(v) of [v] of 5 of ending diagonal triangle[v] of 5. Possibly, the price completed a descending correction b of (v), which may be followed by an ascending wave с of (v).

The critical level for this scenario until the price completes an ascending zigzag (v) of [v] is at the level where this zigzag started, 170.40. In order to finish a complete diagonal triangle[v], the price needs to cross the confirming level at 175.33, which it the closest target.

Wave structure on the daily chart hasn’t changed much – the price is about to complete the final wave [v] of 5 of an ascending impulse 5 in the form of an ending diagonal triangle.

Considering an extension inside wave [iii] of 5 of an impulse 5 of (1), it’s quite logical to expect that waves [v] of 5 and [i] of 5 may be equal in length and the price may complete this diagonal triangle[v] of 5 lower than 180. However, at the same time we should note, that wave (iii) of [v] of diagonal triangle[v] of 5 is shorter than its first wave, (i) of [v], which means that the pair is expected to finish this diagonal triangle[v] of 5 not higher than ~178.

However, at the same time one should remember that any possible scenario is subjective and the market may move in a completely different direction.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.