Thorny Path to European QE. Fundamental analysis for 02.09.2014

02.09.2014

The impending meeting of the ECB raises increasingly heated debates on the effectiveness of the possible onset of the European version of quantitative easing. Opponents of the incentive program argue that the ECB was “stalling” for too long and the exhaust from the mass purchase of assets will not be as significant as it was in the States, where the unemployment rate seems to be stabilized, and the economy has returned to growth.

Supporters of the start of QE insist that the risks of deflation and the meagre GDP dynamics just do not leave the European regulator any other way to influence the situation. Inflation is with each month getting closer to approaching the zero line, which certainly increases the pressure on the ECB. However, the main consequence of QE is to increase aggregate demand, namely stagnant demand remains one of the key problems in the euro zone.

However, the economy will not be fed by only one pumping of liquidity. The fact is that QE solves short-term economic problems and creates the conditions for the implementation of structural reforms. Actually, it is the more active work of national governments that Mario Draghi called for in his speech at the symposium of the Fed. The basis of the restoration of the euro zone lies in deregulation and simplification of the business environment.

For example, France and Italy, the second and the third largest economy in the euro zone are in the Ranking of convenience of doing business (from the calculation of the World Bank) on 38th and 65th places respectively. Moreover, Belarus and Kazakhstan have somehow managed to overtake Italy, where in spite of recent reforms, the bureaucracy continues to flourish, and the labour market did not get any meaningful reforms.

It is possible that to somehow get out of the situation, the ECB will still announce the beginning of a program of purchases of securities, but the timing of its start can be significantly shifted to the future. Additionally, you may follow the reservation that in the case of correction in the statistics, the regulator can refuse to start QE, which is likely to be composed only of purchases of loan portfolios, rather than debt obligations.

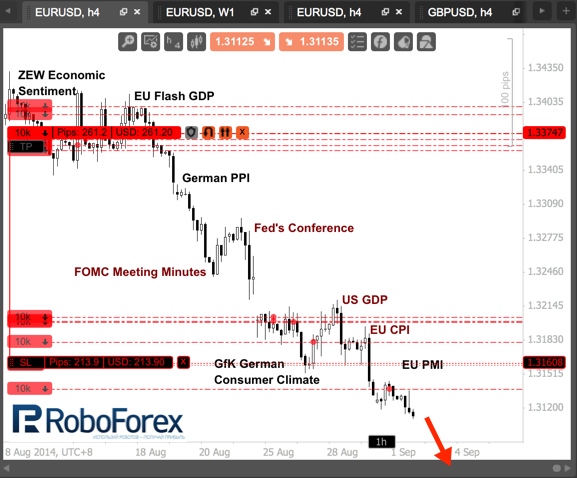

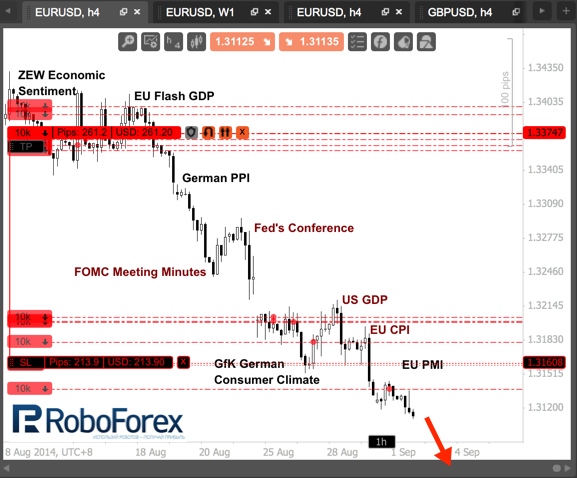

I continue to hold transactions on sale of the Eurodollar. Negativity for the Eurodollar is still abound - the producer price index hit a drawdown. Evening block statistics across the United States may well support the euro bears, which risks turning a series of new lows. However, to balance the current risks, I moved the stop transactions after the market.

RoboForex Analytical Department

Supporters of the start of QE insist that the risks of deflation and the meagre GDP dynamics just do not leave the European regulator any other way to influence the situation. Inflation is with each month getting closer to approaching the zero line, which certainly increases the pressure on the ECB. However, the main consequence of QE is to increase aggregate demand, namely stagnant demand remains one of the key problems in the euro zone.

However, the economy will not be fed by only one pumping of liquidity. The fact is that QE solves short-term economic problems and creates the conditions for the implementation of structural reforms. Actually, it is the more active work of national governments that Mario Draghi called for in his speech at the symposium of the Fed. The basis of the restoration of the euro zone lies in deregulation and simplification of the business environment.

For example, France and Italy, the second and the third largest economy in the euro zone are in the Ranking of convenience of doing business (from the calculation of the World Bank) on 38th and 65th places respectively. Moreover, Belarus and Kazakhstan have somehow managed to overtake Italy, where in spite of recent reforms, the bureaucracy continues to flourish, and the labour market did not get any meaningful reforms.

It is possible that to somehow get out of the situation, the ECB will still announce the beginning of a program of purchases of securities, but the timing of its start can be significantly shifted to the future. Additionally, you may follow the reservation that in the case of correction in the statistics, the regulator can refuse to start QE, which is likely to be composed only of purchases of loan portfolios, rather than debt obligations.

I continue to hold transactions on sale of the Eurodollar. Negativity for the Eurodollar is still abound - the producer price index hit a drawdown. Evening block statistics across the United States may well support the euro bears, which risks turning a series of new lows. However, to balance the current risks, I moved the stop transactions after the market.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.