Italy risks the same fate as Greece. Fundamental analysis for 22.09.2014

22.09.2014

The return of Italy, the third-largest euro zone economy, into a recession carries a much higher risk than it might seem at first glance. The thing is that the country is the largest carrier of government debt in Europe, which has already passed the mark of 2.3 trillion euro, which is almost 133% of the national GDP. Therefore, if GDP ceases to grow, and all debts are increasing, the percentage will only increase.

If in the case of Greece, they somehow managed to pour in money to extinguish the fire, the amount there were far more modest. Since 2007, the level of public debt as a percentage increased from 103 to 133%, according to Eurostat. According to OECD, at the end of this year it will reach a figure of 137.5%, and if the stagnation will continue in the future, then by 2016 the debt load will exceed the level of 150%, which is unlikely to please investors.

It is hard to say at what point the solvency of Rome will start to topple over, there is no metric that shows that up to 150% of the country can extinguish the debt, and after 151% it can’t. For example, Japan is at a state debt of over 200% of GDP, while coping with their payments. However, there is a fundamental difference - the land of the rising sun has its own central bank, which regularly pumps up the economy with new money, which is not true of the ECB.

The only way out of this trap is to show economic growth rate exceeding the growth of debt. However, in the current environment, the economy is unlikely to be able return to growth by itself, it needs a monetary stimulus. Where would they come from? The right to manage the interest rate has gone to the ECB, quantitative easing and debt consolidation on the balance of the regulator has also become inaccessible, but there is the euro.

Now the authorities rely on the reforms of the labour market, which say the company will have the right to fire workers under a simplified procedure, which will give workforce more mobility - and that's when the economy starts to grow. However, the example of Japan suggests the opposite - that is not enough. Deeper reforms are needed, including tackling corruption and bureaucracy, and the current government is unlikely to have the courage to do this.

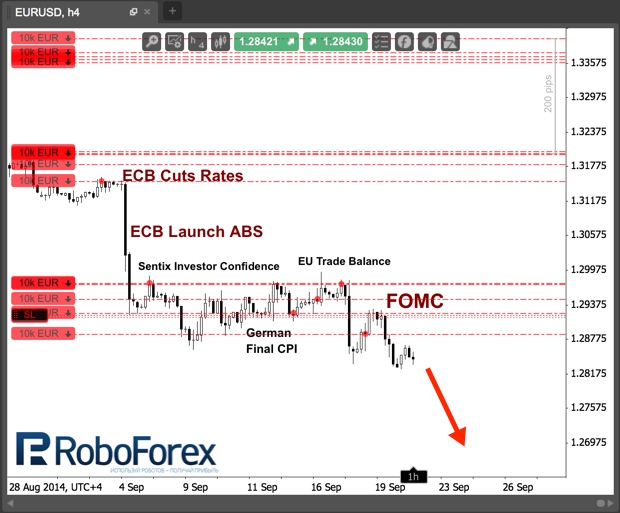

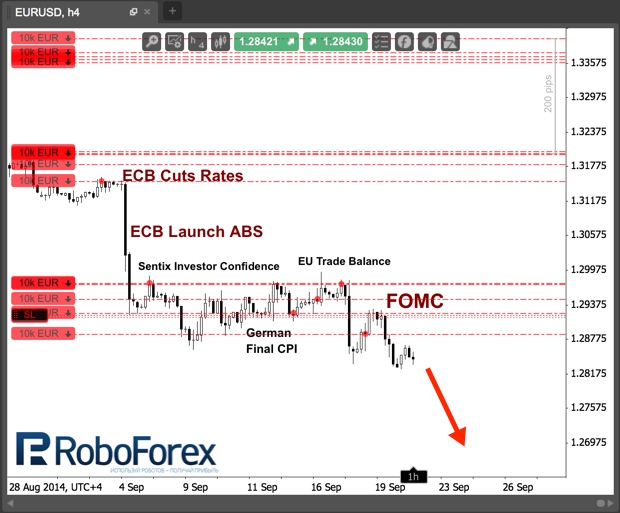

The macroeconomic background is quiet this Monday, but for 14:00 GMT Mario Draghi is scheduled to speak in front of the European Monetary Commission. It is unlikely that we will hear anything new, compared to the last press conference of the ECB. However, if he will again speak confidently about the possibility to "use all available tools" to deal with low inflation, the Eurodollar might break though another minimum.

RoboForex Analytical Department

If in the case of Greece, they somehow managed to pour in money to extinguish the fire, the amount there were far more modest. Since 2007, the level of public debt as a percentage increased from 103 to 133%, according to Eurostat. According to OECD, at the end of this year it will reach a figure of 137.5%, and if the stagnation will continue in the future, then by 2016 the debt load will exceed the level of 150%, which is unlikely to please investors.

It is hard to say at what point the solvency of Rome will start to topple over, there is no metric that shows that up to 150% of the country can extinguish the debt, and after 151% it can’t. For example, Japan is at a state debt of over 200% of GDP, while coping with their payments. However, there is a fundamental difference - the land of the rising sun has its own central bank, which regularly pumps up the economy with new money, which is not true of the ECB.

The only way out of this trap is to show economic growth rate exceeding the growth of debt. However, in the current environment, the economy is unlikely to be able return to growth by itself, it needs a monetary stimulus. Where would they come from? The right to manage the interest rate has gone to the ECB, quantitative easing and debt consolidation on the balance of the regulator has also become inaccessible, but there is the euro.

Now the authorities rely on the reforms of the labour market, which say the company will have the right to fire workers under a simplified procedure, which will give workforce more mobility - and that's when the economy starts to grow. However, the example of Japan suggests the opposite - that is not enough. Deeper reforms are needed, including tackling corruption and bureaucracy, and the current government is unlikely to have the courage to do this.

The macroeconomic background is quiet this Monday, but for 14:00 GMT Mario Draghi is scheduled to speak in front of the European Monetary Commission. It is unlikely that we will hear anything new, compared to the last press conference of the ECB. However, if he will again speak confidently about the possibility to "use all available tools" to deal with low inflation, the Eurodollar might break though another minimum.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.