Deflationary stir. Fundamental analysis for 16.09.2014

16.09.2014

Statistics from the euro zone continue to point to the possibility of the return of the recession. According to the ZEW, economic sentiment has fallen to the lowest point of December 2012. Moreover, the forecast of the Italian GDP in the current year was revised from +0.2% to -0.4%. Moreover, no positivity is expected in the near future, especially if in Brussels they are still able to defend the need to further reduce costs.

ECB delayed for too long with the launch of incentives, and now, in an accelerating decline, there are questions about their efficacy. However, a different vector of monetary policy of the ECB and the Fed has already led to a significant reduction in the euro dollar rate, which European exporters literally begged for. Moreover, the no charges against the ECB in starting a currency war are audible at all.

The fact is that in case of the arrival of deflation in the euro area there is a substantial likelihood of a repetition of the Japanese script, only on a slightly larger scale. No one is interested In this scenario, respectively, we do not hear angry comments from the walls of the Fed. Moreover, on Wednesday a regular meeting FOMC is scheduled, where there is a possibility of another hint at an imminent rate increase, which will certainly give the euro bears new forces.

The ECB is also trying to keep up appearances, constantly pointing out the fact that exchange rates are not the aim of the regulator’s policy. However, before Mario Draghi has already noted that the sharp rise of the single currency from mid-2012 just slowed down inflation by 40-50 basis points. Meanwhile, as the euro sank by only 7% in comparison with March highs, which according to the head of the French central bank, is not enough.

A cheapening euro has led to an increase in import prices, which should have a positive impact on the rate of inflation. However, a further weakening of the euro is necessary some tangible results. In the absence of global conflict between the regulators on this issue, we can expect the gradual decline of the euro, at least up until the arrival of the risks of deflation in the euro area will not be as significant.

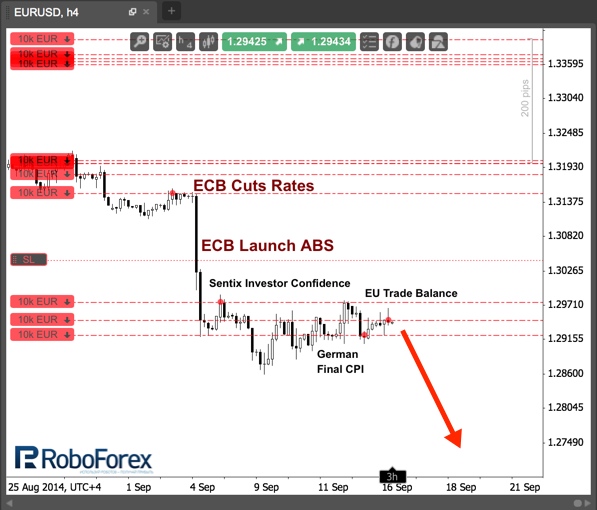

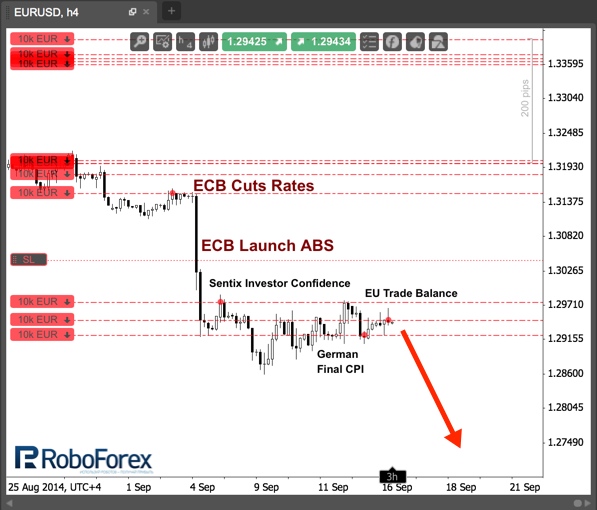

I continue to sell the Eurodollar as it’s unlikely the tomorrow's FOMC meeting will somehow reverse the market. Even if nothing concrete is said about the rate increase, the approaching formal end of QE3 may also provide support for the dollar. It is possible that the growth of inflation in America stagnating in Europe will also help bears update the lows of last week.

ECB delayed for too long with the launch of incentives, and now, in an accelerating decline, there are questions about their efficacy. However, a different vector of monetary policy of the ECB and the Fed has already led to a significant reduction in the euro dollar rate, which European exporters literally begged for. Moreover, the no charges against the ECB in starting a currency war are audible at all.

The fact is that in case of the arrival of deflation in the euro area there is a substantial likelihood of a repetition of the Japanese script, only on a slightly larger scale. No one is interested In this scenario, respectively, we do not hear angry comments from the walls of the Fed. Moreover, on Wednesday a regular meeting FOMC is scheduled, where there is a possibility of another hint at an imminent rate increase, which will certainly give the euro bears new forces.

The ECB is also trying to keep up appearances, constantly pointing out the fact that exchange rates are not the aim of the regulator’s policy. However, before Mario Draghi has already noted that the sharp rise of the single currency from mid-2012 just slowed down inflation by 40-50 basis points. Meanwhile, as the euro sank by only 7% in comparison with March highs, which according to the head of the French central bank, is not enough.

A cheapening euro has led to an increase in import prices, which should have a positive impact on the rate of inflation. However, a further weakening of the euro is necessary some tangible results. In the absence of global conflict between the regulators on this issue, we can expect the gradual decline of the euro, at least up until the arrival of the risks of deflation in the euro area will not be as significant.

I continue to sell the Eurodollar as it’s unlikely the tomorrow's FOMC meeting will somehow reverse the market. Even if nothing concrete is said about the rate increase, the approaching formal end of QE3 may also provide support for the dollar. It is possible that the growth of inflation in America stagnating in Europe will also help bears update the lows of last week.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.