The States are returning to pre-crisis levels. Fundamental analysis for 27.08.2014

27.08.2014

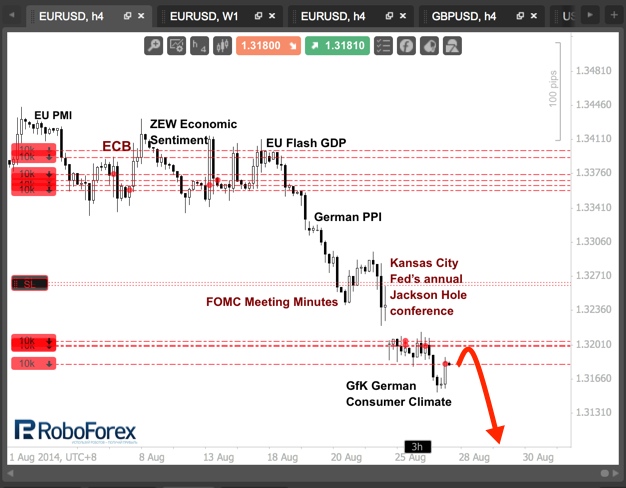

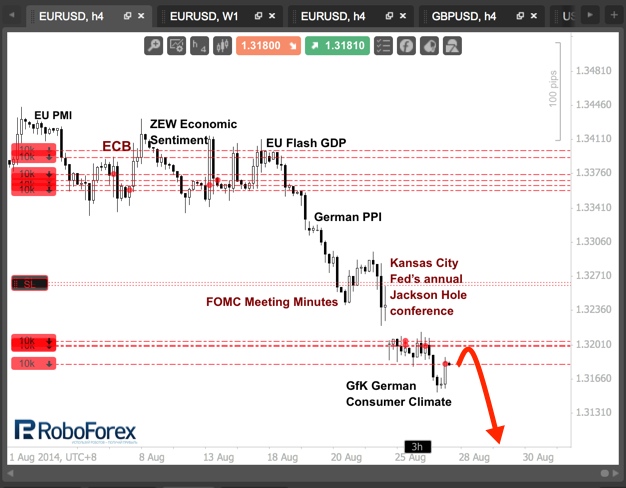

The statistics even more clearly reflect the problems with the economic recovery, the beginning of which all European capitals were speaking about a few months ago. And today it became known that the German consumer confidence index has reduced from 9 to 8.6. It seems to be a slight drawdown, but this is the first negative monthly release level since December 2012. In addition, import prices fell by 0.4%.

Disappointing reports came from other countries as well. In France, the producer confidence index fell, but the most dramatic data is out in Italy, the third largest economy in the euro zone. Earlier there were reports that the country has once again landed in a recession, and now data came out on a sharp drop in the consumer confidence index - with last month’s drop from 104.0 to 101.9 in August. Consequently, a rapid recovery from recession may not happen.

On the other side of the Atlantic completely different statistics are coming out. Yesterday there was a momentous event for the United States - the index of consumer confidence has returned to pre-crisis levels, showing the strongest value since September 2007. Meanwhile, retailers say that a very weak wage growth does not allow us to talk about the return of consumer spending to sustainable growth, which is the basis of the entire American economy focused on domestic demand.

Moreover, yesterday data was published on the growth of demand for durable goods (over three years) which was record high since 1992. The index rose from 22.6% in comparison with the July data, thanks to a surge in the avalanche of demand for aircrafts (in the last month, Boeing has reported on a record number of orders for 324 aircrafts). It should be borne in mind that the positive effect of the economy will not be observed immediately.

However, if you leave aircrafts and other vehicles out of the equation, the total volume of orders immediately falls by 0.8%. Nevertheless, according to the latest population statistics, GDP growth rate in the third quarter may be better than current expectations. Consequently, all this provides additional support for the dollar, especially against the background of hints from the Fed about the possibility of an early rate hike, if economic growth will continue in the future.

Despite the current correction, I continue to sell the Eurodollar. No more important statistics are planned for Wednesday, and hence there are chances of a continuation of the correction. On Thursday there will be a block of meaningful statistics for the euro area, which does not bode well, so there is every chance of a further decline of the market to new lows.

RoboForex Analytical Department

Disappointing reports came from other countries as well. In France, the producer confidence index fell, but the most dramatic data is out in Italy, the third largest economy in the euro zone. Earlier there were reports that the country has once again landed in a recession, and now data came out on a sharp drop in the consumer confidence index - with last month’s drop from 104.0 to 101.9 in August. Consequently, a rapid recovery from recession may not happen.

On the other side of the Atlantic completely different statistics are coming out. Yesterday there was a momentous event for the United States - the index of consumer confidence has returned to pre-crisis levels, showing the strongest value since September 2007. Meanwhile, retailers say that a very weak wage growth does not allow us to talk about the return of consumer spending to sustainable growth, which is the basis of the entire American economy focused on domestic demand.

Moreover, yesterday data was published on the growth of demand for durable goods (over three years) which was record high since 1992. The index rose from 22.6% in comparison with the July data, thanks to a surge in the avalanche of demand for aircrafts (in the last month, Boeing has reported on a record number of orders for 324 aircrafts). It should be borne in mind that the positive effect of the economy will not be observed immediately.

However, if you leave aircrafts and other vehicles out of the equation, the total volume of orders immediately falls by 0.8%. Nevertheless, according to the latest population statistics, GDP growth rate in the third quarter may be better than current expectations. Consequently, all this provides additional support for the dollar, especially against the background of hints from the Fed about the possibility of an early rate hike, if economic growth will continue in the future.

Despite the current correction, I continue to sell the Eurodollar. No more important statistics are planned for Wednesday, and hence there are chances of a continuation of the correction. On Thursday there will be a block of meaningful statistics for the euro area, which does not bode well, so there is every chance of a further decline of the market to new lows.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.