Long-term growth in the Eurozone is under threat. Fundamental analysis for 23.07.2014

23.07.2014

Recovery is gathering momentum in Spain, the fourth largest economy in the euro zone. According to preliminary estimates of the national central bank of the country in the second quarter, GDP grew by 0.5% compared to the first quarter, which also showed a positive trend at 0.4% of the economy in the fourth quarter of last year. If we compare the second quarter of 2013 and 2014, we will see growth of 1.1%.

It should be noted that these figures are significantly higher than the pan-European growth, which, in contrast, tends to decrease due to record low inflation. Neighbouring France, for example, is sinking into stagnation, showing zero growth. Against this background, Madrid updated its forecasts for GDP growth, which this year is expected to reach 1.3%, and the next, it could reach 2% with envy from their Eurozone neighbours.

However, sustaining growth will be extremely difficult. The fact that during the years of crisis, under pressure from Brussels and Berlin, Southern European countries have been forced to go on serious spending cuts. Naturally, the first to go under the knife are investment in infrastructure and research projects, as it reduces the long-term foundation for growth, but in the midst of the debt crisis, few people have heard this warning from the economists.

It is clear that, against the backdrop of the upcoming elections, the majority of governments are extremely reluctantly to implement cuts in social spending, to keep the voters pleased. It should be noted that at that time the European Commission and the IMF warned of the need to first go to the optimization of government away from the swollen benefits and payments in many countries, which at some point became simply unaffordable for the budget.

In this regard, it is worth noting the study French economists led by Natasha Valla, who found that by reducing government spending on infrastructure and science by 1% of GDP it subsequently leads to a decrease of the GDP by 1.5%. Among other things, the reason for this phenomenon is a reduction in domestic demand, which in turn has a negative impact on the volume of tax revenues, and then problems with the deficit begin to raise their.

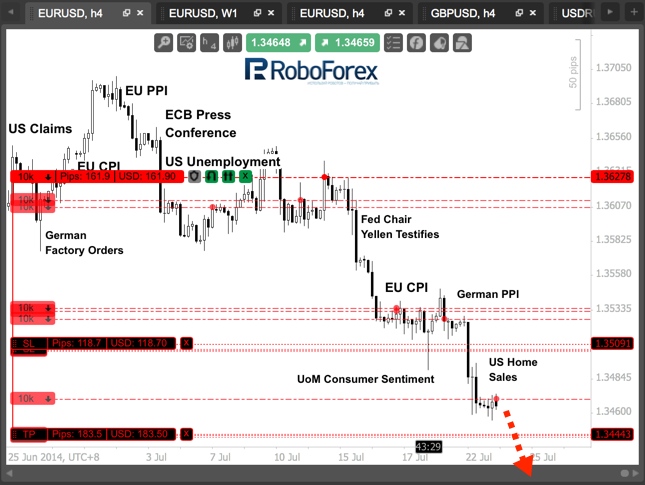

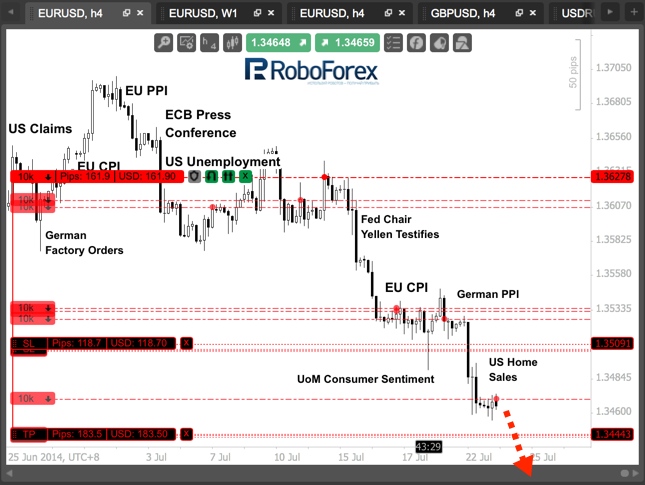

At the macroeconomic level it is an almost completely calm environment, which is why the market can afford to consolidate. However, on Thursday we expect data on new home sales in the United States, which on the background of positive dynamics in the secondary market may also bring better than expected values. Consequently, if the released statistics are positive, the “bears” can get a new impetus to update the lows.

RoboForex Analytical Department

It should be noted that these figures are significantly higher than the pan-European growth, which, in contrast, tends to decrease due to record low inflation. Neighbouring France, for example, is sinking into stagnation, showing zero growth. Against this background, Madrid updated its forecasts for GDP growth, which this year is expected to reach 1.3%, and the next, it could reach 2% with envy from their Eurozone neighbours.

However, sustaining growth will be extremely difficult. The fact that during the years of crisis, under pressure from Brussels and Berlin, Southern European countries have been forced to go on serious spending cuts. Naturally, the first to go under the knife are investment in infrastructure and research projects, as it reduces the long-term foundation for growth, but in the midst of the debt crisis, few people have heard this warning from the economists.

It is clear that, against the backdrop of the upcoming elections, the majority of governments are extremely reluctantly to implement cuts in social spending, to keep the voters pleased. It should be noted that at that time the European Commission and the IMF warned of the need to first go to the optimization of government away from the swollen benefits and payments in many countries, which at some point became simply unaffordable for the budget.

In this regard, it is worth noting the study French economists led by Natasha Valla, who found that by reducing government spending on infrastructure and science by 1% of GDP it subsequently leads to a decrease of the GDP by 1.5%. Among other things, the reason for this phenomenon is a reduction in domestic demand, which in turn has a negative impact on the volume of tax revenues, and then problems with the deficit begin to raise their.

At the macroeconomic level it is an almost completely calm environment, which is why the market can afford to consolidate. However, on Thursday we expect data on new home sales in the United States, which on the background of positive dynamics in the secondary market may also bring better than expected values. Consequently, if the released statistics are positive, the “bears” can get a new impetus to update the lows.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.