Short-term positivity from the euro zone. Fundamental analysis for 25.07.2014

25.07.2014

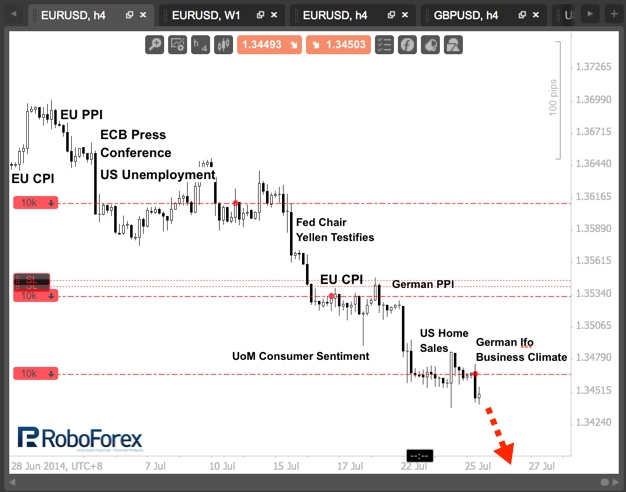

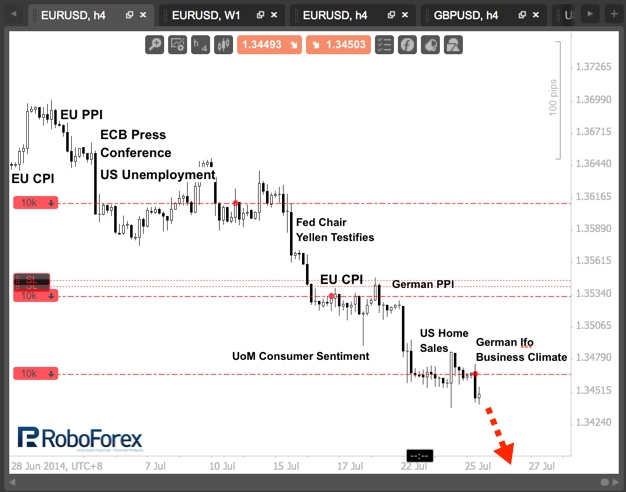

Yesterday the euro zone was unusually positive. The sharp decline in the Spanish unemployment by 1.4% (from 25.9% to 24.5%) was a real surprise. Of course, unemployment remains inexcusably high, but a roll back to the level of April 2012 is a clear success for the Spanish economy, especially on the back of forecasts for higher GDP growth from the national central bank.

French statistics were controversial - industrial PMI continued its contraction, and has been rolled back to 47.6. However, the service PMI was able to return to growth (after two months of decline, the rate went slightly above the critical level of 50, which indicates an increase). However, there is nothing to particularly enjoy. In Paris, the implementation of reforms is being dragged on, and some of the highest taxes in the euro zone continue to grow.

German service PMI also showed growth that pulled up the pan-European statistics, closing at 54.4 - the highest since May 2011. Earlier, we have witnessed an extremely poor data on industrial production - almost across the whole of the euro zone, and even in prosperous Germany, there was a significant fall in the indicator, which surprised many.

The point of the PMI is that it reflects the data nearly in real time thus this positivity will be reflected in the statistics with a certain time lag. It is also worth noting that the beginning of the correction in the Eurodollar was made possible largely due to U.S. statistics, showing a decline in sales of new homes, as well as a negative revision of last month’s indicator.

Friday's statistics also were not able to support the launch of yesterday’s correction - lending in the euro area is still reducing, this time the index sank by 1.7%, and, consistent decline has continued for more than two years. And finally the chances of the bulls for any significant correction were crossed out by German statistics that reflected, according to the IFO, a drop in the business climate.

I continue to hold transactions to sell and on the correction I opened an additional trade. I note that most of the transactions closed on take-profit. Friday night the data on orders for durable goods in the United States will be published, which is expected to be significantly better than last month’s. Therefore, a positive reaction from the market is very likely and possibly the minimum will be sampled before the close of trading.

RoboForex Analytical Department

French statistics were controversial - industrial PMI continued its contraction, and has been rolled back to 47.6. However, the service PMI was able to return to growth (after two months of decline, the rate went slightly above the critical level of 50, which indicates an increase). However, there is nothing to particularly enjoy. In Paris, the implementation of reforms is being dragged on, and some of the highest taxes in the euro zone continue to grow.

German service PMI also showed growth that pulled up the pan-European statistics, closing at 54.4 - the highest since May 2011. Earlier, we have witnessed an extremely poor data on industrial production - almost across the whole of the euro zone, and even in prosperous Germany, there was a significant fall in the indicator, which surprised many.

The point of the PMI is that it reflects the data nearly in real time thus this positivity will be reflected in the statistics with a certain time lag. It is also worth noting that the beginning of the correction in the Eurodollar was made possible largely due to U.S. statistics, showing a decline in sales of new homes, as well as a negative revision of last month’s indicator.

Friday's statistics also were not able to support the launch of yesterday’s correction - lending in the euro area is still reducing, this time the index sank by 1.7%, and, consistent decline has continued for more than two years. And finally the chances of the bulls for any significant correction were crossed out by German statistics that reflected, according to the IFO, a drop in the business climate.

I continue to hold transactions to sell and on the correction I opened an additional trade. I note that most of the transactions closed on take-profit. Friday night the data on orders for durable goods in the United States will be published, which is expected to be significantly better than last month’s. Therefore, a positive reaction from the market is very likely and possibly the minimum will be sampled before the close of trading.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.