Pressure on inflation in the euro zone grows. Fundamental analysis for 21.07.2014

21.07.2014

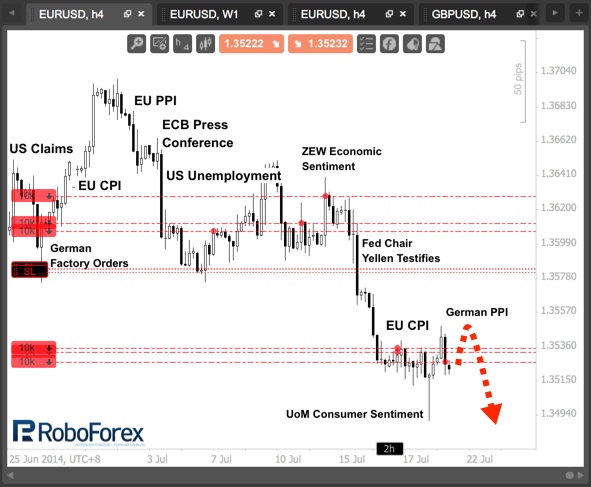

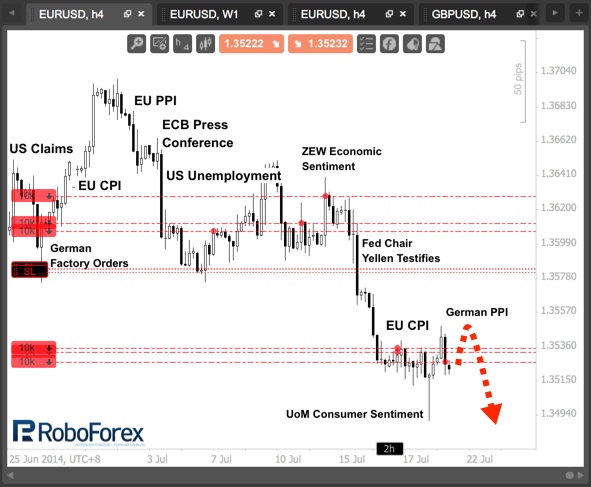

The week began with the publication of the producer price index in Germany (PPI) - instead of expected growth we got the rate at zero, and since February of this year, German PPI comes out either at zero or in the red. On the background of a major drawdown of industrial production a further decrease in the PPI seems logical, but the overall pressure on inflation only increases.

Overall, the next trading days will be extremely boring in macroeconomic terms. Of greatest interest is the data on U.S. inflation, which is expected on Tuesday. Since January inflation shows unhurried growth - each subsequent release of data was either at the same level or slightly exceeded it. As a result, we have seen progress from 0.1% in the begging of the year to the current 0.3%.

On the background of the Fed's exit from QE3 such dynamics are, of course, very pleasing. The situation in the services sector will be decisive, because it has a major impact on the benchmark inflation. With the same trends it can be expected that the inflation will stay at current levels with the prospect of growth in the coming months, which will be an additional argument for the Fed, with the full completion of QE3.

On the other hand, inflation has another side - against the background of very modest growth of income for Americans higher rates of inflation increase the risk of problems in the consumer sector. Updated statistics on the growth of wages will also be published on Tuesday, but it’s difficult to expect any breakthroughs. During the whole time of the economic recovery income growth barely exceeded 2%.

Among other things, on Thursday, data on new home sales is being published. Last month, the indicator miraculously gained more than 18%, surpassing the mark of 500k, for the first time since April 2010. It is unlikely that after such a jump we will see continued upward momentum, but if the statistics are still able to stay in the area of last month’s peak, that's when the Eurodollar will get a serious reason for a further fall.

I continue to hold the deals to sell and opened an additional trade at the correction. It is possible that after the fall caused by the publication of the German PPI, we will see a flat before the scheduled for Tuesday release of data on U.S. inflation and the level of wages. There is a substantial likelihood that the statistics will be released on the expected levels or better, that may become a driver for the break through the latest minimum.

RoboForex Analytical Department

Overall, the next trading days will be extremely boring in macroeconomic terms. Of greatest interest is the data on U.S. inflation, which is expected on Tuesday. Since January inflation shows unhurried growth - each subsequent release of data was either at the same level or slightly exceeded it. As a result, we have seen progress from 0.1% in the begging of the year to the current 0.3%.

On the background of the Fed's exit from QE3 such dynamics are, of course, very pleasing. The situation in the services sector will be decisive, because it has a major impact on the benchmark inflation. With the same trends it can be expected that the inflation will stay at current levels with the prospect of growth in the coming months, which will be an additional argument for the Fed, with the full completion of QE3.

On the other hand, inflation has another side - against the background of very modest growth of income for Americans higher rates of inflation increase the risk of problems in the consumer sector. Updated statistics on the growth of wages will also be published on Tuesday, but it’s difficult to expect any breakthroughs. During the whole time of the economic recovery income growth barely exceeded 2%.

Among other things, on Thursday, data on new home sales is being published. Last month, the indicator miraculously gained more than 18%, surpassing the mark of 500k, for the first time since April 2010. It is unlikely that after such a jump we will see continued upward momentum, but if the statistics are still able to stay in the area of last month’s peak, that's when the Eurodollar will get a serious reason for a further fall.

I continue to hold the deals to sell and opened an additional trade at the correction. It is possible that after the fall caused by the publication of the German PPI, we will see a flat before the scheduled for Tuesday release of data on U.S. inflation and the level of wages. There is a substantial likelihood that the statistics will be released on the expected levels or better, that may become a driver for the break through the latest minimum.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.