A five-year low of the European inflation. Fundamental analysis for 30.09.2014

30.09.2014

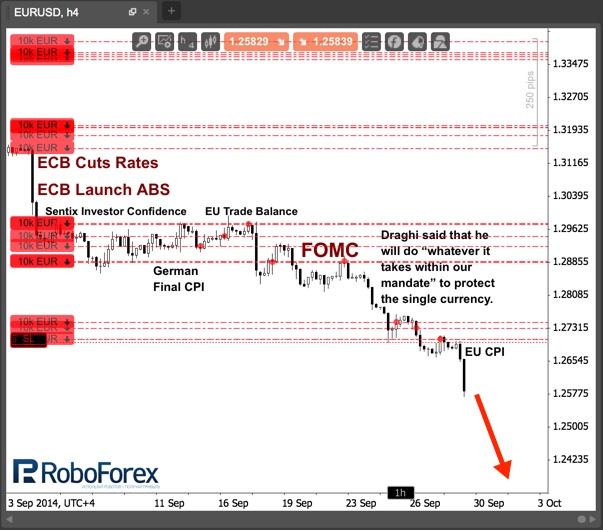

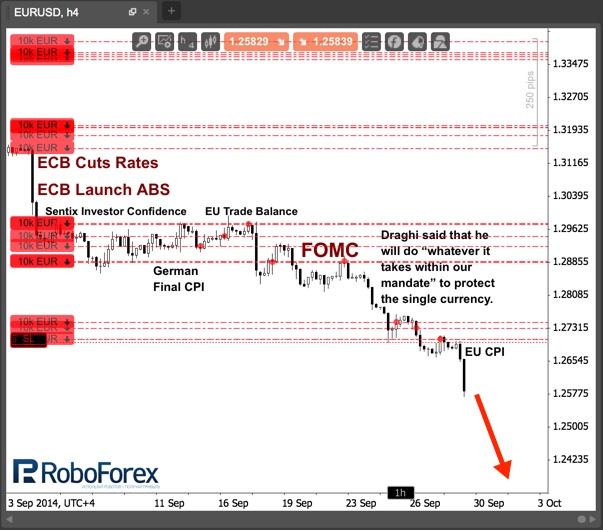

The Eurodollar continues to decline, drawing strength from the latest statistics. Despite the revision of inflation in the last month from 0.3% to 0.4%, in September the figure again came in at 0.3%. Moreover, core inflation slipped to last month’s 0.9% to 0.7% (a measure that does not consider the dynamics of prices for food and energy, as well as a number of other headings, subject to market fluctuations).

As inflation continues to remain at a five-year low, it provides even greater pressure on the ECB. During this week the regulator should determine the parameters for future asset purchases, but if an agreement for the provision of guarantees for securitized bonds with the major European capitals will not be met, the program will get only the most reliable ones, which will adversely affect its efficiency.

Accordingly, it will be an additional driver to reduce the Eurodollar. Unemployment has remained the same at 11.5% for the euro area as a whole, but in Italy, figure among the youth set new anti record at 44.2%. Since the country is in a recession, the continued escalation in the labour market clearly indicates that the recovery is still far away, especially if the authorities continue to sit idly by.

However, as with the experience in Britain and the States, without injections of liquidity it is extremely difficult to reverse the situation. You can spend hours debating about the inflated "bubble" in the stock market, but the "non-standard" measures really helped the economy to return to growth. The latest statistics show the British GDP growth of 0.9%. In the euro zone, such dynamics can only be dreamt of.

Recent business surveys point to a continued weakening of economic activity in the third quarter, which could also adversely affect inflation. The only available positive growth is retail by 2.5% in Germany and 0.7% in France. However, it should be noted that both of them in the previous month were in the "red zone", and stable low inflation carries the risk that consumers will hold out on big spending in the hope of an even greater decline in prices.

The major statistics for Tuesday have already played for the market, and because of that there is a possibility of a development of a correction, on which I plan to add to my sales. I put a consolidated stop for all transactions on the sale transaction at the local maximum. Among the possible drivers for a further reduction - the weak data on European PMI, the output of which is scheduled for Wednesday.

RoboForex Analytical Department

As inflation continues to remain at a five-year low, it provides even greater pressure on the ECB. During this week the regulator should determine the parameters for future asset purchases, but if an agreement for the provision of guarantees for securitized bonds with the major European capitals will not be met, the program will get only the most reliable ones, which will adversely affect its efficiency.

Accordingly, it will be an additional driver to reduce the Eurodollar. Unemployment has remained the same at 11.5% for the euro area as a whole, but in Italy, figure among the youth set new anti record at 44.2%. Since the country is in a recession, the continued escalation in the labour market clearly indicates that the recovery is still far away, especially if the authorities continue to sit idly by.

However, as with the experience in Britain and the States, without injections of liquidity it is extremely difficult to reverse the situation. You can spend hours debating about the inflated "bubble" in the stock market, but the "non-standard" measures really helped the economy to return to growth. The latest statistics show the British GDP growth of 0.9%. In the euro zone, such dynamics can only be dreamt of.

Recent business surveys point to a continued weakening of economic activity in the third quarter, which could also adversely affect inflation. The only available positive growth is retail by 2.5% in Germany and 0.7% in France. However, it should be noted that both of them in the previous month were in the "red zone", and stable low inflation carries the risk that consumers will hold out on big spending in the hope of an even greater decline in prices.

The major statistics for Tuesday have already played for the market, and because of that there is a possibility of a development of a correction, on which I plan to add to my sales. I put a consolidated stop for all transactions on the sale transaction at the local maximum. Among the possible drivers for a further reduction - the weak data on European PMI, the output of which is scheduled for Wednesday.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.