Inflation is falling. Fundamental analysis for 27.11.2014

27.11.2014

Latest statistics on European inflation were again worse than expected. If the figure in Germany came at zero after industrial reduction by 0.3%, while in Spain inflation fell to the -0.4% mark, which was the fifth month of continuous reduction of the price index. Moreover, despite all efforts by the ECB and the negative deposit rate, lending to the private sector continues to remain in the "red zone."

It is worth noting that the volume of lending is falling continuously since June 2012. Some stabilization, of course, is happening, and from month to month the speed of the fall is slowing down, but if the recovery will continue to be so sluggish, then next year, no significant growth we will be seen for sure. Accordingly, without a splash of lending it is difficult to expect the return of inflation to the design goals of the ECB.

Another factor of tension in the euro zone again becomes Greece. At that time, the anticipation of a possible expansion of asset purchases by the ECB the yields on most Eurobonds continue to fall, interest rates on Greek securities show a sharp increase. On Thursday it became known that the rate on French 10-year government bonds fell to less than 1%, while the yield on the securities of Athens passed over the level of 8%.

There are several reasons for this. Firstly, the negotiations with the "troika" of creditors are close to failure, which means that the final tranche may never get to Greece, which will lead to a budget crisis. The rising cost of borrowing also will not allow covering the deficit on the part of the debt market. Then the growth of social tension follows, the peak of which has the potential to come at the parliamentary elections scheduled for March next year.

It is very likely that the mass popular discontent will lead to even greater growth in the support of the Syriza Radical Party. If it does happen, then the talks in Athens and Brussels will be virtually meaningless, given the anti-European political platform of Syriza. As a key element of the party is the suspension of payments on international loans, then in the spring of the debt crisis in the euro zone can reach a new level.

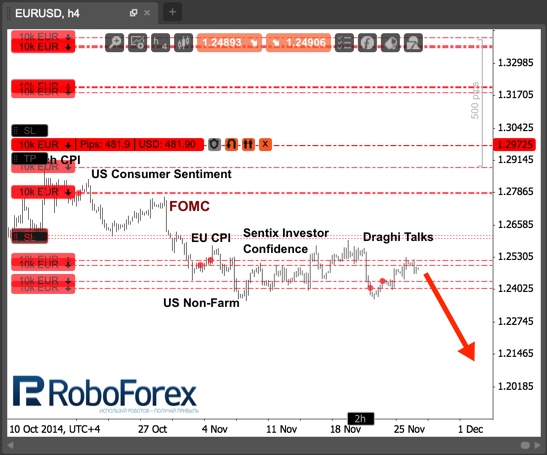

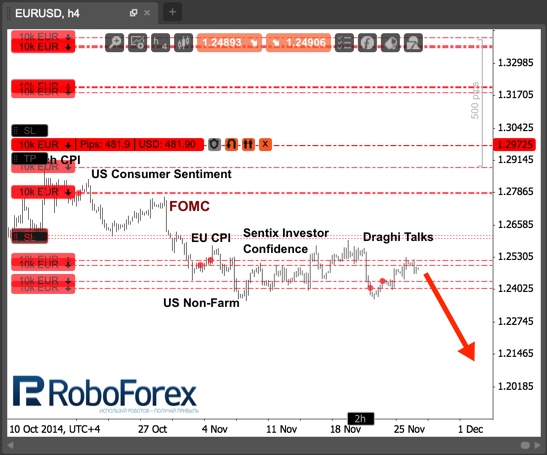

As not the most positive statistics for the euro area has a whole is scheduled for Friday - inflation and unemployment – I continue to hold the deal to sell. Since inflation is expected to slow to 0.3%, in the event of data coming out at this level, the pressure on the ECB will increase more and more. Therefore, the expectations of the program of purchases can support the euro bears.

It is worth noting that the volume of lending is falling continuously since June 2012. Some stabilization, of course, is happening, and from month to month the speed of the fall is slowing down, but if the recovery will continue to be so sluggish, then next year, no significant growth we will be seen for sure. Accordingly, without a splash of lending it is difficult to expect the return of inflation to the design goals of the ECB.

Another factor of tension in the euro zone again becomes Greece. At that time, the anticipation of a possible expansion of asset purchases by the ECB the yields on most Eurobonds continue to fall, interest rates on Greek securities show a sharp increase. On Thursday it became known that the rate on French 10-year government bonds fell to less than 1%, while the yield on the securities of Athens passed over the level of 8%.

There are several reasons for this. Firstly, the negotiations with the "troika" of creditors are close to failure, which means that the final tranche may never get to Greece, which will lead to a budget crisis. The rising cost of borrowing also will not allow covering the deficit on the part of the debt market. Then the growth of social tension follows, the peak of which has the potential to come at the parliamentary elections scheduled for March next year.

It is very likely that the mass popular discontent will lead to even greater growth in the support of the Syriza Radical Party. If it does happen, then the talks in Athens and Brussels will be virtually meaningless, given the anti-European political platform of Syriza. As a key element of the party is the suspension of payments on international loans, then in the spring of the debt crisis in the euro zone can reach a new level.

As not the most positive statistics for the euro area has a whole is scheduled for Friday - inflation and unemployment – I continue to hold the deal to sell. Since inflation is expected to slow to 0.3%, in the event of data coming out at this level, the pressure on the ECB will increase more and more. Therefore, the expectations of the program of purchases can support the euro bears.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.