A "remake" by Mario Draghi. Fundamental analysis for 24.09.2014

24.09.2014

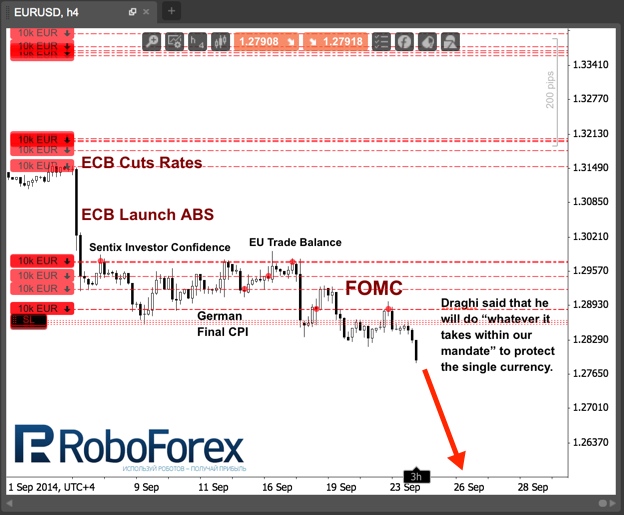

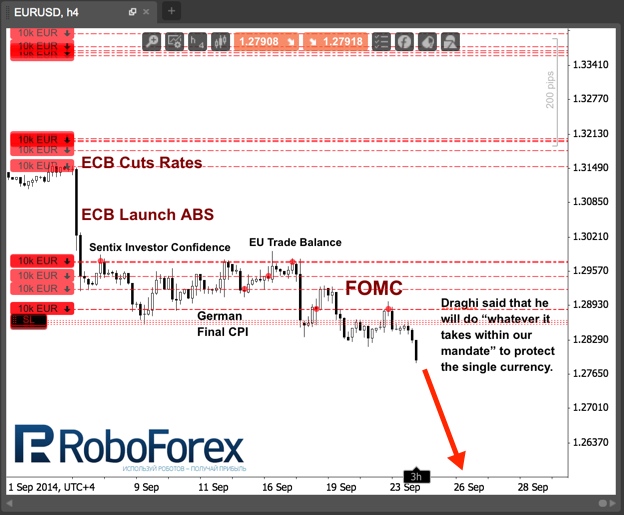

This becomes a good tradition - macroeconomic statistics in the euro area regularly come out worse than the market expectations, which help the euro bears to move the market lower and lower. Data on German business climate is not an exception, which reached 104.7 (worst performance since April 2013). This fact cannot be called an accident - the decline is for the fifth consecutive month.

Earlier, at the end of II quarter, German GDP showed a contraction, and that probably played a key role in the decision of the ECB about the beginning of asset purchases, although it is still far from a full-fledged quantitative easing in the way, in which we have seen in the United States and Britain. It could sound strange, but the ECB is surely delighted with such statistics - degree of protest in Berlin against the deployment of control measures can now go into decline.

The current deterioration in statistics, in a recently stable in Germany, came together with many factors. In the first place, is a certainly failed pulse of recovery of the European economy. A quick dash to growth did not happen; the euro zone is stuck with a low inflation rate, which now leads to an increase in the debt burden as a percentage. "Sanctions war" with Russia is also not conducive to economic growth.

For example, the German MAN, which is Europe's third largest truck manufacturer due to a fall in demand from Russia announced a reduction of about 4,000 workers. A number of other sectors showed a similar pattern - Activity in the German industrial sector dropped to a 15-month low. All of this has simply unprecedented pressure on the ECB – everyone is waiting for a panacea from the regulator.

And here Mario Draghi comes into the arena again. Just a few hours ago on the radio station "Europe 1", he said that he would do "whatever is necessary, within the mandate" to protect the single currency. In fact, we heard a clear "remake" of Draghi’s words at the height of the debt crisis, which became his turning point and saved a number of euro zone countries from certain bankruptcy. It is logical that today the Eurodollar responded to this with a break through the minimum.

The Eurodollar sales strategy proves to be valuable. The support to the bears from the chief of the ECB, as well as the latest statistics do not even suggested any significant correction. Moreover, on Thursday recent statistics on lending in the euro area are expected, which almost certainly will once again be in the red, which can give the downtrend additional acceleration.

RoboForex Analytical Department

Earlier, at the end of II quarter, German GDP showed a contraction, and that probably played a key role in the decision of the ECB about the beginning of asset purchases, although it is still far from a full-fledged quantitative easing in the way, in which we have seen in the United States and Britain. It could sound strange, but the ECB is surely delighted with such statistics - degree of protest in Berlin against the deployment of control measures can now go into decline.

The current deterioration in statistics, in a recently stable in Germany, came together with many factors. In the first place, is a certainly failed pulse of recovery of the European economy. A quick dash to growth did not happen; the euro zone is stuck with a low inflation rate, which now leads to an increase in the debt burden as a percentage. "Sanctions war" with Russia is also not conducive to economic growth.

For example, the German MAN, which is Europe's third largest truck manufacturer due to a fall in demand from Russia announced a reduction of about 4,000 workers. A number of other sectors showed a similar pattern - Activity in the German industrial sector dropped to a 15-month low. All of this has simply unprecedented pressure on the ECB – everyone is waiting for a panacea from the regulator.

And here Mario Draghi comes into the arena again. Just a few hours ago on the radio station "Europe 1", he said that he would do "whatever is necessary, within the mandate" to protect the single currency. In fact, we heard a clear "remake" of Draghi’s words at the height of the debt crisis, which became his turning point and saved a number of euro zone countries from certain bankruptcy. It is logical that today the Eurodollar responded to this with a break through the minimum.

The Eurodollar sales strategy proves to be valuable. The support to the bears from the chief of the ECB, as well as the latest statistics do not even suggested any significant correction. Moreover, on Thursday recent statistics on lending in the euro area are expected, which almost certainly will once again be in the red, which can give the downtrend additional acceleration.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.