Mario Draghi is "banging his fist". Fundamental analysis for 21.11.2014

21.11.2014

ECB chief Mario Draghi continues to pursue "verbal interventions". On Friday, he said that the very low inflation rate should be raised by any means. In addition, he bluntly pointed out that in the recent months there was no improvement in the euro zone economy, and if the current actions by the regulator will not give the desired effect, the ECB will start widening the current asset purchase program.

It is noteworthy that yesterday the PMI indices on key euro zone countries once again came out considerably worse than the predicted values. The most alarming situation is in France, where the industrial and service PMI are below 50 for three consecutive months, which means a reduction. Moreover, even in Germany there is a slowdown in most sectors of the economy, which creates the risk of the recession returning.

Since the volume of new orders is falling, in the next month no progress is expected. Inflation continues to be at the minimum (its value is 0.4%), and the current data points to the actual lack of "natural growth" of prices in the coming months. Decoupling is likely to be followed at the December meeting of the ECB.

It is expected that the regulator will update the forecasts of GDP growth and inflation. In the case of their reduction the announcement of a further injection of liquidity into the economy of the euro zone would be quite logical. The most probable is that the ECB will go for the inclusion of purchases of corporate bonds into the program, leaving the Eurobonds aside the last instrument to influence the situation (the rate is already minimal).

Since Draghi used "we have to raise inflation and inflation expectations as soon as possible", in his speech, the market reacted with the fall of the euro and a decline in yields on Eurobonds. Interestingly also is the fact that in the week the head of the Bundesbank did not comment on the possible extension of the program of asset purchases, noting that he can not always comment on Mario Draghi.

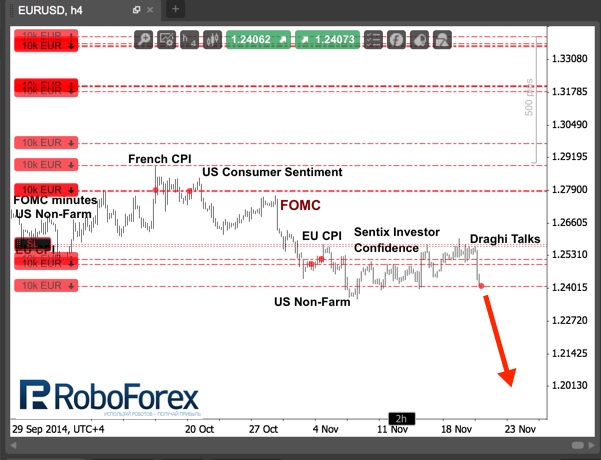

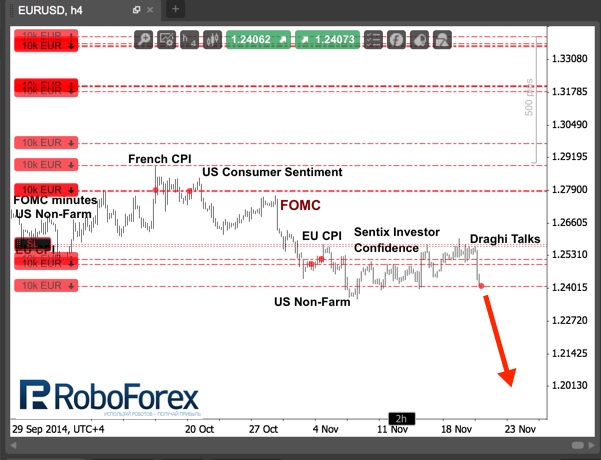

Against the background of recent statements by Mario Draghi I continue selling the Eurodollar. In addition, next week is expected to yield data on inflation in a number of euro zone countries, and on the currency union as a whole. As a high probability of a further fall of the indicator, on the background of Friday the head of the ECB comments the market may continue to decline further - first on expectations, and subsequently on the actual deterioration of inflation.

It is noteworthy that yesterday the PMI indices on key euro zone countries once again came out considerably worse than the predicted values. The most alarming situation is in France, where the industrial and service PMI are below 50 for three consecutive months, which means a reduction. Moreover, even in Germany there is a slowdown in most sectors of the economy, which creates the risk of the recession returning.

Since the volume of new orders is falling, in the next month no progress is expected. Inflation continues to be at the minimum (its value is 0.4%), and the current data points to the actual lack of "natural growth" of prices in the coming months. Decoupling is likely to be followed at the December meeting of the ECB.

It is expected that the regulator will update the forecasts of GDP growth and inflation. In the case of their reduction the announcement of a further injection of liquidity into the economy of the euro zone would be quite logical. The most probable is that the ECB will go for the inclusion of purchases of corporate bonds into the program, leaving the Eurobonds aside the last instrument to influence the situation (the rate is already minimal).

Since Draghi used "we have to raise inflation and inflation expectations as soon as possible", in his speech, the market reacted with the fall of the euro and a decline in yields on Eurobonds. Interestingly also is the fact that in the week the head of the Bundesbank did not comment on the possible extension of the program of asset purchases, noting that he can not always comment on Mario Draghi.

Against the background of recent statements by Mario Draghi I continue selling the Eurodollar. In addition, next week is expected to yield data on inflation in a number of euro zone countries, and on the currency union as a whole. As a high probability of a further fall of the indicator, on the background of Friday the head of the ECB comments the market may continue to decline further - first on expectations, and subsequently on the actual deterioration of inflation.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.