Everything is in the hands of the Federal Reserve. Fundamental analysis for 17.12.2014

17.12.2014

Again, everyone understands - the further fate of the world economy is in the hands of the FOMC led by Janet Yellen. Athough the IMF and other global institutions have some weight, they are not able to set the vector of development of the financial system. For the past week that emerging markets are in a state of a permanent earthquake, and of course the kind of anti-records puts out the Russian economy and the weakening ruble.

It is worth noting that Russia, by and large, is considered a developing economy only by inertia. The current rate of growth is not sufficient for a continued stay in this "club", since the current statistics is at lower levels than in developed countries. However, in order to be considered a developing country, it is necessary to show the dynamics of GDP, anticipatory to the data in developed countries.

The fall in the current price of oil will certainly hurt not only Russia but also other exporting countries. However, for the US economy, despite all the nuances of self-production, cheap oil brought an extra non-monetary incentive, which the Fed probably could only have dreamt of. The current decline in inflation in the United States is, for certain, largely due to falling energy prices.

Accordingly, in the scale of the economy a considerable amount of money is released, a lot of which is in the main part in the hands of consumers. It is worth noting that the US gasoline prices fall after oil, and for the last month drawdown was more than 6% (the largest monthly decline since 2008). By the way, in Russia the price of gasoline somehow miraculously continues to rise despite the drop in oil prices.

So, against the backdrop of a negative inflation, the Fed may well retain the wording of the "considerable period" of low rates, which would be a plus for the US economy. However, developing countries will have hard times, as on the background of all the accumulated problems in them, money will continue to flow into the United States, and the so unloved by many Treasury bonds, still remain the most reliable tool for investors.

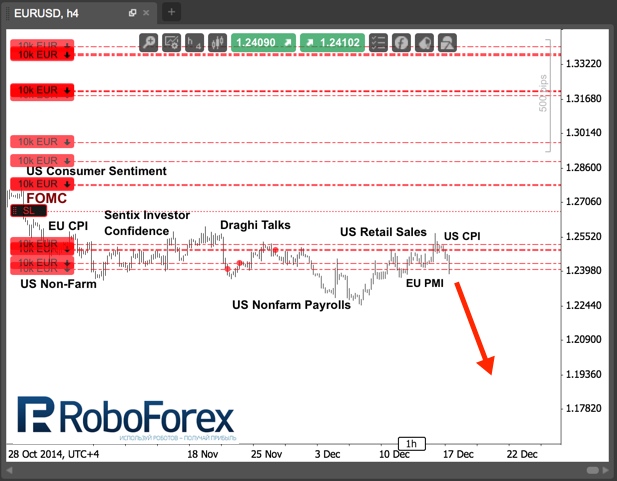

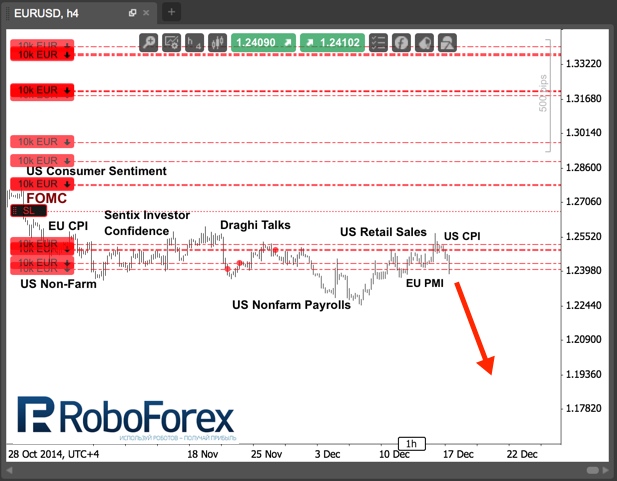

In the current situation it would be strange to leave the sales, so I keep them in my trades. It is possible that after the outcome of the FOMC meeting the market will at least update. In addition, the general expectation of a deteriorating situation in Europe will probably not allow the single currency to show any significant reduction.

RoboForex Analytical Department

It is worth noting that Russia, by and large, is considered a developing economy only by inertia. The current rate of growth is not sufficient for a continued stay in this "club", since the current statistics is at lower levels than in developed countries. However, in order to be considered a developing country, it is necessary to show the dynamics of GDP, anticipatory to the data in developed countries.

The fall in the current price of oil will certainly hurt not only Russia but also other exporting countries. However, for the US economy, despite all the nuances of self-production, cheap oil brought an extra non-monetary incentive, which the Fed probably could only have dreamt of. The current decline in inflation in the United States is, for certain, largely due to falling energy prices.

Accordingly, in the scale of the economy a considerable amount of money is released, a lot of which is in the main part in the hands of consumers. It is worth noting that the US gasoline prices fall after oil, and for the last month drawdown was more than 6% (the largest monthly decline since 2008). By the way, in Russia the price of gasoline somehow miraculously continues to rise despite the drop in oil prices.

So, against the backdrop of a negative inflation, the Fed may well retain the wording of the "considerable period" of low rates, which would be a plus for the US economy. However, developing countries will have hard times, as on the background of all the accumulated problems in them, money will continue to flow into the United States, and the so unloved by many Treasury bonds, still remain the most reliable tool for investors.

In the current situation it would be strange to leave the sales, so I keep them in my trades. It is possible that after the outcome of the FOMC meeting the market will at least update. In addition, the general expectation of a deteriorating situation in Europe will probably not allow the single currency to show any significant reduction.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.